September in the U.S. has always marked the beginning of Fall, and for many kids an escalating anticipation of a spooky 6-to-8 weeks ahead, culminating in Halloween on October 31. But sometimes it feels like market participants haven’t grown out of their fears of this frightful time. As a case in point, the September-October window marks the weakest seasonal period for S&P 500 performance, based on returns going back 30 years, according to Bloomberg data as of October 17. And this Fall, the market has had ample reason to fear a “trick” instead of a “treat:” indeed, stagflation, demand destruction, soaring energy prices, the U.S. debt ceiling, a hawkish Federal Reserve, a weak Chinese property sector and elevated corporate profit warnings have taken turns in dominating the headlines. In the current commentary we hope to address this October’s unique market ghouls and further how we think resilient portfolios should be oriented around them.

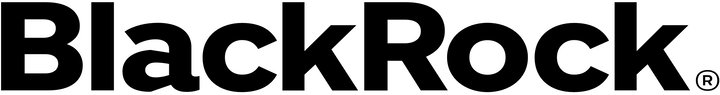

Figure 1: Google Trends: Worldwide Stagflation Queries

Ghoul # 1: Could “Stagflation” be Coming to our Doorsteps?

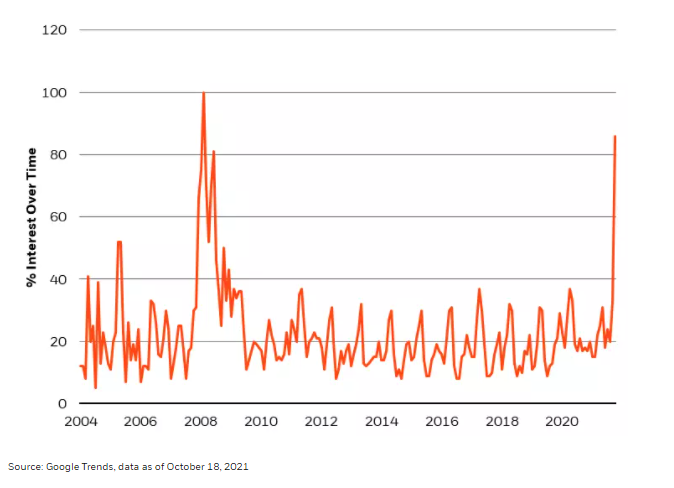

Perhaps there are so many Google queries about stagflation (see Figure 1) because nobody really knows what it means – which is helpful for stagflation prognosticators, since a very wide range of outcomes could then be considered “right.” The fact remains that predicting how the pandemic and policy response would ultimately influence consumption would have been near impossible, evidenced by the wild swings in prices and quantities over the last two years (see Figure 2). Smaller goods segments have been more volatile, while most services consumption trends can be explained by the nature of the pandemic (social distancing, curtailed mobility etc.). So, “stagflation” then becomes a one-word oversimplification of the complexity facing the global economic recovery today.

Figure 2: U.S. Consumption: Q2 2019 – Q2 2021 Change

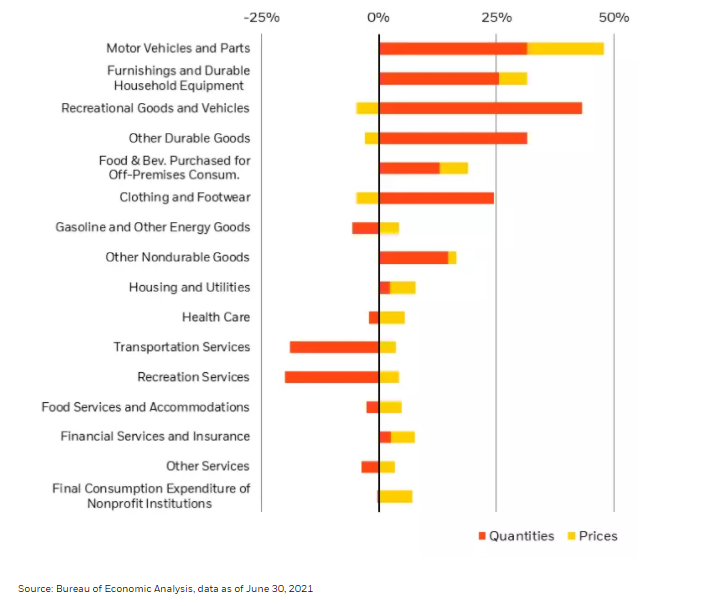

It is likely that in time pandemic distortions and extreme base effects will ease, though not immediately, pulling aggregate prices back toward a 2% rate of growth and allowing quantities to continue expanding once supply pressures alleviate. Nonetheless, this is not a normal set of historical patterns that can be easily modeled – many inflation factors are likely to stay sticky for a while, even as the aggregate PCE inflation metric may normalize in the year ahead (see Figure 3). Thus, in our view, owning inflation breakevens (TIPS) still makes sense, as do inflation sensitive sectors, which could serve as portfolio protection against more persistent inflation.

Figure 3: PCE Inflation Should Normalize in the Year Ahead

Click here to read the full article

—

Originally Posted on November 3, 2021 – Halloween and Christmas for Markets

© 2021 BlackRock, Inc. All rights reserved.

Investing involves risks, including possible loss of principal. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic, or other developments. These risks may be heightened for investments in emerging markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of October 29, 2021 and may change as subsequent conditions vary. The information and opinions contained in this commentary are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees, or agents. This commentary may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Prepared by BlackRock Investments, LLC, member FINRA

©2021 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH1121U/S-1893895-1/20

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.