By AgResource

The opinions expressed in this report are those of AgResource and are considered market commentary. They are not intended to act as investment recommendations. Full disclaimers are available at the end of this report.

HIGHLIGHTS

- Actual size of 2024 Brazilian crop

- Expanding U.S. biofuel production: Does it require additional soybean oil supplies?

- World soybean trade to be impacted by politics

- Growth in Brazilian soybean production in 2025

- La Nina and Argentina

Actual size of 2024 Brazilian crop

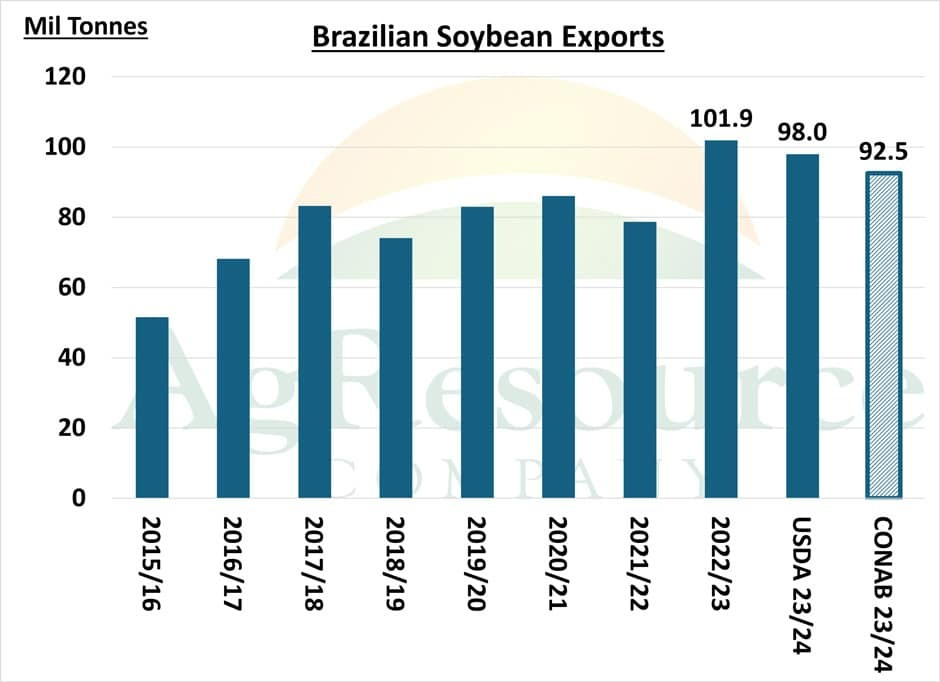

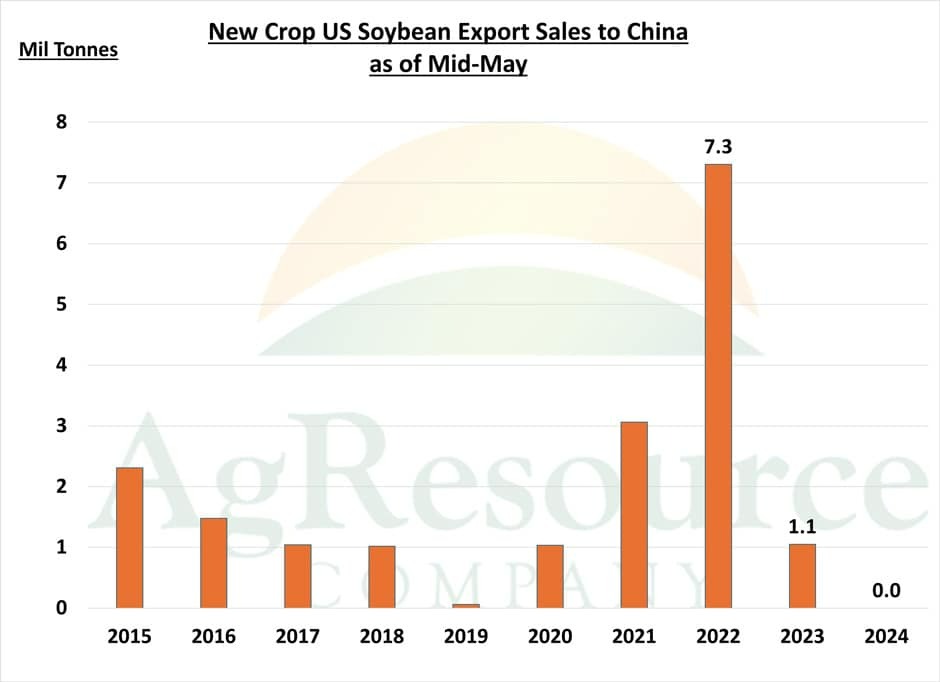

There’s currently no consensus on the size of Brazilian soybean production in 2024. South America’s surplus will be large in almost any scenario, but there’s currently a discrepancy of 6.3 million tons between the Brazilian government (CONAB), which projects production at 147.7 million tons, and USDA, which estimates production at 154 million. Some in the trade are still forecasting Brazilian soybean production in 2024 at 140 million tons or less, and some forecast production above 155 million tons. Unfortunately, the actual size of Brazil’s soybean crop in 2024 is unlikely to be known until early 2025. In recent years, the market can only work out Brazilian supplies once Brazil’s exportable surplus is exhausted. Yet, a Brazilian crop below 145 million tons implies the U.S. will dominate world trade between September and December. A Brazilian crop above 155 million tons implies there’s not much need for production growth in the U.S. or elsewhere. So far, the Brazilian cash market is behaving as though the Brazilian government is correct with its 147.7-million-ton estimate. FOB premiums in Brazil for June and July delivery are quoted at $.25 per bushel above CBOT prices. A year ago in May, Brazilian offers were $.10-.20 per bushel below CBOT prices.

Figure 1: Brazilian soybean export (2015-2024)

Source: AgResource

Expanding U.S. biofuel production: Does it require additional soybean oil supplies?

