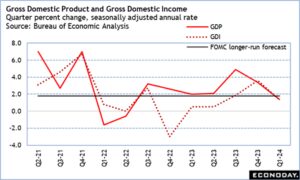

Investor sentiment strengthened this morning as fears of banking troubles moderated and the Consumer Price Index (CPI) showed that February’s inflation, while still high, was in-line with expectations.

After the collapse of SVB Bank and Signature Bank and the subsequent selloff of banking stocks, shares of regional banks such as First Republic, PacWest and KeyCorp. surged this morning. This indicates that investors believe fears of a contagion among financial institutions may be overblown.

Despite persistent inflation, investors are choosing to view the glass half-full this morning. Equities are rallying as market players cheer the eighth consecutive month of y/y progress on the inflationary front. The S&P 500 and NASDAQ Indices are up 1.5% and 1.8% respectively as they price in a lighter Fed path than anticipated prior to the bank failures. Cross currents are present, however, with yields on 2-year and 10-year Treasuries rising dramatically on the back of accelerating core inflation, the Fed’s preferred gauge within the CPI. The 2-year is up 32 basis points (bps) to 4.35% while the 10-year duration is up 16 bps to 3.68%. The Dollar Index is catching a bid as well—it’s up 0.2% to 103.83. Despite OPEC expecting more demand for oil barrels from China, oil prices dove again this morning as recession fears offset the positive demand story from Asia. WTI crude oil is down 1.5% to $73.65.

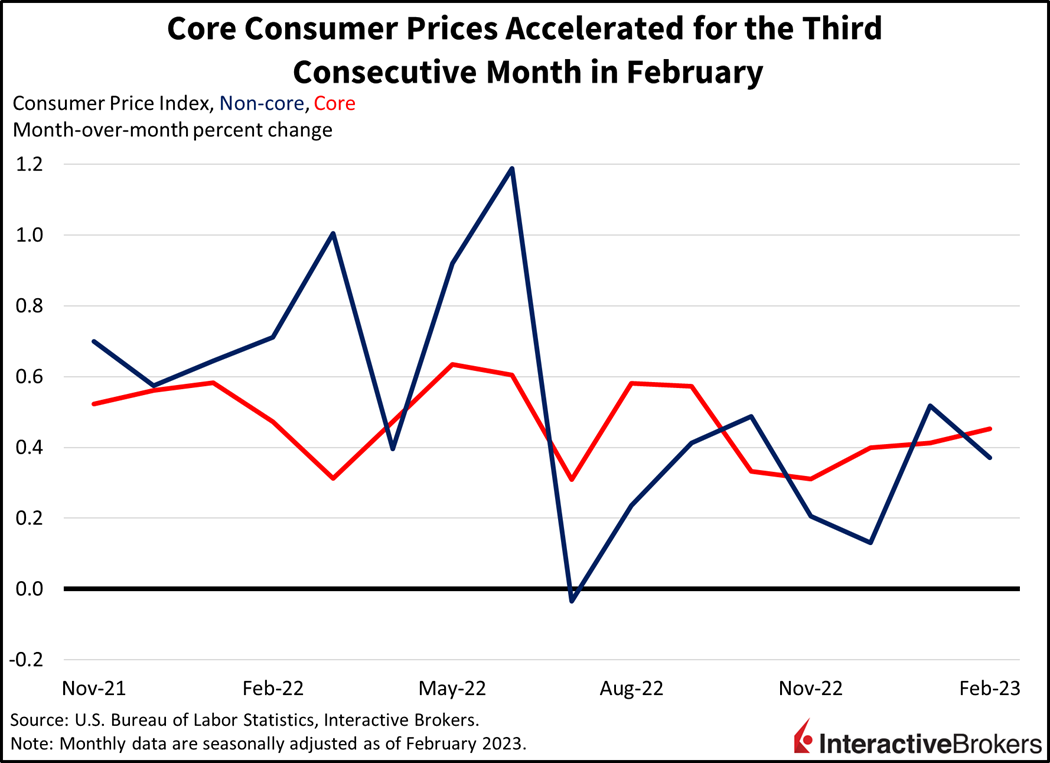

Also this morning, the CPI alleviated concerns that inflation last month could be higher than anticipated. The CPI increased 0.4% month over month (m/m) and 6% year-over-year (y/y). Declining energy prices, such as heating oil and natural gas, helped to keep the top-line number from increasing more dramatically. However, the Core CPI, which excludes volatile energy and food prices, advanced 0.5% m/m and 5.5% y/y. Core CPI m/m exceeded the Dow Jones analyst consensus expectation of 0.4%, but the Core CPI y/y reading and readings for both m/m and y/y headline CPI met expectations.

Price pressures were led by transportation services, gasoline, shelter, apparel, and food at dining establishments. Each category notched lofty month-over-month increases of 1.1%, 1.0%, 0.8%, 0.8% and 0.6%. Electricity, food at home, new vehicles and medical care commodities contributed to rising prices to a lesser degree, however. On the relief front, heating oil, used vehicles and medical care services registered price declines of -8.0%, -2.8% and -0.7%.

The in-line report shows persistent pressure in the sticky services components while highly-weighted shelter prices are expected to eventually soften as apartment renters seek lower-cost housing after their leases expire and prospective home sellers acquiesce to the limited availability of offers. Nevertheless, it’s important to consider the base effects of the data. In other words, the y/y inflation rate is being compared to an already high base inflation rate from a year ago.

The Fed is tasked with threading the needle with tremendous finesse to simultaneously maintain financial stability while extinguishing the inflation fire.

This report firmly cements expectations for a 25-bp hike at next week’s pivotal Fed meeting, as core inflation in February continued to pick up steam, accelerating for the third consecutive month while overall inflation moderated slightly. Odds of a 25-bp hike rose to 83% following the data release and odds of the Fed staying put and not raising rates were 17%. Things become ever more interesting as we move along the fed funds futures curve, with interest rate cuts expected as soon as the June meeting. In fact, some market participants have even suggested that the Fed should cut next week, as banking stresses reflect the harsh reality that the economy can’t handle more monetary policy tightening at this juncture. The Fed is tasked with threading the needle with tremendous finesse to simultaneously maintain financial stability while extinguishing the inflation fire.

As optimism among investors increased this morning, Facebook parent Meta announced to its employees that it will layoff 10,000 workers. The company also laid off 11,000 employees last year. In an email to employees, Meta Chief Executive Mark Zuckerberg explained that the cuts are needed to make the company more efficient.

The strong investor sentiment today and growing expectations that the Fed will raise the fed funds rate only 25 bps next week face two hurdles tomorrow that could potentially point to stronger than anticipated inflation and the central bank becoming more aggressive with its monetary tightening. Both the retail sales and the Producer Price Index (PPI) are scheduled for release tomorrow. For retail sales, investors will assess if consumers have been able to extend their purchasing power in the face of higher interest rates, rising prices, loftier credit card balances and declining savings. On a broader basis, the PPI will illustrate if businesses are continuing to struggle with higher input costs.

Visit Traders’ Academy to Learn More about the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.