Market participants are pressing the pause button on Wall Street’s recent stock rally as they sift through a buffet of remarks from Fed speakers. Another reason for the halt is tomorrow evening’s hotly anticipated earnings announcement from semiconductor behemoth Nvidia. The options market is anticipating a sharp move in the bellwether name after the company releases its earnings results, which may very well embolden equity bulls or awaken the bears from hibernation. Gold and copper aren’t taking a break, however, and have set fresh all-time highs this week with silver not far behind.

Fed Speakers Reiterate Need for Patience

Federal Reserve speakers yesterday emphasized that the current fed funds rate is restrictive and is likely to continue to support disinflation, but more evidence is needed that price pressures are easing in a sustainable manner before the central bank lowers rates.

Fed Board Governor Michael Barr said he believes the economy is performing strongly with solid growth and low unemployment. He reiterated a conclusion from the central bank’s last meeting—Fed members need more data showing that inflation progress is sustainable before cutting the fed funds rate. He believes the Fed needs to allow the current restrictive monetary policy to have more time to tame inflation.

Barr also said the Fed is considering requiring all large banks to report unrealized losses on capital. Currently, only the largest banks are required to do so. By expanding the requirement to additional banks, reporting would better reflect interest rate risks. The Fed is also considering increasing liquidity requirements to improve banks’ ability to deal with funding shocks. Another proposal involves limiting banks’ use of held-to-maturity assets within liquidity buffers. The Fed, meanwhile, is reviewing public comments on various proposals, including requiring banks to issue more long-term debt that could be used when bank failures are resolved.

Fed Vice Chair Philip Jefferson said he believes monetary policy is sufficiently restrictive and that the economy is still strong. He acknowledged that the first-quarter GDP growth rate of 1.6% was a deceleration from 3.4% in the fourth, but private domestic final purchases were still strong. The metric excludes inventory investment, government spending and net exports. Jefferson believes it is a clear signal of underlying demand. It grew 3.1% in the first quarter, which was comparable to the second half of last year. Meanwhile, labor demand and supply have moved closer to being balanced, a result of the labor participation rate for individuals aged 25 to 54 exceeding levels that existed prior to the pandemic, which has contributed to a moderation in wage pressures. Disinflation and the loosening of the labor market imply that the Fed’s monetary policy is adequately restrictive. Going forward, consumer spending is likely to weaken as the Fed’s restrictive monetary policy weighs on demand. Regarding inflation, he explained that the Fed estimates Personal Consumption Expenditures prices rose at an annual rate of 4.1% during the first four months of this year. He said it’s too early to tell if the slowing pace of disinflation will be long-lasting.

Also yesterday, Cleveland Fed President Loretta Mester told Bloomberg Television that she believes monetary policy is restrictive. She echoed concerns of other policymakers, however, by saying the Fed needs more data showing easing inflation before cutting interest rates. She had previously believed three rate cuts would be appropriate this year, but after seeing higher inflation during the first quarter, she no longer believes that is appropriate. In the meantime, she expects the current fed funds interest rate to continue to bring inflation down.

In a Bloomberg interview yesterday, Atlanta Fed President Raphael Bostic said he believes that interest rates could remain higher for some time than they were in the past decade as inflation declines at a slow pace. He anticipates a continued decline in inflation through this year and into 2025 and he continues to expect that the central bank will cut rates only once this year, but not until the final quarter. Based on conversations with business leaders, it appears the economy is slowing and corporations’ pricing power is weakening. Bostic said the question of when the Fed becomes comfortable that it is on a sustainable path of 2% inflation is more important than how many rate cuts may occur next year.

