The life story of Charlie Munger, who passed away last week at age 99, serves as a shining example of the enduring American Dream, especially now at a time when many people doubt whether the promise of a better life is still intact. On the contrary, I believe that Munger’s journey, coupled with data from the updated Forbes 400 list, reaffirms that the American Dream still thrives.

Charlie Munger’s life began in a modest Midwestern town, far from the glamor of Wall Street. His early years were marked by hardships, including a marriage that ended in divorce, a rarity at the time, which left him with little in the way of assets.

But adversity was not done with him yet. Munger’s son Teddy fell victim to leukemia, and Charlie bore the financial strain of his son’s illness, paying for everything out of pocket. Tragically, Teddy passed away at the tender age of nine, devastating Charlie.

In the face of such overwhelming challenges—a failed marriage, financial ruin, the loss of his beloved son and then the surgical removal of his left eye following a botched cataract surgery—I suspect it must have been tempting for Munger to surrender to the vices that many others have succumbed to.

Fortunately for him, it was around this time that the future billionaire’s path intersected with a quirky investor from Omaha, Nebraska, by the name of Warren Buffett. Together, the two value investors began buying distressed shares in an old textile company called Berkshire Hathaway. The rest, as they say, is history.

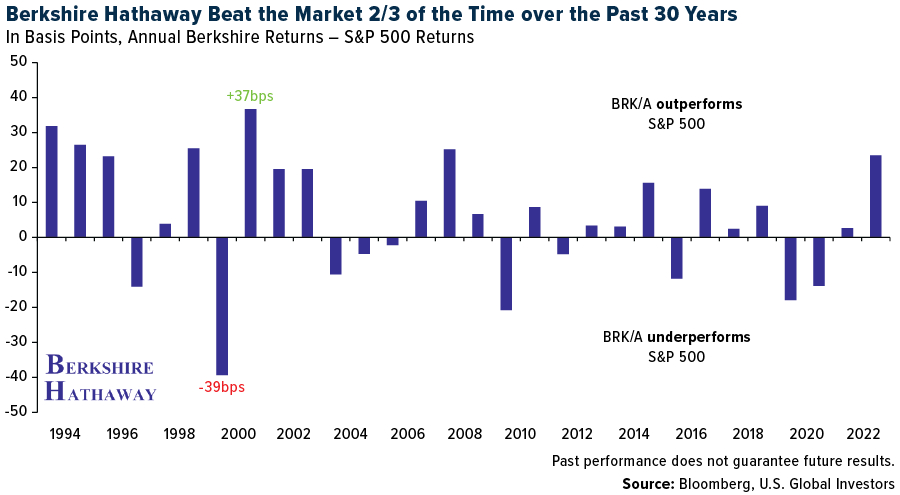

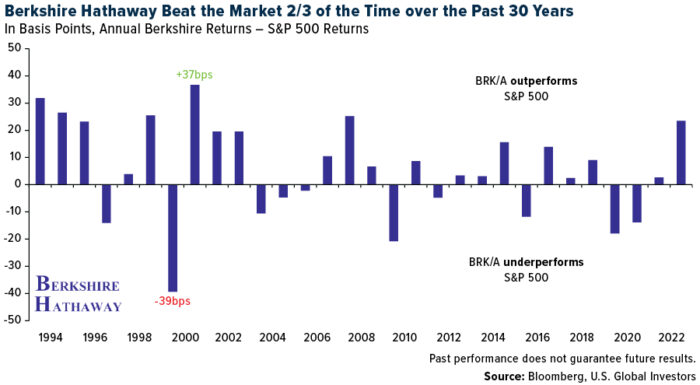

Between 1992 and 2022, Berkshire delivered a compound annual growth rate (CAGR) of 13%, beating the S&P approximately two-thirds of the time on an annual basis. Had an investor bought $100 of Berkshire shares in 1978, when Munger joined the company, that investment would be worth around $400,000 today. The chart below shows annual returns for Berkshire A shares minus annual returns for the S&P 500.

American Dream In Crisis?

James Truslow Adams, the Pulitzer Prize-winning historian who coined the term “American Dream,” defined it in 1931 as the “dream of a better, richer and happier life for all our citizens of every rank.” Does the dream still hold true? Today, many Americans can’t help but have second guesses.

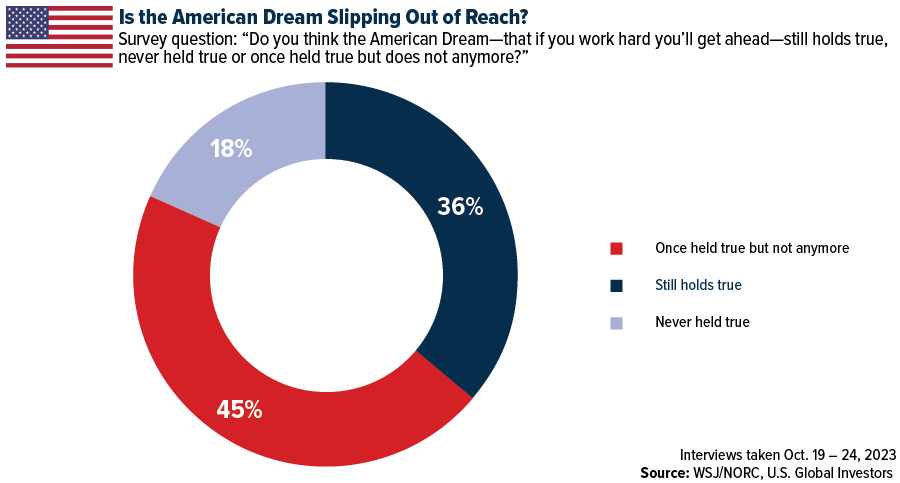

According to a recent Wall Street Journal/NORC survey, only 36% of American adults still believe in the American Dream, a significant drop from 53% in 2012 and 48% in 2016. Roughly two-thirds of respondents said that the American Dream either once held true but no longer or never held true to begin with. What’s more, half of people believe that life in the U.S. has worsened over the past half-century.

