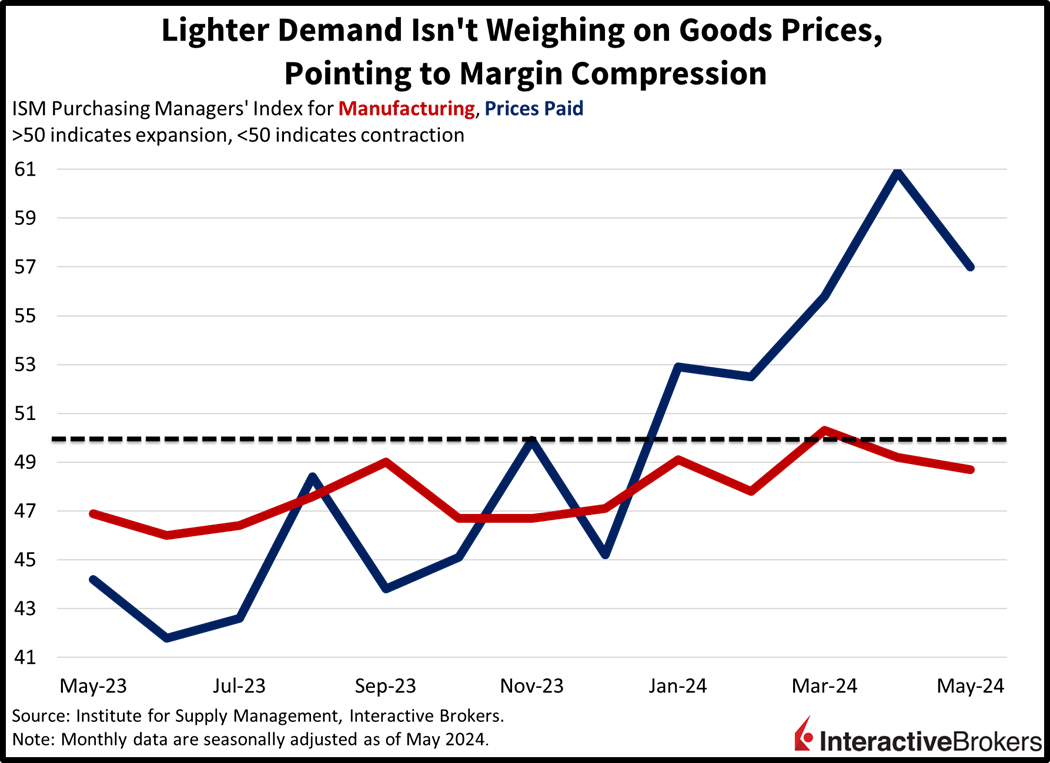

Meme mania caused stocks to surge north this morning as we flipped the calendar to June, but the rally, ignited by stock investor Roaring Kitty, was short-lived as investors shifted their focus to lofty earnings prospects that may not materialize considering batches of soft economic data. Indeed, weaker-than-expected figures from both the ISM and the construction industry may mark a shift from investors craving bad data to support rate reductions and buoyant liquidity conditions toward investors fearing that firms may not make their numbers. To that end, despite manufacturing orders contracting sharply, the ISM prices-paid component reflected considerable inflationary pressures in the pipeline, pointing to mounting odds of margin compression.

Manufacturing Weakens for Second Month

Manufacturing failed to recover into expansion territory in May as customer activity and inventory conditions as a result remained weak, marking the second-consecutive month below the growth threshold. ISM’s Purchasing Managers’ Index for manufacturing dove further south to a score of 48.7 from April’s less dramatic decline of 49.2. May’s figure also missed expectations of 49.6 and extended the index’s distance from the contraction-expansion border of 50. New orders, inventories and order backlogs weighed the most on overall conditions, sporting figures of 45.4, 47.9 and 42.4. Employment and production offset some of the weakness with modest results of 51.1 and 50.2, respectively. The prices-paid component was the loftiest figure and the most concerning development within the report, coming in at 57, below the median estimate of 60 and April’s 60.9 but nonetheless firmly in expansion territory. Recently, fierce upside moves in commodity prices have pressured manufacturer input costs. Overall, however, elevated prices, towering borrowing costs and reduced credit availability are leading to sluggish purchasing activity, lighter inventories and softer backlogs as the goods sector can’t catch much of a break.

