What’s going on here?

US manufacturing contracted for the third straight month in June 2024, with the PMI falling to 48.5, down from 48.7 in May. A PMI below 50 signals contraction.

What does this mean?

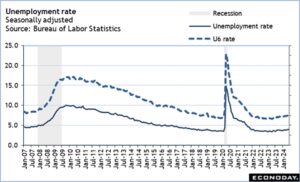

Manufacturing in the US is feeling the pinch from a mix of weaker demand and persistent high interest rates. The Institute for Supply Management (ISM) reported that June’s PMI dipped to 48.5, reflecting ongoing contraction. The price index for inputs hit a six-month low of 52.1, down from 57.0 in May, signaling reduced demand and potential easing of inflation pressures. This slump is partly due to the Federal Reserve’s steadfast benchmark interest rate of 5.25% to 5.50%, in place since last July. Despite a slight uptick in the new orders sub-index to 49.3 from 45.4 in May, factory output fell, with the production sub-index dropping to 48.5 from 50.2. Employment in the sector also took a hit, aligning with a broader cooling in the overall job market.

Why should I care?

For markets: Manufacturing blues signal economic shifts.

The ongoing contraction in manufacturing points to significant economic shifts that investors need to watch. Weaker demand for goods and high interest rates are throttling factory activity and could herald broader economic challenges. Predictions had the PMI rising to 49.1, but reality fell short, emphasizing the unpredictable nature of the current market environment. These trends highlight a potential risk to industrial stocks and could prompt reevaluation of investment strategies.

The bigger picture: Economic ripple effects from industrial decline.

A sustained contraction in manufacturing could have far-reaching implications. Government data shows a 4.3% annualized decline in Q1, mostly from long-lasting goods. If this trend continues, it could dampen economic growth and affect global supply chains. The slight recovery in new orders offers some hope, but the overall picture remains bleak. Understanding these patterns can provide insights into future economic policy adjustments and global market dynamics.

—

Originally Posted July 1, 2024 – US Manufacturing Shrinks For Third Straight Month

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Finimize and is being posted with its permission. The views expressed in this material are solely those of the author and/or Finimize and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.