It’s undeniable that the U.S. faces historic economic challenges right now. Despite higher interest rates, inflation remains sticky, increasing 3.2% year-over-year in October. Homeownership is arguably the most important component of the American Dream, but due to sky-high mortgage rates, housing affordability is at record lows, as are pending home sales.

As dire as this sounds, I’m optimistic that the worst is behind us. Pain is temporary, and hope will prevail.

Self-Made Billionaires Embody The Dream

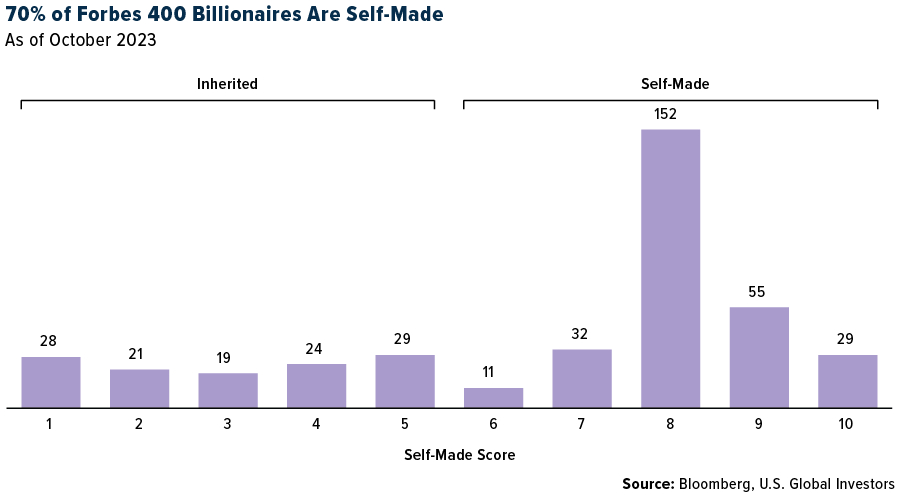

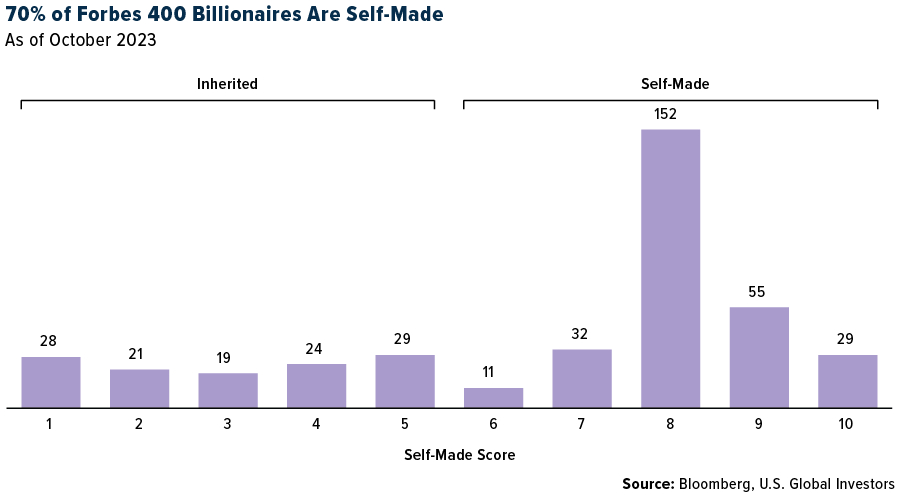

Don’t take it from me, though. The updated Forbes 400 list, released in October, reveals an encouraging trend. Over two-thirds of today’s billionaires are self-made, a remarkable increase from less than half in 1984. In 2023, an astonishing 70% of billionaires built their fortunes from the ground up.

Among these self-made billionaires, 29 earned a score of 10, indicating that they once lived below the poverty line or faced significant adversity during their journey to success. The list includes individuals like former Starbucks CEO Howard Schultz, who grew up in a Brooklyn housing project, and David Murdock, the former CEO of Dole Food Company and a war veteran who briefly experienced homelessness.

This diversity of backgrounds and stories within the ranks of the wealthiest Americans underscores the resilience of the American Dream.

Munger’s Legacy Lives On

In these times of doubt and uncertainty, Charlie Munger’s life story reminds us that the American Dream is not a relic of the past. It is very much alive, thriving, and within the reach of those who dare to dream, work hard and persevere through adversity. Munger’s journey from the depths of despair to becoming a billionaire and a revered figure in the world of finance speaks volumes about the opportunities that still exist in this great nation.

Let us draw inspiration from his legacy as well as the stories of self-made billionaires who continue to shape the landscape of American success.

Happy December!

—

Originally Posted December 4, 2023 – How Losing An Eye Helped Charlie Munger See Success

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. A basis point is one hundredth of 1 percentage point. The Forbes 400 Self-Made Score ranges from 1 to 10, with 1 to 5 meaning an individual inherited most of his or her wealth and 6 to 10 meaning he or she built their company or established their fortune.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 9/30/2023.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Charlie Munger was a great example of hope.

The American Dream still lives.

Strength and growth comes from challenges.

American will overcome.

All should continue with the American Dream in spite of the present challenges.

LOL so the American dream relies on you meeting another person who is willing to front you the capital. Good one