Market inefficiencies create opportunities for active managers. We believe there are more mispriced companies in small cap growth than in other equity markets, and we have developed an approach that allows us to capitalize consistently when we find them.

Gross/Net expense ratio as of 3/31/2023: 1.25%/1.13%. The Adviser has contractually agreed to waive certain fees through June 30, 2024. The net expense ratio is applicable to investors.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050. See additional disclosures at the end of the piece.

Inefficiencies in Small Cap Growth = Opportunity

Active managers focus on identifying stocks that have underappreciated growth prospects relative to their current price. Because markets are not perfectly efficient, mispricing can occur when there is a fundamental misunderstanding about a company. The small cap market is especially prone to mispricing.

An Emerging Landscape

Many smaller companies operate in rapidly evolving markets that are giving rise to new industries or market segments. Additionally, these companies may have relatively short track records as public companies, creating skepticism about their growth trajectories. Think about Amazon in its early days when people did not understand how book sales and broader retail categories could be revolutionized online, displacing individual stores by centralizing warehousing and distribution. This type of ambiguity creates an opportunity to use in-depth research to identify the small subset of companies that are positioned to succeed over time.

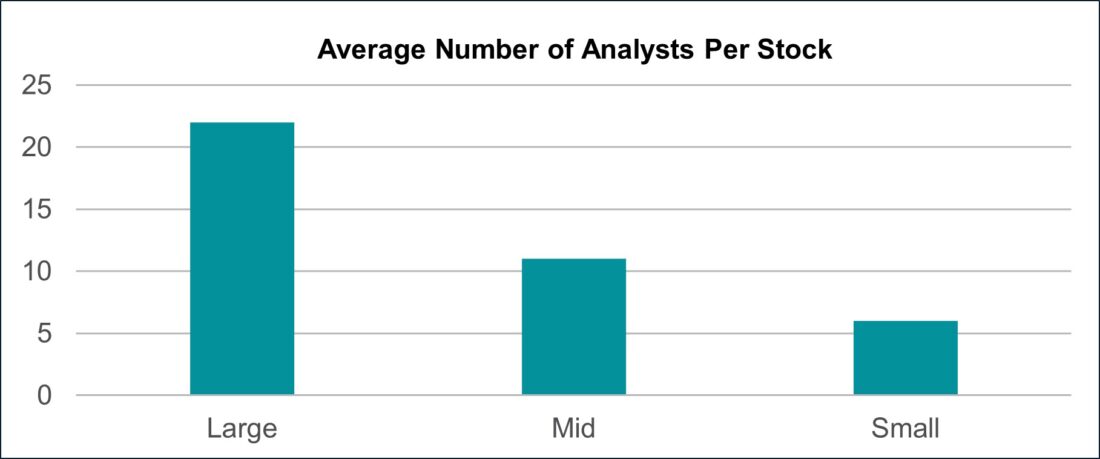

Limited Analyst Coverage

Additionally, the small cap market lacks in-depth analyst coverage. Analysts tend to focus their attention on larger companies, which are more widely known and have a larger impact on the market, as illustrated in the chart below.

Source: FactSet. Data as of June 2023. Large, mid, and small cap indexes are S&P 500, S&P MidCap 400, and S&P SmallCap 600, respectively.

When you couple the market inefficiencies created by both the potential mystery around smaller companies and lower analyst coverage, experienced investors can add value through disciplined fundamental research. In his book, Pioneering Portfolio Management, former Yale University Chief Investment Officer David Swensen wrote:

Because Wall Street finds following smaller companies far less profitable, in terms of both day-to-day trading opportunities and occasional investment banking transactions, investors face the prospect of uncovering some interesting, mispriced investment opportunities. Although success demands hard work, small capitalization equity managers with an edge have a reasonable shot at generating attractive relative returns.

Successfully Navigating the Small Cap Growth Market

Not all small cap companies will be able to grow and create shareholder value. It is critical to deploy a disciplined approach to identify those companies that can deliver sustainable growth over a multi-year horizon.

We have found that focusing on a high-conviction portfolio of carefully selected businesses has allowed us to deliver strong results over time. Companies in our portfolio must meet our standard of quality, growth, and valuation.

Quality

Because the small cap market includes many unproven and unprofitable companies, it is critical to focus on quality businesses. We define “quality” as companies with the following four characteristics: (1) a distinct proprietary advantage; (2) a leading position in the industry; (3) potential for margin expansion; and (4) the presence of a strong management team.

Through our in-depth fundamental research, we identify a select group of quality companies and generally avoid unprofitable and/or highly levered businesses. Our San Francisco location gives us the opportunity to perform ground-floor research with many of our portfolio companies and their competitors, as well as meet with management teams frequently.

Secular Growth

We are also committed to finding companies that are experiencing durable secular growth, as opposed to cyclical businesses that are simply benefitting from a strengthening economy. In other words, we are looking for companies that operate in a sector or industry that is undergoing a structural transformation, as this generally translates into an expanding customer base as well as pricing power. Historically, we have found that secular growth drives sustainable increases in both customer demand and revenue growth.

Moreover, secular growth usually marks a permanent shift in purchasing patterns. Sometimes it is because an older, inferior product is replaced by a better one (e.g., flip phones -> smart phones), and sometimes it is because something entirely new comes along (e.g., cloud computing, artificial intelligence). We focus on smaller companies with the innovative DNA to deliver superior value to customers. By contrast, incumbents, which are frequently larger companies, can get caught off-guard. As Alphabet’s CEO recently admitted, “scale isn’t always good for you since it makes it harder to “move fast [and] maintain a culture of risk-taking.” He added that “counter-intuitively … the more successful things are, the more risk-averse people become.”