During the Third Conference on the International Roles of the US Dollar yesterday, Fed Board Governor Christopher J. Waller said the US dollar is still the primary global currency, but its role may evolve as world economies change. The Fed and other researchers are continuing to study the topic. For example, a paper to be presented by Linda Goldberg of the New York Federal Reserve Bank, found that financial sanctions and geopolitical distance from the United States are associated with lower dollar shares in foreign exchange reserves. In another paper presented by Ryan Chahrour, the prolonged use of sanctions and policies intended to promote the use of other currencies, such as the renminbi, could reduce the global prominence of the US dollar. In another study, the availability of the US dollar in central bank swap lines helps ensure that credit flows to households and businesses while enhancing stability, which in turn protects the global dominance of the dollar. In a presentation this morning, Waller said weak results from the Institute for Supply Management’s survey of purchasing managers and a slowdown in retail spending point to the Fed’s policy being restrictive. He added that wage growth is higher than what is required to bring inflation to the central bank’s 2% goal.

BoE Deputy Governor Anticipates Summer Rate Cut

In the UK, at least one member of the Bank of England is optimistic that the organization may cut its Bank Rate this summer. Yesterday, Deputy Governor Ben Broadbent said a summer rate cut is possible depending on how quickly wages grow and price increases ease. Business surveys show that wage pressure, which is a major driver of inflation, is likely to ease but only slowly. On a positive note, wage increases have exceeded price gains, helping households improve their spending clout.

Consumer Spending Weakens While Enterprise Tech Growth Falters

Consumer spending during the recent quarter was sluggish, at best, while enterprise tech vendors produced mediocre results. In the travel industry, at least one airline is bracing for softening demand in Europe. Consider the following earnings highlights:

- Macy’s first-quarter earnings surpassed Wall Street expectations, but revenue fell short of forecasts and declined 3% year over year (y/y) with weak sales at its namesake stores and internet channel. The company maintains its strategy of adding store employees and improving how merchandise is presented has helped results and it upgraded its full-year guidance. Despite the guidance increase, Macy’s believes “customers will continue to be discerning in their discretionary purchases,” according to a press release. Earlier this year, the company announced it would close 2,300 Macy’s stores and focus on better performing locations. Macy’s share price gained approximately 3% in early trading.

- Lowe’s said first-quarter revenue declined from $22.35 billion in the year-ago quarter to $21.36 billion. Despite the decline, both revenue and earnings exceeded analyst consensus expectations. Lowe’s attributed the revenue decline primarily to do-it-yourself customers cutting back on buying more expensive items. It expects full-year comparable sales, a metric that excludes new stores, to decline 2% to 3% relative to 2023.

- Palo Alto Networks, which provides internet security technology, beat earnings and revenue expectations for its fiscal third quarter. However, it provided weaker-than-expected revenue and billing guidance for the current quarter which runs through July. Shares initially declined approximately 10% after the earnings release last night. Chief Financial Officer Dipak Golechha maintains that subscription growth has been stronger than expected and that volatility in the company’s revenue and billing guidance was driven, in part, by payment terms. The company expects its revenue to strengthen during the second half of this year.

- Zoom reported a fiscal first-quarter y/y sales increase of 3.2% with revenue and earnings exceeding analysts’ expectations. Zoom has been expanding its product lineup to include call center services and artificial intelligence. It experienced a small increase in consumer churn due to it implementing new late payment rules while its number of enterprise clients also declined.

- Ryanair, a Dublin-based airline, said its fare increase and large traffic volume helped it offset a 24% y/y jump in operating costs with jet fuel expenses 32% higher for its full fiscal year. For the fiscal year ending next March, the company anticipates an 8% growth in passenger traffic volume and will add 200 new routes. CEO Michael O’Leary, however, says Europe has a recessionary feel and is experiencing weak consumer sentiment that will likely lead to softer prices this summer.