Construction Spending Declines for Second Month

Construction investments declined for the second consecutive month in April as lofty borrowing costs weighed on apartment builders as well as commercial construction projects. Construction outlays declined 0.1% in April, missing expectations for 0.2% growth while slipping slightly less than March’s 0.2% rate of contraction. Weighing on investment dollars were the religious, health care, lodging, sewage, commercial and apartment building categories with spending contracting 3.5%, 2.4%, 1.6%, 1.3%, 1.1% and 0.3% month over month (m/m), respectively. Helping to soften the blow were the conservation, manufacturing, transportation, water supply and single-family segments, which rose 2.1%, 0.9%, 0.5%, 0.5% and 0.1% during the period.

Unrealized Bank Losses Hit Half a Trillion Dollars

Bank losses on long-term real estate debt continue to mount with the combined write-downs of held-to-maturity and available-for-sale securities climbing to $517 billion in the first three months of this year, up $39 billion, according to the FDIC Quarterly Banking Profile. While much ink has been spilled on troubles with commercial real estate debt (CRE), the recent uptick in unrealized losses resulted from residential mortgage-back-securities declining in value due to higher interest rates. It was the ninth-straight quarter of unusually high unrealized losses following the Fed’s interest-rate hike campaign that started in early 2022. Meanwhile, residential foreclosures are rising in some Texas and Florida cities, a potential warning sign that the combination of higher taxes, increased insurance premiums, elevated home values and loftier interest rates are overwhelming households. Houston, for example, experienced 3,020 foreclosures in the first quarter, almost as many as in early 2019, according to Bloomberg. Homeowners that are overwhelmed with mortgage payments are less likely to find buyers for their properties with mortgage rates exceeding 7%. Bloomberg notes that in Texas, 35% of mortgage defaults this year occurred among homeowners who purchased properties in the past four years. These homeowners lack sufficient equity to sell homes and payoff their mortgages. The Quarterly Banking Profile also notes that year-over-year loan volume grew only 1.7%, the slowest rate since the third quarter 2021. Credit card and CRE finance contributed the most to the growth.

On a positive note, the Quarterly Profile Report maintains that the banking industry continued to demonstrate resilience in the first quarter, with net income rebounding. Without accounting for lower expenses related to the FDIC special assessment and lower goodwill write-downs, net income increased 14.3% from the prior quarter.

Markets Promptly Shrug Off Meme Mania

Markets ran for hills in pre-market trading and shortly after the 9:30 am opening bell but have since retreated sharply. While all major US equity indices were in the green at the open, only the tech-heavy Nasdaq Composite is still there at the moment, but it’s now up just 0.2%. The Dow Jones Industrial, Russell 2000 and S&P 500 benchmarks have all reversed, with the baskets declining 0.6%, 0.4% and 0.2%. Sector breadth is awful with only healthcare and consumer discretionary up on the session, with gains of 0.6% and 0.5%. Piloting the charge lower are the energy, industrials and utilities segments which are losing 2.2%, 1.6% and 1.2%. Treasuries are catching a strong bid on the back of weaker-than-projected macro data with the 2- and 10-year maturities changing hands at 4.82% and 4.41%, 6 and 9 basis points (bps) lighter on the session. Rate relief and a slowing economy are derailing the greenback, whose index is down 45 bps as the US currency loses ground relative to all of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. In commodity land, oil is trading lower following OPEC+ announcing the gradual phasing out of voluntary production cuts at yesterday’s meeting amidst mounting demand concerns. WTI crude is down 0.9%, or $0.69 to $77.12 per barrel. Gold and silver are higher by 0.7% and 0.6%, however, on safe-haven demand stemming from worsening tensions between Beijing and Taipei, and the potential for global election volatility. Copper is up 0.5% on lighter supplies and prospects for persistent manufacturer cost pressures.

Bad News May No Longer Be Good News

Today could mark a significant turning point in equity markets. In recent months, investors have cheered weaker-than-estimated data based on expectations that it could accelerate the start of the Fed’s loosening of policy. Investors are now reacting to soft data with fear because it could point to a phase of the business cycle in which stocks decline along with yields as economic growth weakens. While lower yields can reduce business’ financing costs, the lower expenses don’t make up for the impact upon corporate earnings of consumers being tapped out. With a sluggish consumer, furthermore, the benefits of accommodative monetary policy and abundant liquidity conditions are likely to be much more muted, leading to the possibility of equities selling off despite cratering yields.

Visit Traders’ Academy to Learn More About the ISM Purchasing Managers’ Index and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

You wrote the article too soon.