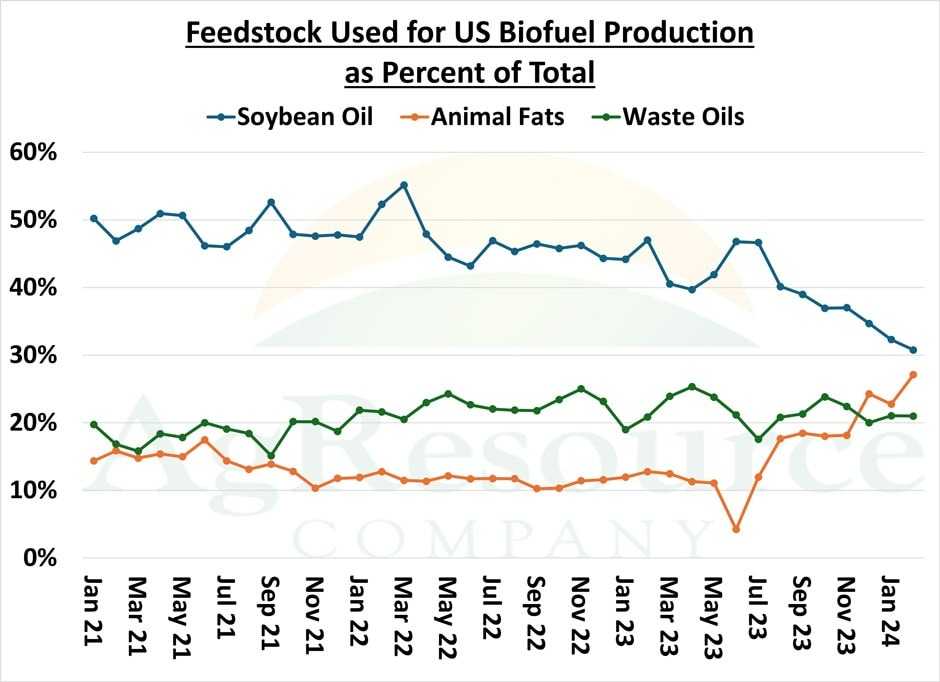

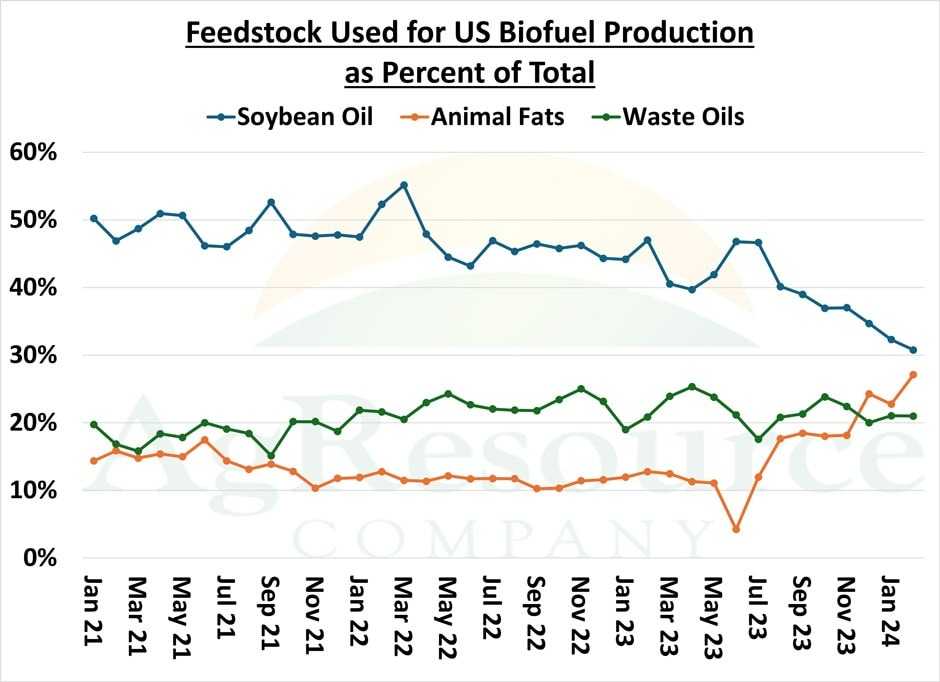

Renewable diesel production in the United States exploded in 2022 as California’s clear air policies mandated greater renewable fuel production and consumption. Since, states along both coasts have adopted similar measures, with California and Oregon providing credits for the use of biofuel and renewable diesel, which is chemically identical to conventional diesel. Soybean oil consumption followed. Record-high soybean oil prices were scored in April 2022 as the market feared supplies would decline to near zero. We note that renewable diesel production margins were still positive despite soybean oil prices of $.80 per pound.

However, high prices tend to cure high prices. U.S. soybean oil exports were shut off completely. The U.S. became a net importer of vegetable oils – used cooking oil in particular – and soybean oil was forced to share the biofuel market with waste oils and animal fats.

Soybean oil in January accounted for only 31% of total biofuel production. Soybean oil’s share collapsed, while the use of animal fats exploded. Waste oil’s share of production has been steady, and a large portion of U.S. renewable diesel production is now being satisfied with imported used cooking oil. Whether this changes in summer and autumn is important. Is there enough used cooking oil in the world to satisfy additional growth in the U.S. biofuel sector? Soybean oil stocks typically decline during the summer months. The speed of this decline is critical. Soybean oil is currently priced to find demand – not slow it.

Figure 2: What is used for U.S. biofuel production?

