This morning’s CPI report was terrific, with May inflation sporting a doughnut (a huge zero). Investors are responding by sending stocks to the moon and yields to the tombs as market players dial up the odds of a dovish Fed Chair Powell this afternoon. Increasingly significant, on the other hand, is whether this morning’s print could possibly propel the committee’s own expectations for 2024 cuts up a notch. Policymakers’ rate outlooks are due half an hour prior to Chair Powell taking the mound.

Inflation Eases

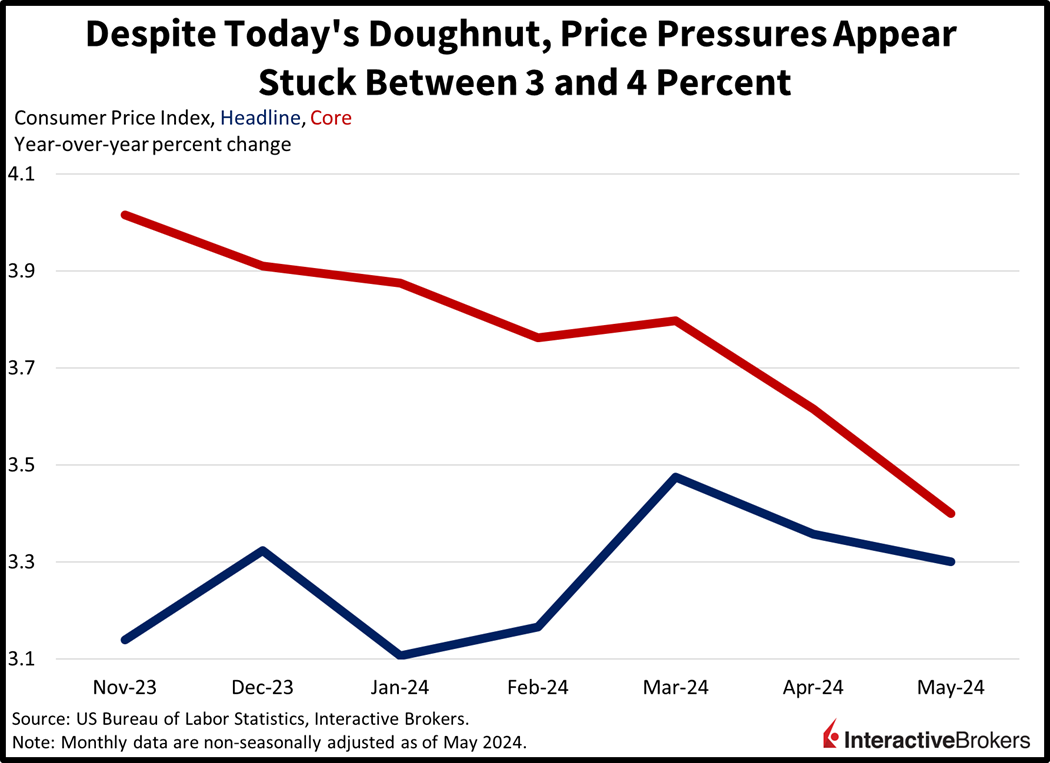

The Consumer Price Index (CPI) in May was flat month over month (m/m) compared to the 0.3% increase in April and analysts’ expectations for a 0.1% gain. On an annual basis, prices climbed 3.3%, slightly below analysts’ expectations for a 3.4% increase, which was also the year-over-year (y/y) rate recorded in April. The Core CPI, which excludes energy and food due to the items’ volatile characteristics, rose 0.2%, the lowest rate in 10 months, while analysts expected the measurement to match last month’s 0.3% result. On a y/y basis, core prices climbed 3.4%, down 20 basis points (bps) from April and below the analyst expectation of 3.5%.

On a m/m basis, the following categories became more expensive by the stated percentages:

- Medical care commodities, 1.3%

- Used cars and trucks, 0.6%

- Food away from home, 0.4%

- Medical care services, 0.3%

Prices for the food at home category were flat while the following categories demonstrated the noted price declines:

- Energy commodities, 3.5%

- Transportation services, 0.5%

- New vehicles, 0.5%

- Apparel, 0.3%

- Energy services, 0.2%

UK Economy Falters

Real gross domestic product (GDP) in the UK was flat in April after climbing 0.4% in the preceding month, according to estimates from the National Office of Statistics. April’s result met analysts’ expectations and was supported by services output increasing 0.2% in April 2024, its fourth consecutive month of expansion. The growth was offset by production output and construction declining 0.9% and 1.4%, respectively. In March, production output expanded 0.2%. Construction has now declined for three consecutive months. For the first quarter of this year, real GDP is estimated to have grown 0.7% relative to the final three months of 2023. Growth was supported by both services and production output.

Markets Rally on Fed Rate Cut Optimism

Markets are ripping on the back of this morning’s doughnut CPI, with financial conditions loosening, as a result of narrower credit spreads, lighter bond yields, a weaker dollar and robust stock gains. Indeed, all major US equity indices are pointing north, with the rate-sensitive Russell 2000 leading the charge; it’s up 2.9%. The Nasdaq Composite, S&P 500 and Dow Jones Industrial benchmarks are loftier by 1.8%, 1.1% and 0.4%. Sectoral breadth is pointing to some exhaustion, however, with just 6 out of 11 sectors green on the session. The upside is being led by technology, real estate and consumer discretionary, which are increasing 2.5%, 2.1% and 1.5%. Offsetting some of the positivity are energy, consumer staples, and utilities, which are travelling south by 1%, 0.5% and 0.5%. Treasuries are catching strong bids as the 2- and 10-year maturities change hands at 4.69% and 4.27%, 18 and 19 bps lesser on the session. Reduced borrowing costs and expectations of an increasingly accommodative Fed are weighing on the greenback, with its index down 101 bps as the US Dollar loses ground relative to most of its major counterparts, including the euro, pound sterling, franc, yen, and Aussie and Canadian dollar. It is gaining relative to the yuan, however. The weaker dollar and optimism for potential Fed cuts are pushing most commodities higher, with silver, copper and gold gaining 2.4%, 1.4% and 0.5%. On the other hand, however, crude oil is down 0.2%, or $0.19, to $77.93 per barrel on heavier stateside inventories. Lumber is also down 0.2%.

One Month is Not a Trend

Investors are cheering today’s data with hopes that it may prompt the Fed to turn accommodative, but as I explained during a Yahoo Finance interview this morning, I believe numerous months of benign inflation figures are required before policymakers embark on easing policy. Today’s CPI numbers, furthermore, benefited from energy commodities dropping 3.5%, but a significant risk was buried in the figures—persistent increases in shelter costs. The Fed has been patiently waiting for housing expenses to decline based on the expectation that new apartment dwellers will pay lower leases due to landlords offering incentives. That is unlikely because of the current housing shortage against the backdrop of multifamily builders slowing their plans, which points to the risk that shelter may continue to push price pressures above the Fed’s 2% target and further delay the central bank’s pivot. With those points in mind, I believe the dot plot to be released today may show only one reduction for the year.

Visit Traders’ Academy to Learn More About the Consumer Price Index and Other Economic Indicators

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

So expectation was for a 0.1% rise, it came it at 0.0%, not wildly off the mark. I think the market reaction is telling that it is still very ebullient in looking for rate cuts, but why cut rates if there are no storms on the horizon? Also, market participants know how the CPI is calculated so not sure why this statistic always generates such excitement/trepidation.