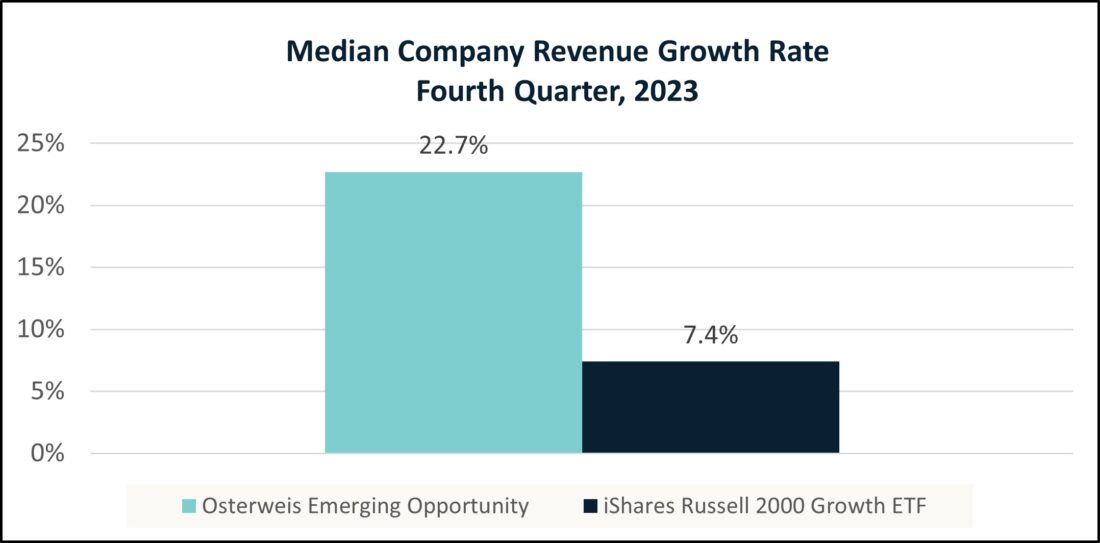

Our portfolio is built around companies that can deliver durable increases in demand, so it has maintained much higher revenue growth than the index.

Source: FactSet. The figures above exclude companies where data was not available.

Valuation

Buying at the right time is nearly as important as buying the right companies. Because of their distinctive growth/quality characteristics, the companies in our portfolio tend to trade at premiums compared to many names in the index, which have lower growth and/or profits. We are patient investors that wait for appropriate entry points. In selecting investments, we utilize an absolute valuation discipline – each new position must have 100% upside potential based on our five-year earnings model using an industry appropriate P/E ratio of no more than 30x, and we generally trim when the upside falls to 50% or lower.

Final Thoughts

Identifying and exploiting mispricing opportunities is always challenging, but it is less so in an inefficient market like small cap growth, which contains many relatively unknown companies. This allows us to conduct our own due diligence and formulate a differentiated view, which can lead to substantial upside.

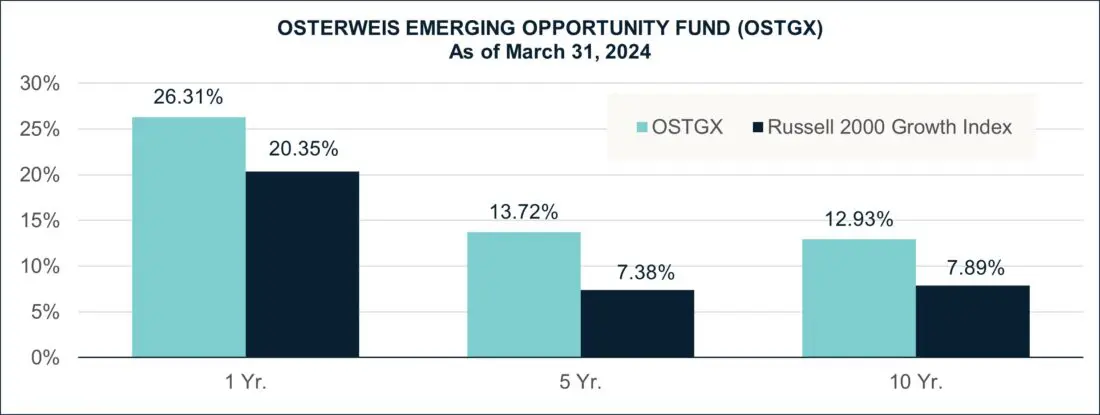

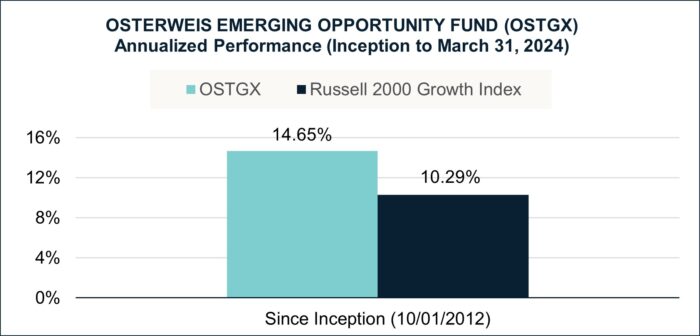

Using a combination of quality, growth, and valuation, we have established a repeatable method of finding these opportunities to drive long-term returns. This disciplined approach has led to outperformance versus the Russell 2000 Growth since the inception of the fund.

Originally Posted May 30, 2024 – Active Pays in Small Cap Growth

—

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Osterweis Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Osterweis Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Mutual Funds

Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in Mutual Funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds' assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please visit https://www.interactivebrokers.com/en/index.php?f=1563&p=mf

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.