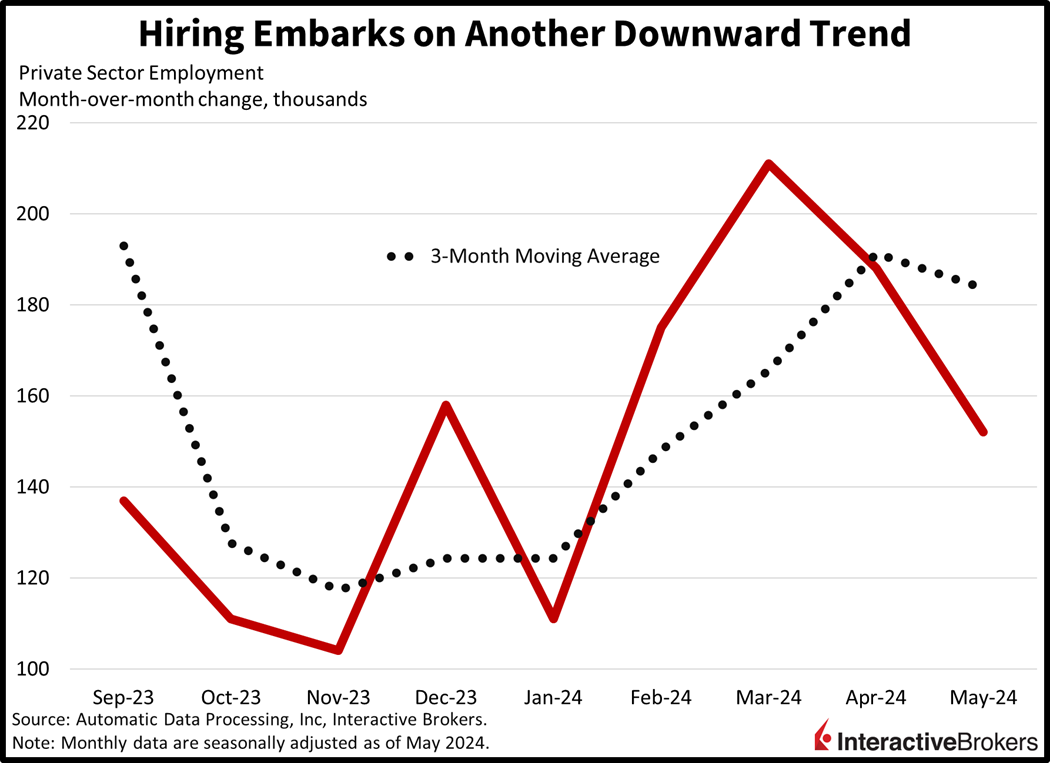

Markets are pumping aggressively this morning as investors pray that the Fed follows its counterpart north of the border in cutting rates. Economic data out today was less clear-cut, however, with ADP employment reflecting a moderation in hiring while ISM-services depicted a sharp spending recovery relative to April’s softness. ISM’s stronger-than-projected figure is a shift from the majority of recent releases failing to meet estimates, like ADP this morning. Economists and traders alike are indeed wondering if incoming data will confirm April’s sluggish spending, or if May will feature another robust recovery following a month of weakness, a familiar development throughout this cycle.

ADP Job Numbers Weaken and Miss Expectations

The private sector added 152,000 jobs last month, according to payroll processing company ADP. Hiring activity slowed markedly from April’s 188,000 headline figure while Wall Street anticipated a more modest deceleration to 175,000. Employment additions were hardly broad-based, however, with the report featuring four out of ten sectors losing jobs amidst a non-cyclical tilt characterized by the education and health services segment adding 46,000. The trade/transportation/utilities segment led the charge, however, sporting a figure of 55,000. Other gainers included construction, financial activities, other services and leisure and hospitality with additions of 32,000, 28,000, 21,000 and 14,000. Leading the losers were manufacturing, natural resources/mining, information and professional/business services, which shed 20,000, 9,000, 7,000 and 6,000 workers.

