In the time since we closed early on Wednesday, we’ve had pieces of news that had the potential to move markets. So far they’ve had a significant impact on bond yields, but neither the FOMC minutes nor the June Payrolls report was sufficient to keep stocks from continuing along their usual path.

The headline number gave the illusion of a stronger-than-expected jobs market, but that was belied by revisions and unemployment. A gain of 206,000 Nonfarm Payrolls was above the 190K consensus, but May’s result was revised sharply lower, from 272K to 218K. Meanwhile, the Unemployment Rate rose to 4.1%, when an unchanged 4.0% was expected. Combined, that adds up to a more tepid demand for labor than expected. With Monthly Average Hourly Earnings rising by an as-expected 0.3%, down from 0.4% in May, there is little if anything here to dissuade the FOMC from considering rate cuts.

That said, while 2-Year Treasury yields sank by 9 basis points and 10-year yields sank by 7 bp, stocks had a relatively muted response. Sure, by midday the S&P 500 (SPX) was up by its now usual 0.35% or so, but that more likely attributable to favorable momentum from the usual megacap tech stocks than any real enthusiasm about the economic reports. Six of the Magnificent Seven stocks are higher, with the lone laggard being a relatively unchanged Nvidia (NVDA), pushing the Nasdaq 100 (NDX) to a 0.85% gain. An NDX that far outpaces SPX is a “tell” that the megacaps are in control – especially on a day when declining stocks yet again outpace advancers.

It is also useful to note that rate cut expectations are little changed from Wednesday, though they do increasingly favor move in September. Futures are implying a 6.5% chance for a cut at the July 31st meeting, down slightly from Wednesday’s 8.5% and 12% from a week ago. More importantly, the likelihood of a September cut is now 82%, up from the prior 78.5% and 68% from a week ago.

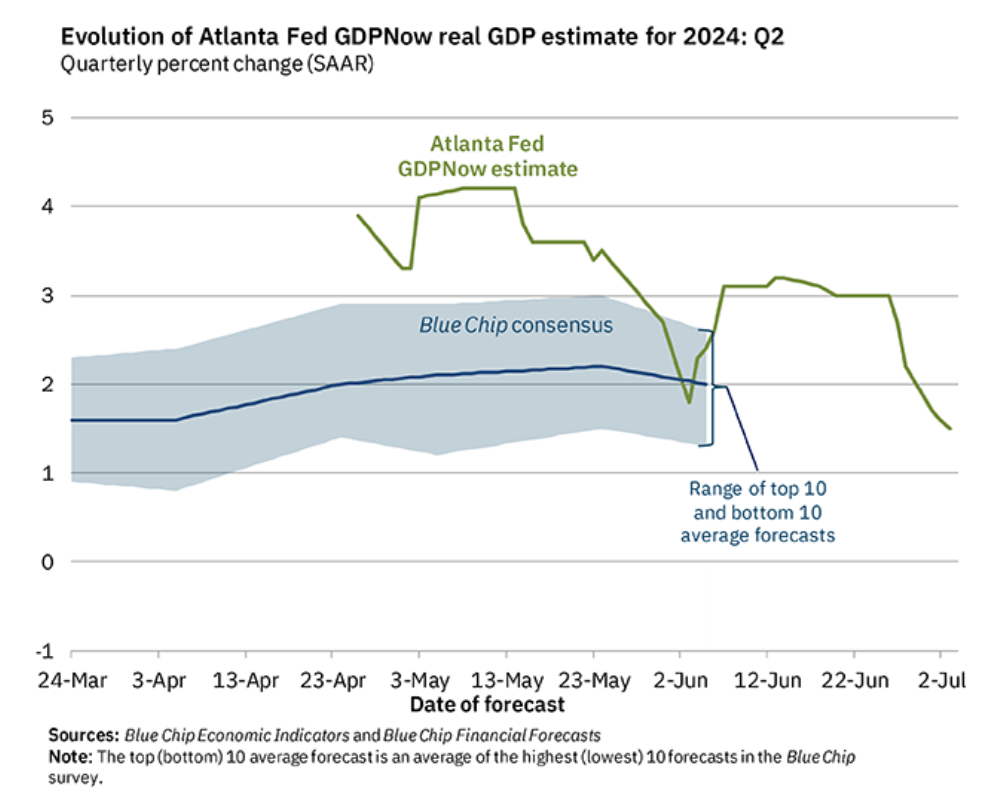

The rising likelihood of a September cut is why I believe that July’s meeting is increasingly consequential. There is growing evidence that the pace of economic growth is slowing. Just as disinflation tells us that prices are rising, just more slowly, we saw a similar effect today in the jobs market. We also see this reflected in GDP estimates. As of Wednesday’s update, the Atlanta Fed’s GDPNow estimate is for a second quarter increase of 1.5%. Indeed, that reflects a growing economy, but at a slower pace, as the graph below shows:

Source: Atlanta Fed

The key question will be the degree to which the FOMC recognizes the risks of slower growth, and whether they believe that the balance of risks has shifted meaningfully from higher prices to a weakening economy. If so, then a modest cut would be welcome. If not, the failure to act could cause investors to believe that the Fed is behind the curve. This would be less about equity investors slavish addiction to the prospect of monetary accommodation than fear that an inordinately tight policy could unduly restrict future growth.

For now, there is nothing to meaningfully restrict the path of the stocks that matter, so up we go again. “Don’t short a dull tape” remains in play. Sure, the next FOMC meeting comes around the height of the upcoming earnings season, but for now that seems to be a distant concern. The low level of VIX bears that out to some extent. As long as there is nothing to dissuade the “Super Friends”, the Mag 7 and other big cap tech names from rallying, (certainly they haven’t cared about European elections, let alone our own drama) they likely will. At least for the short term. And until they don’t.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.