Your Weekly Roadmap with Jay Woods, CMT

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Your Weekly Roadmap

This week’s headlines will be mostly political in nature as the country witnessed its first assassination attempt on a President – sitting or retired – since March 30, 1981.

Saturday’s shocking event at President Trump’s rally resulted in his poll numbers skyrocketing to their highest levels. He is now the clear cut favorite to win the November election. Will this incident have implications on the stock market?

We may get a little rally, a Trump bump if you will, on Monday’s open and could experience intraday volatility all week as political rhetoric will heat up into the Republican Convention.

Overall, the market will get back to focusing on earnings and Fed policy. We are heading into a seasonal time where the markets tend to underperform. Given the recent rally in the indicies, a pullback would be normal. However, every market move will be scrutinized and highlighted with a political backdrop that has reached a boiling point.

The market story to watch is that massive rotation from large to small cap stocks that spun the market around like a twister. The only difference was it didn’t leave a path of destruction in its wake. Money didn’t leave the market, assets were moved around.

In fact, last Thursday’s rare market breadth explosion where the Russell 2000 had its best day since October, rising 3.6%, while the Nasdaq 100 dropped -2.2% marked the widest spread between the two since 2001.

This sets the stage for a week where investors hope to determine if this event was the beginning of a healthy rotation where we see a continued broadening of market participation or a knee-jerk reaction to positive inflationary data and an overdue rally in small caps.

What can keep this broadening theme going? Let’s explore what traders will be watching this week.

The Small Cap Comeback?

This is the move many of us have been waiting for all year. The Russell 2000 is finally trying to join the party and when they join a party they tend to make some major noise.

Last October, the index lagged all year and then jumped 27% in 10 weeks to finish the year strong.

What has it done since?

Pretty much nothing, nada, zip. It’s been recovering from a hangover caused by that epic rally. What sparked that rally? The anticipation of rate cuts.

What sparked this rally? You guessed it – the anticipation of that first cut.

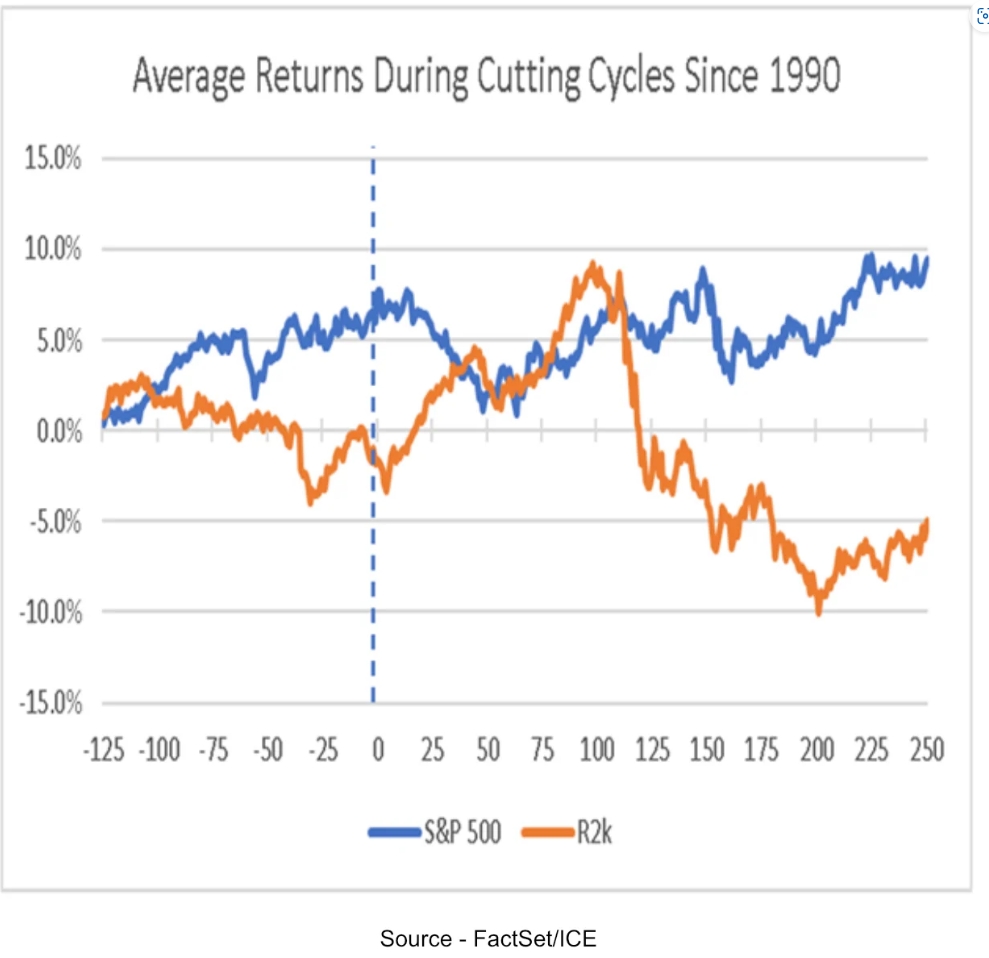

Thanks to my friend Michael Reinking of the NYSE for sharing this chart. It shows how small caps have acted going into a first cut and the days after that cut.

While the sample size is small with only 5 occurrences since 1990, the general pattern is to see a rally the months leading into the cut and then a stronger one the three months after that initial cut.

The first three months after the initial cut the Russell has rallied an average 4.5% while the S&P 500 has fallen -4.6%. Clearly it seems investors are repositioning themselves for a repeat performance of this pattern.

Let’s Look at the Chart…

When in doubt, back it out. That’s the old adage in the technical world when you want to confirm a trend or its potential change. We know the index just made 52-week highs, but over the longer term it looks even more interesting.

Above is the four-year weekly chart of the index. What do we see here?

We see the highest close on a weekly basis going back to early 2022. Could this be the breakout needed on a long-term basis to get this index moving to new all-time highs like every other major index in the market?

It’s a good start but needs to be confirmed. The good news for the small cap bulls is that we remain in a slow moving uptrend. The better news is that when the Russell moves – or as I said earlier, joins the party – it makes its presence felt.

There is much room to run to get to its November 2021 highs – about 14% upside. The launch pad is set both fundamentally and technically, will it have the juice to continue this lift off? We should find out over the coming weeks.

Stage Set for a Rate Cut?

That’s what the pundits are saying for September. This is the highest percentage we have seen all year for that cut. Only 5.6% of those surveyed see rates remaining unchanged past September.

Fed Speak.

While Jerome Powell didn’t telegraph a coming cut while testifying in front of Congress last week, his dovish tone was evident. After that appearance he got more data to support that narrative in the CPI.

On Monday he will make his first official comments when interviewed at the NY Economic Club. He has the chance to telegraph not only a September cut, which seems very likely now, but he could telegraph a cut at the July meeting.

Besides Powell speaking, nine other speakers will make the rounds next week. Will they tip their hand as to when a cut may come and if they are 100% on board with a cut or do they still need more data to confirm that move?

One thing is certain now, the next move is going to be lower. The question is will they make it sooner rather than later?

Earnings.

Things kick into high gear this week as the majority of banks report. We also get results from high profile names like United Healthcare, Netflix, ASML and American Express.

—

Originally posted 15th July 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.