Bifurcated performance also existed across firm sizes, with small businesses trimming labor while larger corporations continued to add. Indeed, large (500+ employees) and mid-sized (50-499 employees) firms boosted rosters by 98,000 and 79,000, respectively. Small firms, however, saw rosters shrink by 10,000. Compensation figures climbed strongly despite decelerating headcount growth, with paychecks growing 5% year over year (y/y) for job stayers, in-line with the previous month. Job changers, meanwhile, saw wages grow 7.8% y/y, slightly down from April’s 8%.

Spending on Services Rebounds

Households splurged on services last month after taking a break in April, according to this morning’s Services Purchasing Managers’ Index from the Institute of Supply Management (ISM). May’s figure of 53.8 trounced estimates of 50.8 and climbed sharply from the prior month’s 49.4. It was the strongest result since last August. Supporting headline growth were exports, production and domestic orders, which scored well above the contraction-expansion threshold of 50, arriving at 61.8, 61.2 and 54.1. Prices continued to gain steam at a brisk pace though, with that segment of the index coming in at 58.1. Offsetting some of the progress and confirming waning labor market momentum was the employment component, which notched a contractionary score of 47.1. Survey respondents mentioned that the reduction in rosters was not due to lighter demand, but rather because of difficulties replacing job leavers amidst appetites for cost-cutting.

Bank of Canada Lowers Key Interest Rate

The Bank of Canada this morning lowered its key interest rate 25 basis points (bps) to 4.75%, making it the first member of the Group of Seven to begin easing monetary policy. Governor Tiff Macklem said the central bank has observed sustained evidence that underlying inflation is easing, reducing the need for restrictive monetary policy. The central bank anticipates making additional cuts if inflation continues to moderate, but he cautioned that global tensions, a faster-than-expected rise in home prices and high wage growth relative to productivity are risks that could stymie efforts to normalize policy.

Consumer Weakness Persists but Demand for Business Technology Grows

Weak consumer spending continues to weigh on retailers’ results while artificial intelligence and cybercrime are supporting sales of enterprise technology. Those are a few points expressed by executives as explained in the following earnings highlights:

- Dollar Tree’s earnings exceeded the analyst consensus forecast while revenue met expectations. The company’s Dollar Tree brand generated same-store sales growth of 1.7% while its more grocery-oriented Family Dollar locations’ comparable sales increased only 0.1% y/y. The company had previously announced plans to shut 1,000 Family Dollar stores and has since closed 500. It now says it is considering selling the brand. Shares of Dollar Tree declined 2% in premarket trading. For the current quarter, it expects Dollar Tree comparable sales to increase by 2% to 4% and Family Dollar sales to be flat.

- Ollie’s Bargain Outlet’s revenue grew 10.8% y/y despite same-store sales increasing only 3% and weakening from the year-ago growth rate of 4.5%. However, the company’s earnings and revenue exceeded analyst consensus expectations. CEO John Swygert echoed observations from other retail industry executives, explaining that consumers are clearly under pressure and are seeking value in their purchases. Ollie’s buys unsold inventory and sells it at steep discounts. The company increased its fiscal year 2024 sales guidance range that has an upper limit that narrowly exceeds analysts’ expectations. It also increased its comparable sales growth to a range of 1.5% to 2.3%. Shares of Ollie’s climbed 7.70% in early trading.

- Campbell Soup reported earnings and revenue that exceeded analyst consensus expectations but said its snacks division, which includes Goldfish crackers, is facing the headwind of consumers reducing their spending. The division’s sales fell 2% in the recent quarter, while sales in the company’s meals and beverages climbed 15%. CEO Mark Clouse believes the challenges of consumers trading down to lower cost items are temporary with sales already improving. On a broader basis, sales were increased by the company’s acquisition of Sovos Brands, which makes Rao’s pasta sauce. Campbell Soup lowered its outlook for organic sales and EPS but increased its overall sales guidance to reflect the acquisition of Sovos Brands. Campbell Soup stock declined 2% in morning trading.

