We came into today with the mindset that the big news of the day would be the FOMC meeting and Chair Powell’s press conference. CPI was certainly on the agenda, but it seemed to be a secondary consideration. Did the CPI report steal Powell’s thunder?

This morning’s CPI report was an unmitigated stunner, beating on every measure. The monthly headline and core results were 0.0% and +0.2%, both coming in 0.1% less than consensus expectations. That was obviously great news for both stock and bond investors. By late morning, we see Treasury yields lower by 14-16 basis points, while the S&P 500 (SPX) is up over 1%. The Russell 2000 (RTY) is up just less than 3%, and NYSE advancers lead decliners by about 5:1. This is a powerful, across-the-board rally predicated upon solid economic news.

Now what? It was clear that markets expected no chance of a rate change at today’s FOMC meeting, but expectations for a September cut rose from 58% yesterday to 81% now. Two full cuts are now priced in for 2024, up from 1.5 yesterday. It is quite fair to believe that progress toward the Fed’s inflation target would raise the likelihood for cuts, even if we discover later that the Summary of Economic Projections (aka SEP or “dot plot”) was likely to show that two cuts were already expected.

We now have to wonder if the markets’ joyful reaction to the CPI report will necessitate a change in tone from Chair Powell. Traders have come to expect a Goldilocks mien from him, if not an outright dovish tone. Even when he tries to be balanced in his approach, traders seize upon the market friendly portion of his narrative. Today he can’t help but notice the euphoric reaction to CPI; will he want to take a more measured, if not dour, tone to avoid throwing gasoline onto the fire?

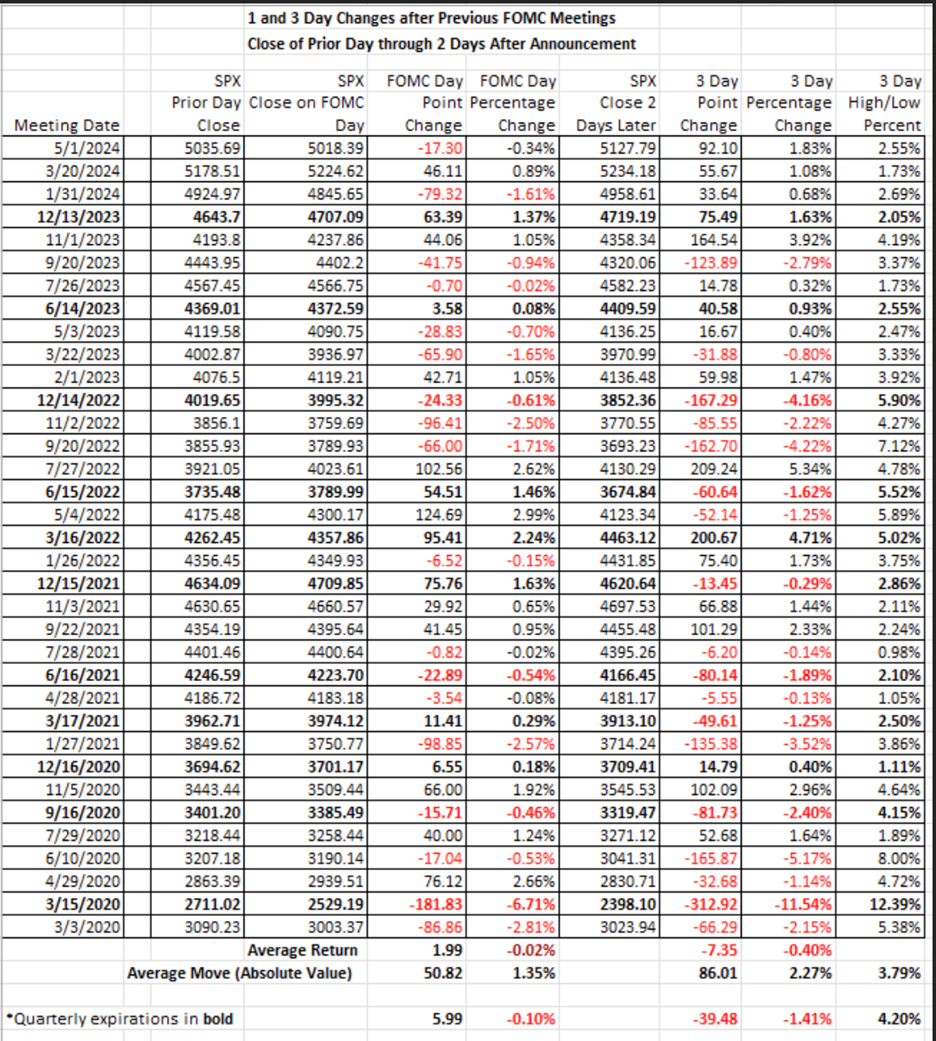

Either way, we’ve already seen a relatively typical post-FOMC move occur already. As the table below shows, it is normal to see a 1.35% change for SPX on Fed day. I simply don’t have enough data to predict what might occur when we’ve already had a move of that magnitude before the announcement:

Source: Interactive Brokers

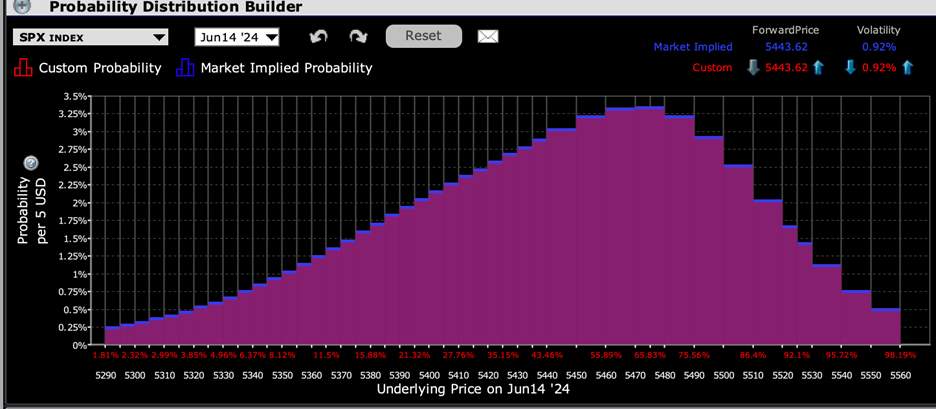

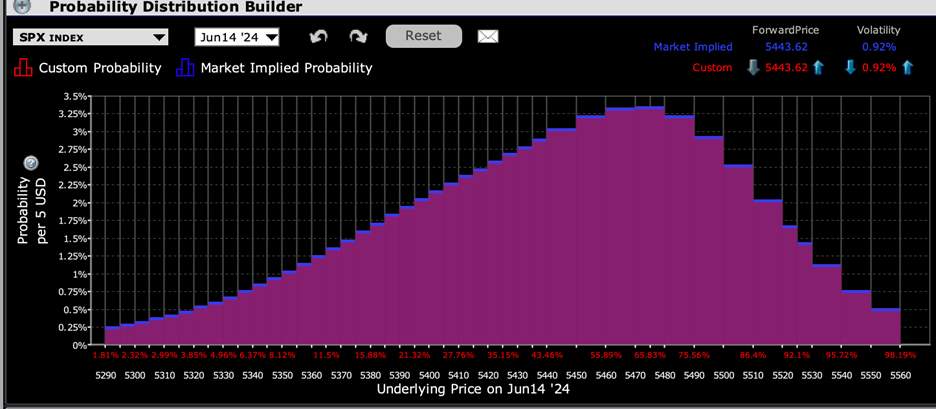

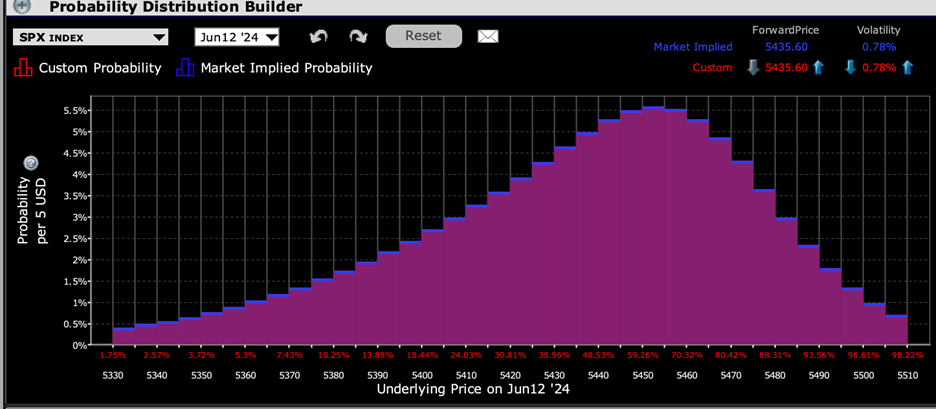

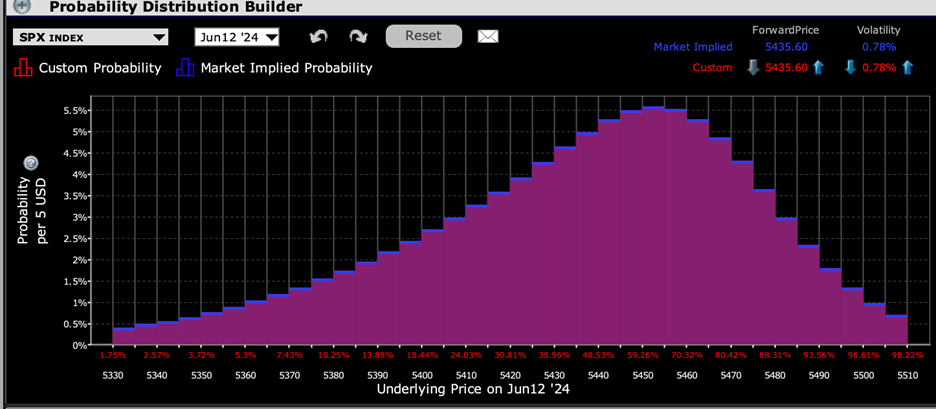

Options markets seem to believe that the enthusiasm will continue after the press conference. Note how the peak probabilities for SPX options expiring both today and Friday are above the current index level:

IBKR Probability Lab for SPX Options Expiring June 12, 2024

Source: Interactive Brokers

IBKR Probability Lab for SPX Options Expiring June 14, 2024

Source: Interactive Brokers

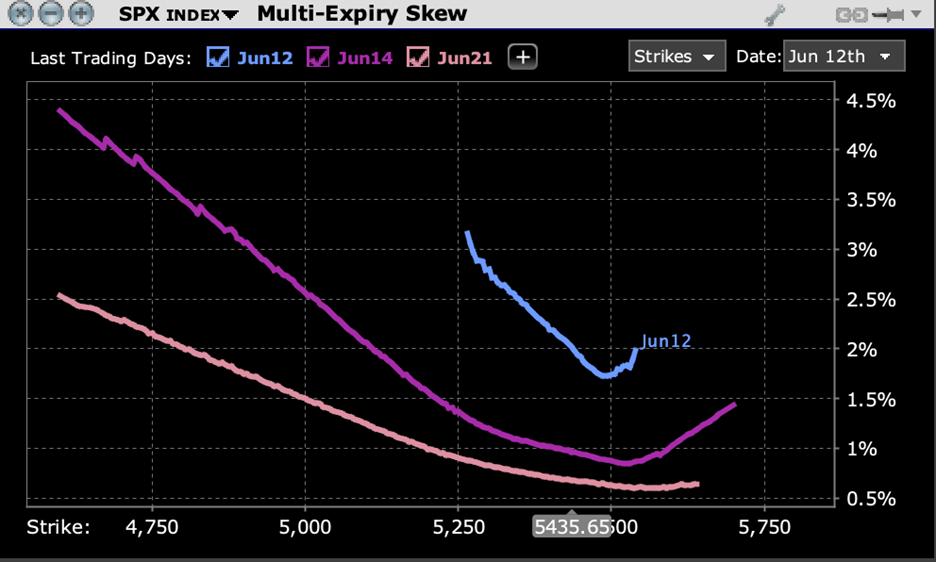

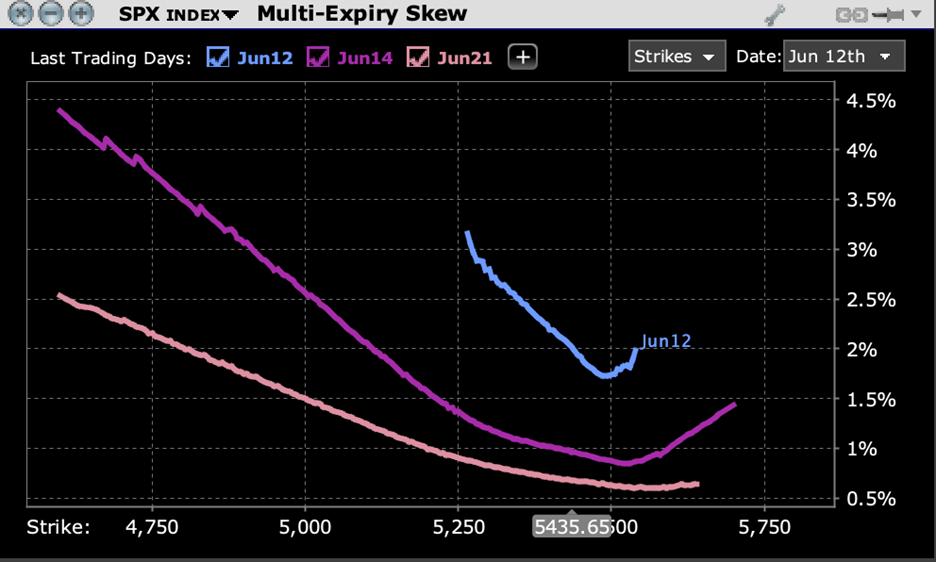

Meanwhile, at-money SPX options are still pricing in a roughly 2% move for today, with about a 1% average daily move expected for the remainder of the week. Implied volatilities for options expiring in the next couple of weeks have dipped, though:

SPX Term Structure of Volatility, Today (yellow), Yesterday (orange)

Source: Interactive Brokers

And though you wouldn’t necessarily expect this, SPX skews for near-term options do show some downside risk aversion:

Skews for SPX Options Expiring June 12th (blue), June 14th (magenta), June 21st (orange)

Source: Interactive Brokers

The bottom line is that we can guess all we want now. We’ll know soon enough what to expect.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

But if …”the first move is usually wrong”……..does this all get reversed at 1430 ET ?

I hope that the Fed has enough guts to not always pander to the market. The markets are doing just fine without the need to cut rates. There would need to be some sort of a crisis to fend off for the Fed to cut rates. Leave rates alone, beat inflation and maybe crack the real estate market to bring the sky high values down to more affordable levels. 25+ years of easy monetary policy has inflated real estate values to the stratosphere. The Fed’s job should now be to bring it down seeing as it did a splendid job in getting us here.

Biden’s economy on fire. Bidenomics working great!