Source: AgResource

World soybean trade to be impacted by politics

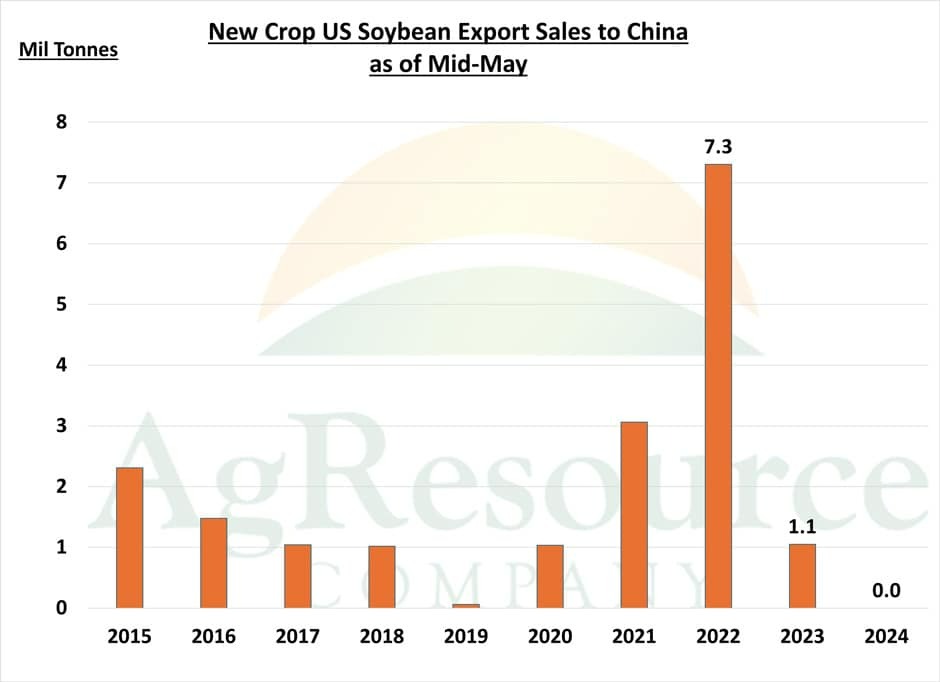

In the short run, the size of Brazilian soybean production and exports in 2024 is most important. Longer term, we’re concerned that politics will play a greater role in world soybean trade growth. Given that China is by far the world’s top importer and consumer of soybeans, this is centered on U.S. and Chinese trade relations, which have no doubt soured. It is unlikely to be resolved no matter who is President in January 2025.

China, if possible, would prefer to import soybeans from Brazil and Argentina exclusively. In 2024, this will not be possible. China will be forced to purchase 20 – 22 million tons from the U.S. However, it doesn’t appear China will import from the U.S. one ton above what it absolutely needs, and this has been featured in USDA data. By the middle of May, China would have typically secured at least one million tons of U.S. soybeans for delivery in the following marketing year. This year, the U.S. has not sold one ton to China for delivery in marketing year 2024/25. Importantly, China in May 2023 had purchased 1.1 million tons of new crop U.S. soybeans despite record production in Brazil, and so this year’s complete absence of China either suggests politics are playing a greater role in world soybean trade or Chinese demand is beginning to slow.

Figure 3: U.S. soybean export to China (May 2015 – May 2024)

