Mike shares what investors need to know as the final quarter of 2019 kicks off.

The fourth quarter of 2019 kicked off with a market selloff and more evidence that a protectionist push is hitting the U.S. industrial sector. How are our asset views faring this year to date–and what are the key themes we see shaping markets in the months ahead? We address those questions in the Q4 update to our Global investment outlook. Here’s a quick look at our answers.

Looking back

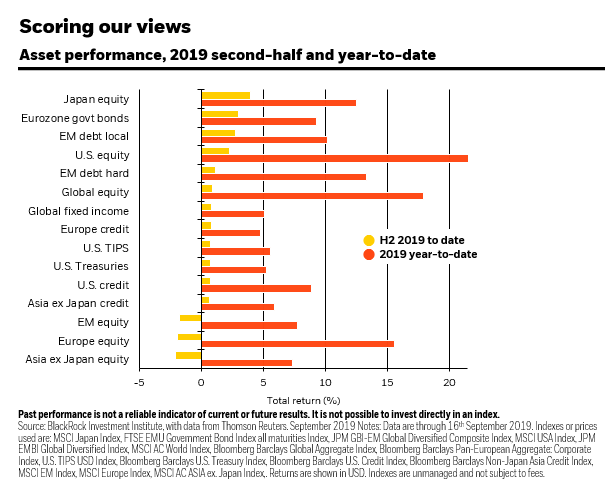

Risk assets have performed strongly year to date, and our overweight in U.S. equities has paid off. Meanwhile, emerging market (EM) and Asia-ex-Japan equities have under-performed since midyear, validating our shift to an underweight stance. See the chart below.

We have been surprised by the extent of the rally in government bonds, which have played an important diversification role in cushioning against equity selloffs. Rising geopolitical tensions loom as an ongoing risk and challenge our overall moderate pro-risk stance. Finally, Japanese equities have outperformed, contrary to our expectations, thanks to a lull in trade tensions that we see as temporary.

Looking ahead

Geopolitics have come to the fore as a major driver of markets and the global economy, just one of the investing themes for 2019 we discuss in our Q4 Global investment outlook. Here are five forward-looking takeaways from the piece.

- Trade disputes and geopolitical frictions have become key drivers of the economy and markets. U.S. trade policy is increasingly unpredictable. Recent geopolitical volatility – including attacks on Saudi oil infrastructure–underscores this message.

- Persistent uncertainty from protectionist policies is denting corporate confidence and slowing business spending. Yet we still believe the economic expansion is intact, supported by dovish central banks and a robust U.S. consumer. This suggests moderate risk-taking will likely be rewarded – even as recent events reinforce our call for a greater focus on portfolio resilience.

- We expect more Federal Reserve rate cuts, but believe markets are pricing in too much monetary easing. The European Central Bank materially exceeded market expectations on stimulus, launching a broad package with a combined impact that should be greater than the sum of its parts.

- We do not believe monetary policy alone is a cure for the fallout from global trade tensions. Supply chain disruptions could deliver a hit to productive capacity that fosters mildly higher inflation even as growth slows. This complicates the case for further policy easing.

- Overall, we favor reducing risk amid the ongoing protectionist push. We prefer U.S. equities for their reasonable valuations and relatively high quality; and the min vol and quality factors for their defensive properties. We like EM debt for its coupon income. We are overweight euro area sovereigns: a relatively steeper yield curve brightens their appeal even at low yields. And we see government bonds as important portfolio stabilizers.

—

Originally Posted on October 3, 2019 – Takeaways From Our Q4 Outlook

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of October 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM1019U-969354

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.