By: Robin Parbrook & Toby Hudson

Stock selection will be critical given high valuations in some markets, while rising state involvement may limit the attractions of Chinese shares in the near term.

- Investment opportunities in China are narrower as state involvement in private firms increases

- Indian equity valuations look elevated but a strong pipeline of expected new listings could throw up opportunities

- Sectors such as financials may benefit from higher inflation but face disruption from new entrants

Asia ex Japan equities had an eventful 2021. Chinese shares in particular faced a number of headwinds and the ripple effects from these are likely to spill into 2022.

Debt problems at property developer Evergrande were one of the major obstacles in 2021. We do not see a potential Evergrande default as a trigger for a systemic financial meltdown. However, we should not gloss over the risks.

An economic jolt is almost certain. Tighter liquidity conditions in the property industry are already leading to slower construction starts and land purchases. As the property sector slows there may be major ramifications across the Chinese economy, especially given the close correlation between property activity and consumer spending.

This comes at a time when there are already other signs of weakness, such as slower retail sales. With ongoing Covid outbreaks and the jump in energy prices, we see multiple headwinds for the Chinese economy in 2022.

Uncertainty remains over Chinese internet stocks

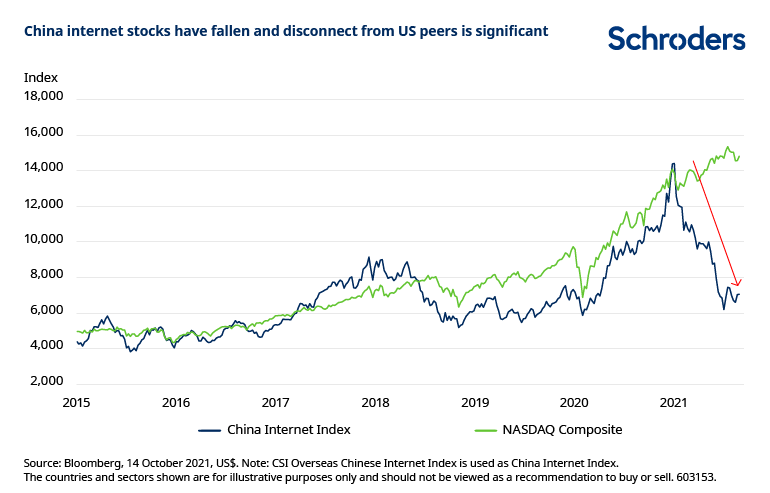

Looking more closely at Chinese stocks, the high profile internet sector is an area where we remain cautious, even after the sector’s underperformance in 2021.

Firstly, the new regulations governing the internet sector – which aim to tackle unfair competition, misuse of consumer information and more – are uncertain. We do not know how they will be implemented and this uncertainty is likely to hold share prices back.

Secondly, significantly more competition is about to enter the key growth parts of the internet companies’ business (such as e-commerce, cloud, content etc).

Thirdly, content restrictions and regulations look set to remain strict for the foreseeable future. Platforms may have to implement ever stricter self-censorship rules – foreign content will be heavily restricted and local content may become less engaging. This could affect usage and advertising revenues.

All told, we think 2022 will be a difficult year for China’s internet sector in terms of profitability as competition and regulations really start to bite. And this will come at a time when the economy is slowing and costs (such as workers’ wages and insurance) are rising.

Share prices in the sector have already declined but the heightened uncertainty about the earnings outlook means it is still hard to pinpoint ‘value’ in the sector.

Narrower set of opportunities in China

The Chinese economy still has many ingredients for strong growth in certain segments of the economy. Our issue is the increasing prominence of state-owned enterprises (SOEs) or state regulation across most key industries in China. Even those not dominated by SOEs – such as the internet sector – are increasingly required to accept a much greater degree of state involvement in their operations.

We think “the state advancing as the private sector retreats” means the outlook for returns for shareholders in many sectors has become more difficult. The range of industries and stocks we are interested in investing in has become narrower.

That said, markets have moved fast to price in the changing outlook. Valuations for the broader China market have pulled back a long way and a much weaker growth outlook is priced in, so downside risks should be less than six months ago.

We have seen sharp reversals in outlook several times before in the last few decades. Each time the Chinese market has eventually managed to turn as attention refocuses on the bottom-up opportunities in what remains a huge, diversified market.

India offers opportunities but looks expensive

India seems to be capitalising on some of the fall-out from the weaker China market. A healthy rebound in domestic activity recently is helping the corporate earnings recovery, while there have been several high profile initial public offerings (IPOs) in the online sector.

This reinforces the compelling ‘catch-up’ potential offered by India in many parts of the economy, alongside a regulatory backdrop that looks more accommodating than in China.

