Shares of GameStop Corp. (GME) and AMC Entertainment Holdings, Inc. (AMC), which had cooled off after a hot rally in mid-May, are surging higher in premarket trading on Monday.

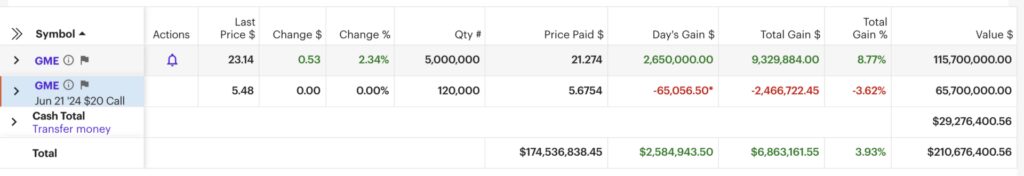

The resumption of the meme rally came on the back of Keith Gill, also known as “Roaring Kitty,” disclosing a substantial position in GameStop on the r/Superstonk Reddit forum. A screenshot shared by Gill on the platform showed he held 5 million GME shares valued at $115.70 million, and 120,000 call options worth $65.70 million, with a strike price of $20 and exercisable on June 21. The calls were purchased at $5.48 per share.

A social media user also shared the final trading update posted by Roaring Kitty before he went on a social media hiatus back in April 2021. The trading update, posted on the r/Wallstreetbets Reddit thread, showed Gill owning 200,000 shares valued at $30.94 million at that time.

Late Sunday, Gill also posted a cryptic picture of a reverse card from the game “Uno” on X.

Analysts and data experts have said the meme stock rally this time could be different. Vanda Research indicated that “meme 2.0” may not be a repeat of 2021, given relatively less retail participation and better-prepared hedge funds, which were heavily affected three years ago.

In premarket trading, GameStop soared 89.20% to $43.78, according to Benzinga Pro data. Fellow “meme stock” AMC climbed 30.02% to $5.63.

—

Originally Posted June 3, 2024 – GameStop Nearly Doubles, AMC Soars 30% Premarket: What’s Setting Meme Stocks On Fire Again?

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Security Futures

Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, please read the Security Futures Risk Disclosure Statement. For a copy visit ibkr.com

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.