Growth

The U.S. economy grew 1.3% q/q saar in 1Q24, falling short of expectations for 2.5% growth. That said, weakness at the headline level masked some of the underlying strength in the report. Consumer spending rose by a downwardly revised 2.0% as spending on services more than offset a decline in goods spending, while the volatile trade and inventories components detracted from growth. However, real final sales to private domestic purchasers, which exclude these volatile segments, rose by a solid 2.8%. Economic growth should continue to moderate during the balance of this year, although this report likely masks recent economic momentum.

Jobs

The May Jobs report came in stronger than expected, although strong jobs growth masked some of the more mixed details. Nonfarm payrolls rose by an impressive 272K, while revisions removed a modest 15K jobs from March and April. Job growth was broad-based across sectors, with health care and government leading the charge higher. In contrast to the establishment survey, the household survey showed a 408K decline in jobs, while the unemployment rate ticked higher to 4.0%. Elsewhere, wage growth came in slightly hot, rising 0.4% m/m and 4.1% y/y. Overall, the labor market continues to look strong, although the broader basket of labor market data points to continued normalization.

Profits

The 1Q24 earnings season has come to a close. Our final estimate for S&P 500 operating earnings per share (EPS) is $54.91, which represents growth of 4.5% y/y and 1.9% q/q. Across sectors, information technology and communication services had strong quarters, while resilient consumer demand supported the consumer discretionary sector. Elsewhere, energy, materials and health care all saw earnings fall. Revenues, supported by resilient economic activity and solid inflation, were the largest contributor to operating earnings growth, although margins will play an increasingly important role as momentum slows.

Inflation

The May CPI report showed a slower than expected rise in inflation. Headline CPI held steady relative to last month and rose 3.3% y/y, while core inflation rose by 0.2% m/m and 3.4% y/y. Energy prices fell 2.0% m/m, led by a sharp decline in gasoline prices, while core goods prices were flat on a monthly basis. Across core services, shelter inflation remained elevated at 0.4% m/m for a fourth consecutive month. However, in a welcome turn of events, auto insurance fell 0.1% m/m after a streak of unexpectedly strong prints. Overall, this report alone won’t do much to sway the Fed’s messaging, but if the idiosyncratic factors keeping inflation elevated show further improvement in the coming months, inflation should continue its slow descent back to 2%.

Rates

At its June meeting, the FOMC voted to hold rates steady at 5.25%-5.50%, as expected, although its updated dot plot provided some hawkish surprises. In the updated Summary of Economic Projections, the Fed left its growth and employment forecasts for 2024 unchanged, while the headline and core inflation estimates were revised up 0.2% to 2.6% and 2.8%, respectively. On the dot plot, the median member lowered the expected number of 2024 rate cuts from three to one, although one cut was added to the 2025 forecast. The longer-run dot also rose to 2.8%, up from 2.6%. Moving forward, the outlook for interest rates remains largely dependent on incoming growth and inflation data. In our view, easing inflationary pressures through the summer and early fall should allow the Fed to cut one to two times this year.

Risks

- Stalling progress on disinflation could delay rate cuts, presenting challenges to both stocks and bonds.

- A slow-moving economy is more vulnerable to any kind of shock.

- Elevated valuations in some parts of the market may lead to volatility and market corrections.

Investment Themes

- Fixed income offers attractive levels of income and protection against an economic downturn.

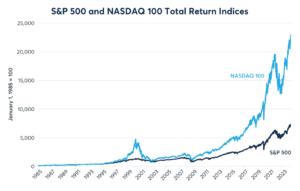

- Broadening profit leadership and reasonable valuations should present opportunities outside of the Magnificent 7.

- Long-term growth prospects and improving fundamentals should support international equities.

—

Originally Posted June 17, 2024 – Economic Update

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

The J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy.

This communication is issued in the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2024 JPMorgan Chase & Co. All rights reserved.

Disclosure: J.P. Morgan Asset Management

Past performance does not guarantee future results.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The price of equity securities may rise or fall because of changes in the broad market or changes in a company’s financial condition, sometimes rapidly or unpredictably. International investing involves a greater degree of risk and increased volatility. There is no guarantee that companies that can issue dividends will declare, continue to pay, or increase dividends. Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage.

JPMorgan Distribution Services, Inc., member of FINRA.

J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc. and JPMorgan Asset Management (Canada) Inc.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from J.P. Morgan Asset Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or J.P. Morgan Asset Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.