Source: AgResource

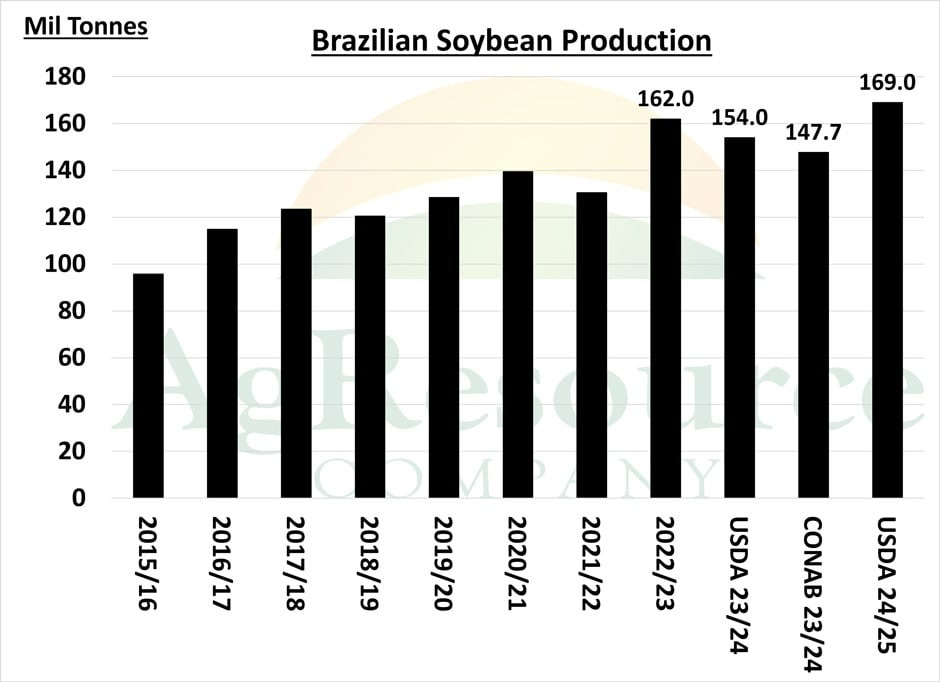

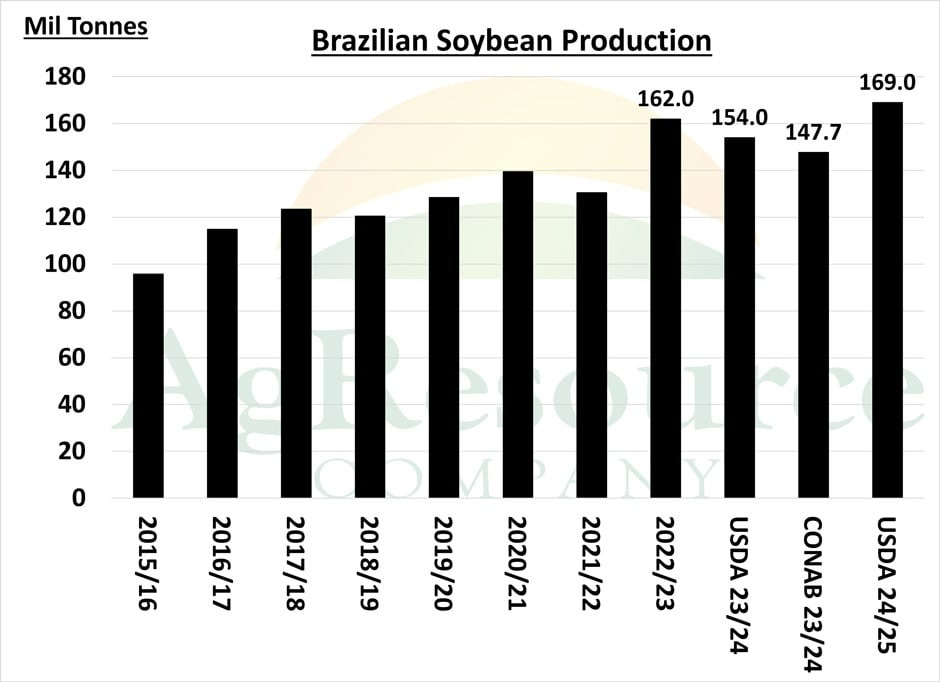

Growth in Brazilian soybean production in 2025

It is possible that China in 2025 and beyond will be able to source nearly all of its soybean from Brazil. Soybean production in Brazil in 2024 was negatively impacted by heat and dryness in November and December. This is common when El Nino is present. However, if Brazil avoids major weather issues between November and January 2024/25, a massive crop must be expected. Brazil is one of the few countries that has arable land not currently being farmed. Our contacts suggest the state of Mato Grosso in Brazil can expand soybean area by 20% if there’s the proper price incentive. The USDA in its May report forecast Brazilian soybean production in 2024/25 at a record 169 million tons, and we have no major disagreement with this estimate. If realized, Brazil’s share of world soybean trade will be expanded. The U.S.’ share will be contracted. There will be no need for acreage expansion in the U.S. in spring of 2025. A crop of 169 million tons will allow Brazil to export 109 million tons. This will roughly match China’s import needs.

Figure 4: Brazilian soybean production (2015 – 2023 actual; 2024 estimates)

