Expectations are high that the FOMC will be cutting rates soon – perhaps at the September 17-18 meeting. Any economic data that would support that outlook will be welcome. The reports during the July 15 week will not do much to further what is known about inflation and the labor market, but they should help paint a picture of the wider economy that will inform Fed policymakers’ upcoming decision.

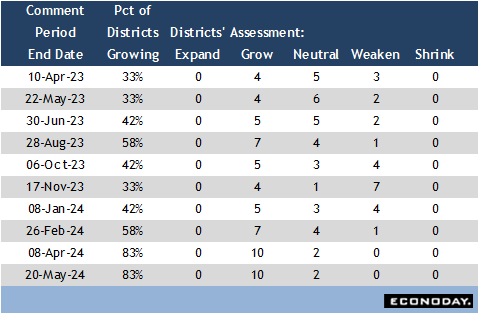

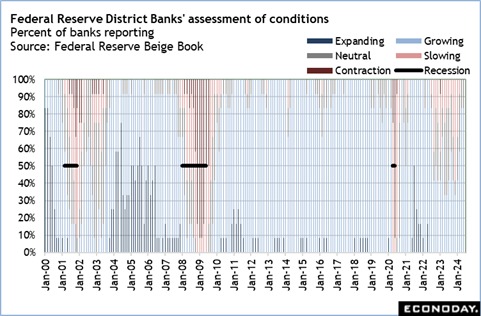

Central to this is the next Beige Book at 14:00 ET on Wednesday which will provide anecdotal evidence about conditions across the 12 Fed district banks for the period between mid-May and early July. Recent Beige Books have indicated that the US economy has pulled away from a potential recession and returned to more broadly – if slightly – expansionary activity. The next report may lose some of that firmer growth as consumers backed away from spending, business conditions softened somewhat, and the outlook was more uncertain. However, the report also will reflect conversations with respondents from before Chair Jerome Powell’s monetary policy testimony and the most recent reports on inflation. It won’t take into account the brightened prospect for a rate cut or that there is some evidence that consumer spending started to pick up in early July.

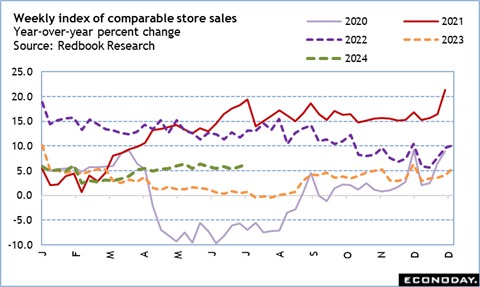

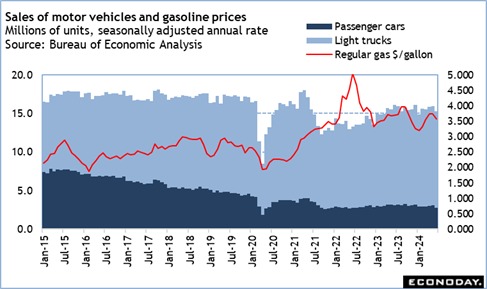

The data on retail sales for June at 8:30 ET on Tuesday is anticipated to finish the third quarter with another soft month. With motor vehicle sales flagging in June, this could hold back the overall performance. Although prices for gasoline were down a bit in June from May, consumers may have held off travel until the week of the July 4 holiday. Online sales activity is probably waiting for Amazon’s annual Prime Day event in July and the associated discounts at Amazon’s rivals. The weakness in the housing market should also be seen in sales of electronics, appliances, and home furnishings.

—

Originally Posted July 12, 2024 – High points for US economic data scheduled for July 15 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.