- CrowdStrike, a cybersecurity firm, said its first-quarter revenue climbed 33% including acquisitions. Additionally, its earnings and sales exceeded analyst consensus expectations. CrowdStrike’s annual recurring revenue, an important metric based on subscription sales, climbed at the same pace as its revenue and also exceeded expectation. The company increased its guidance for the current quarter and full year with the revised quarterly outlook exceeded analysts’ expectations. The company has traditionally focused on endpoint security, or protecting laptops and desktops but has been expanding into other types of digital security services. Its share price jumped 8.9% in early trading.

- Hewlett Packard Enterprise posted earnings and revenue that surpassed analyst consensus expectations with its first-quarter results benefiting from growing demand for its AI-optimized servers. The company’s server revenue climbed 18% y/y while revenue tied to AI more than doubled from the prior quarter. CEO Antonio Neri says the company’s pipeline of new orders is strong, implying that the company could have strong growth during the remainder of this year. Hewlett Packard Enterprise provided a net sales guidance range for the current quarter with a midpoint that exceeds analyst expectations, but the midpoint of its earnings per share guidance is below the analyst forecast. Shares of the company climbed 14% in premarket trading.

Investors Stampede into Almost Everything

Asset prices are rip-roaring with market bulls firmly in control as Fed watchers dial up rate cut expectations and cheer the incrementally shorter journey across the monetary policy bridge. All major US equity indices are pointing north, with the Nasdaq Composite, Russell 2000, S&P 500 and Dow Jones Industrial benchmarks increasing 1.3%, 1.1%, 0.7% and 0.1%. Technology is really piloting the baskets higher as it gains 1.6% amidst split sector participation. Communication services and industrials are in second and third places; they’re up a more tempered 0.8% and 0.5%. Among the laggards, consumer staples, utilities and energy are losing the most; they’re down 0.5%, 0.3% and 0.2%. The rally is extending to fixed-income instruments, with Treasurys adding to their recent upside with the 2- and 10-year maturities available at 4.74% and 4.29%, 3 and 4 bps lighter on the session. The dollar is climbing, however, as central bankers outside of the US, namely Canada and the EU, appear much more eager to cut right here right now. The greenback’s index is higher by 19 bps to 104.35 as the US currency gains relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Commodities are gaining across the board and recovering from yesterday’s fierce selling pressure on dovish rate cut perceptions and stronger demand prospects. Gold, silver, copper and lumber are up 1.2%, 1.2%, 0.7% and 0.1%. Crude oil is also benefitting despite buoyant supply developments and rising stateside inventories; WTI is up 0.9%, or $0.67 to $73.51 per barrel.

A Hatrick of Weak Labor Data

Data today resulted in a hat trick of disappointing labor market data following yesterday’s weaker-than-expected job openings data being the first hockey puck to fly past the goalie. Today’s soft ADP numbers and ISM employment data posted another two points on the rate cut scoreboard. Unlike the past few days, however, bad news has become good news with investors flocking to equities in anticipation that a weakening job market will ease inflation and lead to rate cuts sooner rather than later. Today’s market rally is the third phase of quickly shifting sentiment. The first phase involved markets rallying when the Fed alluded to cutting interest rates in the fourth quarter of last year. The second rally resulted from optimism about the economy driven by the Fed implying that it will delay its monetary easing in the first quarter of this year. Today’s data, meanwhile, is shoring up sentiment by increasing the likelihood that the fed will begin cutting rates promptly. At the same time, meme mania is popping up, pointing to the potential for these index gains to be the last hoorah. What’s missing from the trading patterns is an assessment regarding the potential for corporations to continue growing their earnings despite a weakening economy. While some companies will do so by capturing market share, the overall equity market is likely to struggle with generating revenue growth and meeting investors’ demands for robust earnings, creating an atmosphere of volatile equity trading. Today’s action is emblematic of this risk: small businesses trimming employment, equities running higher in a concentrated manner, and with technology valuations extending week after week. In this game of runs, the bears are certainly due for theirs.

Visit Traders’ Academy to Learn More About Employment and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.