Source: AgResource

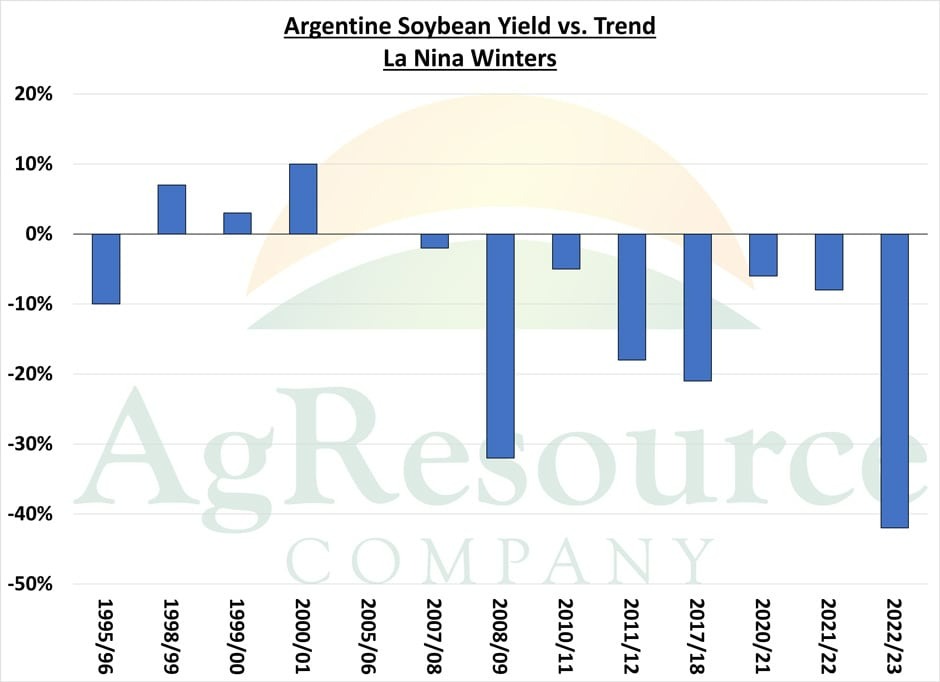

La Nina and Argentina

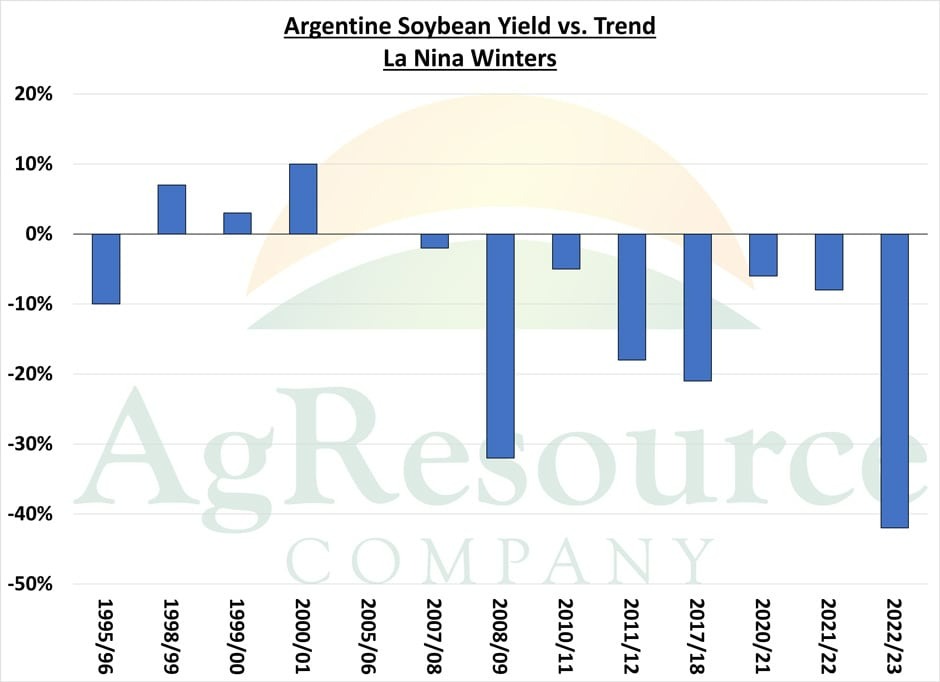

While Brazil dominates world soybean trade beginning in early 2025, soy product supply and demand is less certain. El Nino is currently to La Nina. Long term forecasts no longer project an intense and lasting La Nina event, but it is highly probable that La Nina will be present this autumn and winter. La Nina very often produces drought in Argentina. In fact, the soybean yield in Argentina has been below trend in each of the last eight La Nina winters. It is nearly guaranteed that soybean production in Argentina declines year-over-year if La Nina present in November and December.

