Provisions in the SECURE 2.0 Act introduced new ways this year to avoid a 10% early withdrawal penalty from retirement accounts. Our Bill Cass explains the implications for savers.

With the introduction of new ways to avoid the 10% early withdrawal penalty on retirement accounts, the IRS recently issued Notice 2024-55, which provides additional guidance on two provisions introduced by SECURE 2.0. Learn more about SECURE 2.0 in our article, “SECURE 2.0: Key provisions and planning considerations.”

These provisions add to the growing list of exceptions to the early withdrawal penalty from a retirement plan or IRA. They include penalty-free distributions for personal emergency expenses and distributions for those who are victims of domestic abuse, both available beginning this year.

While the 10% penalty can be avoided in many circumstances, distributions from traditional retirement accounts will still generally be taxable.

More detail on the new exceptions follows.

Emergency personal expense distributions

- Limited to one distribution annually from a defined contribution retirement plan or IRA, which cannot exceed $1,000.

- There is an option to repay the distribution via a tax-free rollover within three calendar years.

- Once a distribution is made, an individual cannot request another emergency distribution during the following three calendar years unless the previous distribution has been repaid or, the aggregate amount of contributions into the plan (employee and employer) after the previous emergency distribution is at least equal to the previous emergency distribution.

- Retirement plan providers and IRA custodians are not required to offer personal emergency distributions.

- The new IRS guidance includes examples of emergencies, but it is not an exclusive list, and the account owner is allowed to self-certify to their plan provider or IRA custodian that they are dealing with an emergency situation. In a recent Notice, the IRS lists factors to consider, including (but not limited to) medical care, accident or loss of property, foreclosure from a residence, funeral costs, auto repairs and “any other necessary emergency personal expenses.”

- While certain plan participants may be eligible for a hardship distribution under the terms of the plan, taking an emergency distribution may be a better option since hardship distributions are generally subject to the 10% early withdrawal penalty.

Domestic abuse victim distributions

- As of 2024, a maximum of $10,000 may be withdrawn (or 50% of the vested account balance if resulting in a lower amount) during the one-year period from when an individual becomes a victim of domestic abuse by a spouse or domestic partner.

- For future years, the $10,000 limit will be adjusted for inflation.

- Similar to emergency distributions, there is a three-year period where the individual can repay the distribution into the account and recoup income taxes paid.

- Similar to emergency distributions, retirement plan sponsors are not required to offer this provision within the plan.

- Per the IRS, “domestic abuse” means physical, psychological, sexual, emotional or economic abuse.

Tracking the ways to avoid penalties

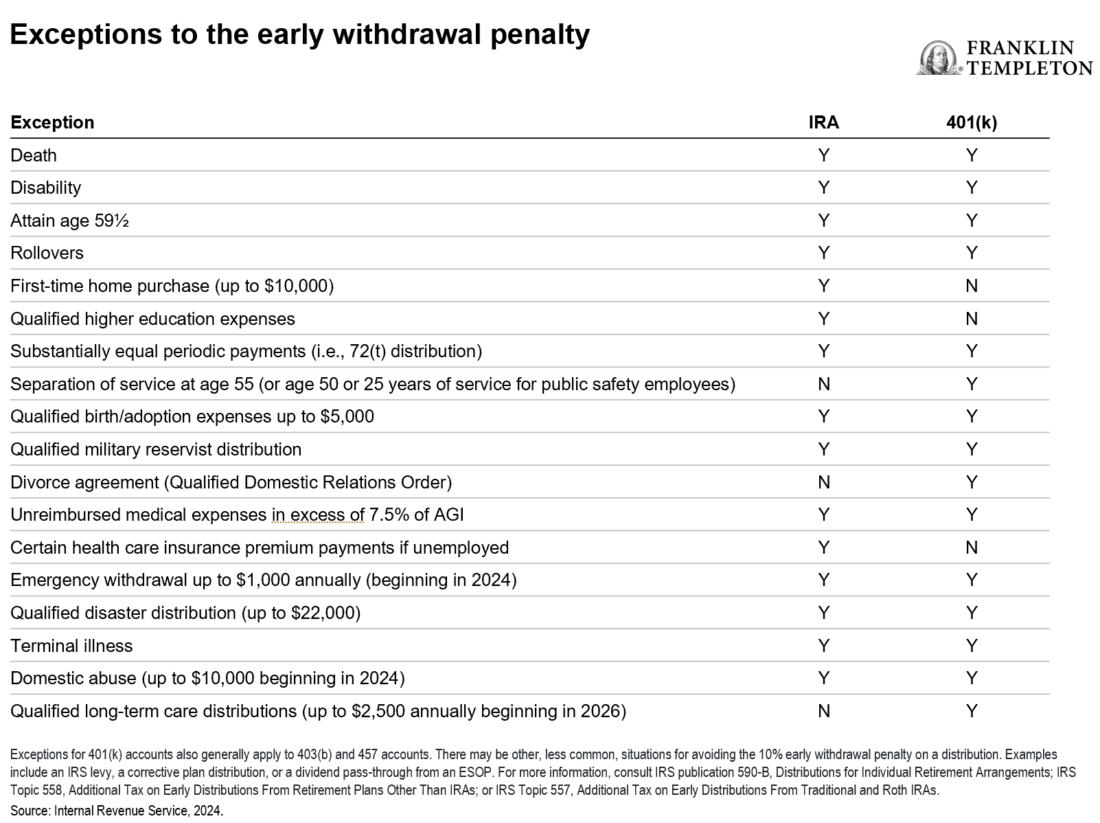

With these new provisions from SECURE 2.0, there are more than a dozen exceptions to the 10% early withdrawal penalty from retirement accounts. But not all exceptions apply to both 401(k) plans and IRAs.

Here’s a look at the exceptions to the 10% early withdrawal penalty and differences between IRAs and 401(k)s.

Consider taxes

Overall, if funds are needed for an immediate expense, it’s generally better to exhaust other options before considering an early withdrawal from a retirement account. Even if there is an exception to the 10% penalty, taxable income will be generated when taking a distribution from a traditional retirement account. With less retirement funds available later in life, longevity and inflation risk may be more of a challenge.

—

Originally Posted July 11, 2024 – New ways to avoid early withdrawal penalties from retirement accounts

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Disclosure: Franklin Templeton

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Franklin Templeton and is being posted with its permission. The views expressed in this material are solely those of the author and/or Franklin Templeton and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.