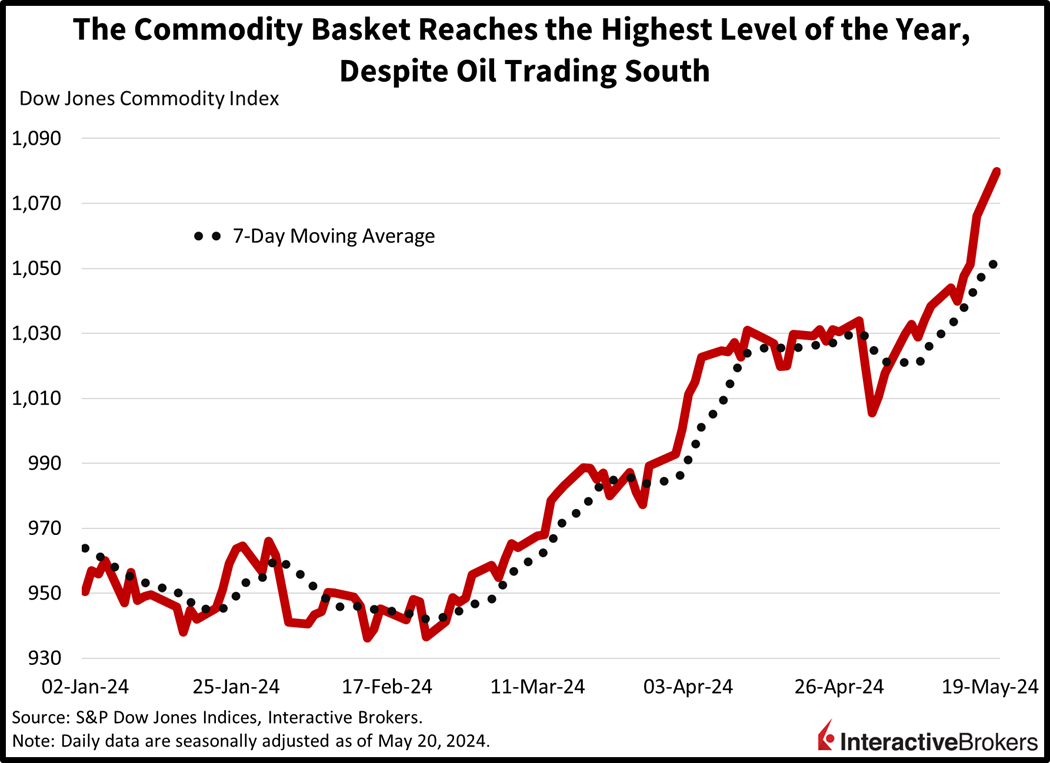

Sidelined Investors Result in Flat-Line Trading

Asset prices are near the flat line as market players await further earnings reports to motivate a swing in either direction. All major US equity indices are close to unchanged amidst balanced sector participation. Leading the gainers are the financials, utilities and energy segments, which are all higher by 0.5%. Steering the laggards are consumer discretionary, industrials and real estate; they’re down 0.4%, 0.3% and 0.2%. The fixed-income and currency areas are also quiet, with the dollar flat while the 2- and 10-year Treasury maturities trade at 4.83% and 4.41%, 2 and 3 basis points (bps) softer on the session. The greenback is losing ground relative to the pound sterling, franc, yuan and yen but gaining versus the euro and Aussie and Canadian dollars. Commodities as a whole are building on recent gains, even as oil is down sharply this month, with precious metals picking up the slack and then some. While gold and copper jumped to all-time highs yesterday, silver also soared to fresh decade highs this week. All three metals are up today, with silver, copper and gold gaining 1.2%, 0.7% and 0.3%. Dwindling demand conditions and upbeat supply sentiment are weighing on oil, however, with WTI crude trading south by 0.4%, or $0.31, to $78.83 per barrel.

Real-Time Data Points to Easing Price Pressures

Rising commodity prices, buoyant capital markets and tough talk from the Fed have weighed on rate cut expectations. Indeed, investors are only projecting one 25 bp reduction by year-end, as price pressures remain well above the Fed’s objective. This month’s real-time inflation data is looking favorable, though, with our gauges of May prices increasing just 12 bps month over month (m/m) so far, consistent with a 2% annualized figure in the short-term. A few consecutive reports near the 12 bp mark and below the 16.67 bp m/m standard for maintaining 2% inflation over the medium- to long-term may pave the route for the Fed’s easing cycle.

Visit Traders’ Academy to Learn More About Monetary Policy and Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.