Figure 5: Argentine soybean yield vs. trend during La Nina winters

Source: AgResource

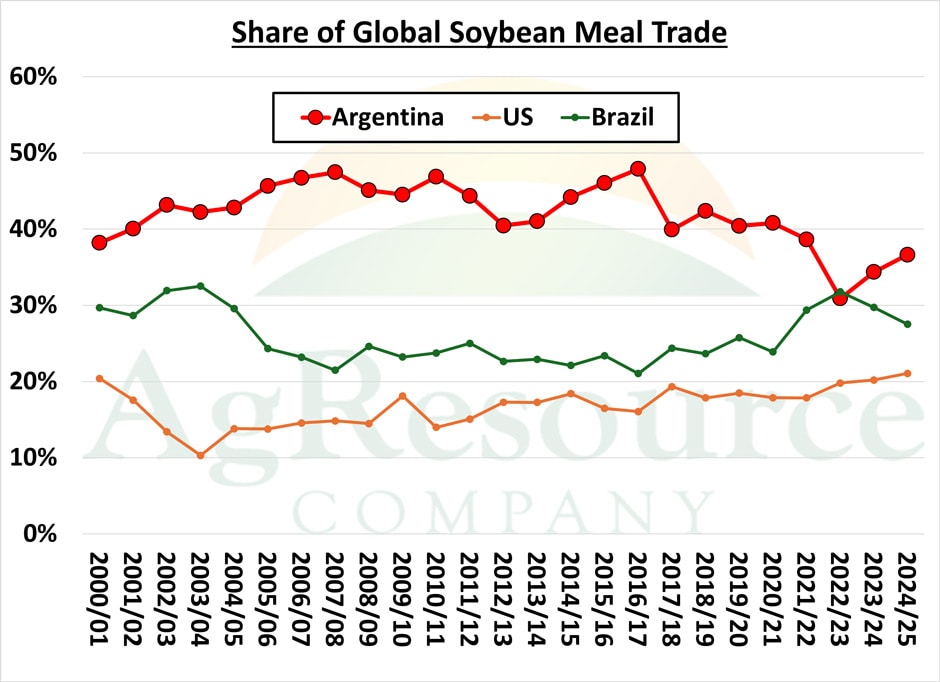

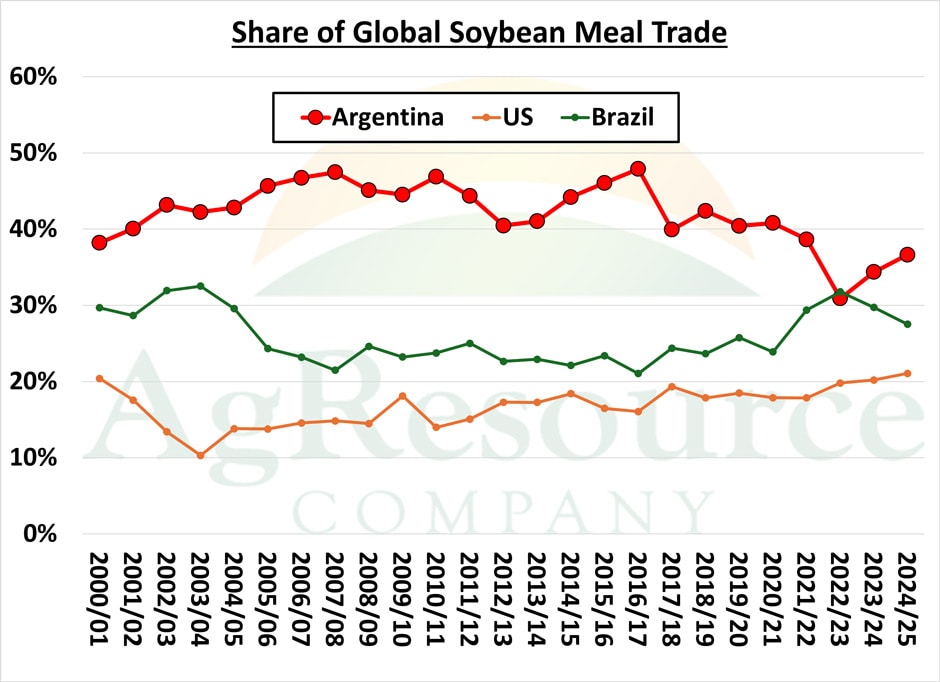

It is possible that gains in Brazilian soybean production will offset losses in Argentina, but drought in Argentina will complicate the movement of soybean oil and soybean meal. Argentina is the world’s largest exporter of soybean meal and soybean oil and accounts for 30% – 40% of global soybean meal trade. Not all can import and crush soybeans, so there is a scenario in which U.S. soybean export demand is weak, but demand for U.S. soybean meal stays very strong.

Figure 6: Argentine share of global soybean meal trade

Source: AgResource

The two most significant determinants of agricultural commodity prices are weather and government policy. Unfortunately, both will have an outsized impact on global soybean price discovery. Our research suggests that rallies in the soy complex will struggle without adverse weather – mostly due to tension between the U.S. and China – but not until August will the world know with confidence Northern Hemisphere oilseed yields and production.

—

Originally Posted May 31, 2024 – Five Things to Watch in the Soybean Market in 2024

Disclaimer

AgResource has no brokerage affiliations, nor manages money for itself or others.

The opinions and statements contained in the commentary on this page do not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs. This content has been produced by AgResource. CME Group has not had any input into the content and neither CME Group nor its affiliates shall be responsible or liable for the same.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.