We remain positive on the longer-term potential in many sectors in India. With improving infrastructure and the roll-out of digitalisation, the outlook for the Indian economy is more promising than for many other developing Asian countries.

The problem in India is valuations, which have become stretched. However, there is still a huge backlog of Indian IPOs and placements to come which may throw up investment opportunities.

What about the rest of Asia?

Asia is not all about China and India. Some of the best companies in Asia are listed in Australia, Taiwan and Korea. We could point to global leaders in healthcare, semiconductor manufacturing, batteries, or niches like bicycle manufacturing.

The outlook for Korean and Taiwanese markets remains heavily geared into the broader global IT cycle. Although profitability across most of the tech sector remains very strong, markets worry about a possible slowdown in 2022. This is based on the view that some of the increased “work-from-home” (WFH) demand for technology products may fade as people return to the office, and be detrimental to related share prices.

We think a flattening out of demand is more likely than a sharp drop off, as stronger corporate demand and a healthier smartphone and auto-related cycle can offset much of any WFH weakness.

Turning to ASEAN (Association of Southeast Asian Nations), we remain relatively cautious on the stock market outlook. The current make up of ASEAN stock markets is not particularly attractive given the disruption faced by incumbent banks and traditional energy stocks from new financial technology and renewable energy.

This may change with new listings coming. Overall though, it is hard to get excited about ASEAN stock markets at the current time, particularly given the high valuations better companies trade on due to their scarcity.

Careful stock selection is essential

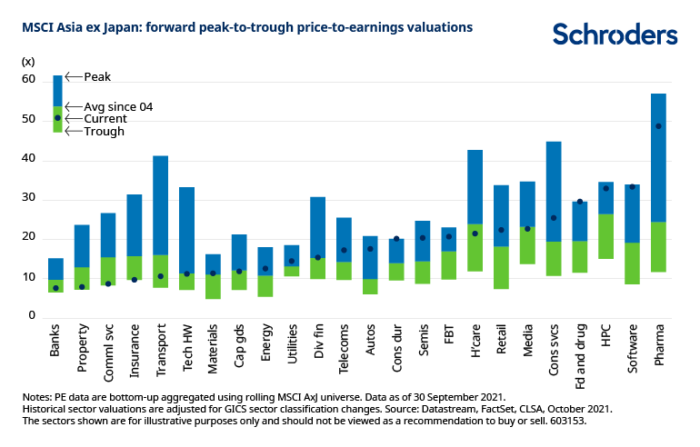

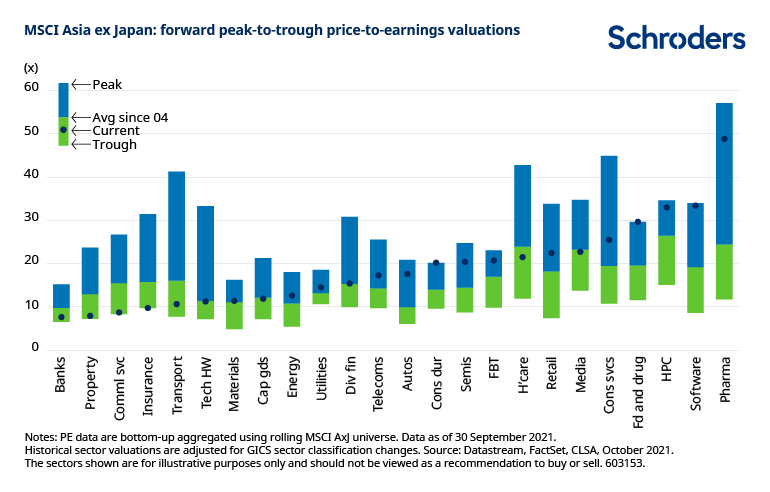

While there has been a drop in the overall market valuation in 2021, most of the correction has come in China where we feel stocks have fallen for good reasons. Other parts of the market have seen only mild corrections, or none at all in the case of India and ASEAN.

The parts of the stock market in Asia that do look cheap on headline multiples are sectors like banks, insurance, or property. These sectors are typically beneficiaries of higher inflation and interest rates, so there are may be opportunities for an improvement in returns in the medium term if inflation is more than just a ‘transitory’ issue. However, these industries face ongoing structural challenges from the rise of fintech and e-commerce in the region, which limits our enthusiasm.

More generally, given the uncertain outlook for growth and inflation in the coming quarters, portfolio construction remains focused on maintaining a healthy level of diversification.

We continue to like Asian-based companies that are global leaders in their respective niche. These may be companies operating in segments where new technology means their addressable market is growing. We also like companies which are using their comparative advantages to take market share. And we still favour technology with a particular focus on semiconductors, design services and software.

—

Originally Posted on November 26, 2021 – Outlook 2022: Asia ex Japan equities

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.