You cannot begin the countdown on 2022, something many investors will bid good riddance, without at the same time looking forward to what 2023 will bring. In many ways, 2022 will be viewed in retrospect as a year of surviving. Investors and markets have had to survive negative GDP growth, the highest inflation in 50 years, the sharpest rise in interest rates in US history, the resurgence of Covid, and many other challenges. As we head into the last month of the year, the S&P 500 is down around 18% while the tech-heavy Nasdaq is trading 28% lower. Given the unprecedented circumstances, it could have been worse this year.

Looking towards 2023, we have impaired visibility in terms of what to expect. It is true that the Fed has hinted it is much closer to slowing (possibly ending) the pace of rate hikes but the labor market data suggests it might be much longer before the Fed is going to be able to be accommodative. A recent report from Goldman Sachs forecasts a labor shortage of nearly 2 million workers for US manufacturing by the year 2030 suggesting labor force tightness may get worse. The tech sector may be engaged in layoffs not experienced since 2000 but the overall supply of labor remains limited. The impact of mass protests in China over Covid restrictions is making global economic growth forecasts difficult. According to Barclays data, Covid restrictions are in place in over 70 cities in China that represent more than 60% of China’s economic output (GDP). An economically ailing China presumably means slower growth for the world and likely ongoing supply chain challenges.

The inflation bug has now spread to the least likely economy to be impacted, Japan. The latest CPI readings in the Asian nation are the highest in more than 40 years and is a signal that the Bank of Japan, European Central Bank and others are just beginning the likely tightening of monetary policy that will be necessary that the US started almost a year ago. Global liquidity is likely to remain under pressure throughout 2023 as the era of ‘cheap money’ appears to have passed for this cycle. The result is likely to be a “risk-off” mentality for many institutional investors as volatility remains above normal.

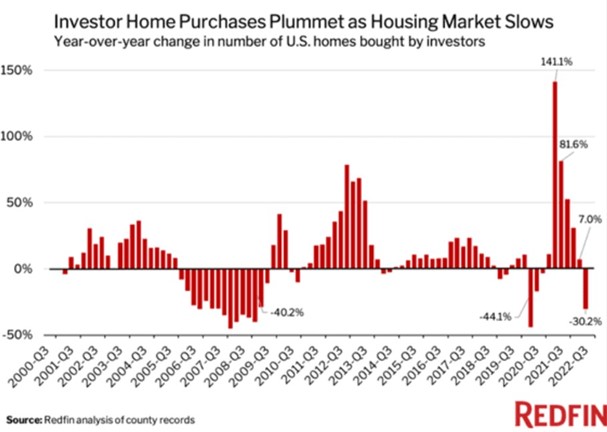

Further complicating visibility for 2023 is the current state of the housing market. Home purchases, such as the data below from Redfin, have fallen dramatically over the last 6 months and the trend is not slowing. Prices in major markets are beginning to reflect this reality but have much further to go as mortgage rates climb above 7%. Redfin data shows the amount of annual income needed to afford the median price home was $60,000 in 2020 and has risen to $108,000 today. When housing becomes this unaffordable, history suggests we are not near an inflection point for a rebound. Broad estimates suggest 20% to 25% of the economy is directly or indirectly impacted by housing so expect an economic headwind going into 2023. There are also increasing segments of the yield curve inverting and the longer this remains, the more economic damage is done. It is likely that lending standards will continue to tighten for the first half of 2023 meaning less credit availability for the shrinking segment of the economy looking to borrow.

I do not want to point a ‘gloom and doom’ picture, there are bright spots investors can latch onto. Corporate earnings have remained very resilient during the rapid rise in interest rates. This is largely due to most balance sheets being healthy and not overindebted. Companies have also had more time to sort out supply chain issues and the availability of key natural resources has risen dramatically even as prices have fallen. Many industrial product prices are lower today than before covid hit in 2020 suggesting margins may remain strong in many sectors of the economy.

“Global liquidity is likely to remain under pressurethroughout2023astheeraof‘cheap money’appearstohavepassedforthiscycle.”

I believe a disconnect remains between the health of the economy and equity market prices. The S&P 500 today is trading at more than 20 times my 2023 earnings estimate of

$190. Given the rising risk premium on equities, I still expect the multiple to drop to 16, if not lower, suggesting the S&P would need to fall to 3,040 to get to fair value. I would suggest caution with equity allocations going into 2023 notwithstanding the number of voices suggesting to ‘buy the dip.’ Stocks will eventually get to fair value, they always do, it just takes patience. There are plenty of opportunities where you can find value, including in technology. History has proven that when a stock falls by 50% it is not necessarily cheap, do not be lured in by how far a stock has dropped but understand what the catalyst for a rebound is.

Originally Posted December 2022 – Impaired Visibility

Disclosure: Peak Capital Management

Peak Capital Management, LLC, is a fee-based SEC Registered Investment Advisory firm with its principal place of business in Colorado providing investment management services. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request. Advisory services are only offered to clients or prospective clients where our firm and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Peak Capital Management, LLC unless a client service agreement is in place. Nothing herein should be construed as a solicitation to purchase or sell securities or an attempt to render personalized investment advice. To receive a GIPS compliance presentation and/or our firm’s list of composite descriptions, please email your request to info@pcmstrategies.com. Peak Capital Management claims compliance with the Global Investment Standards (GIPS). GIPS is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Peak Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Peak Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.