Key News

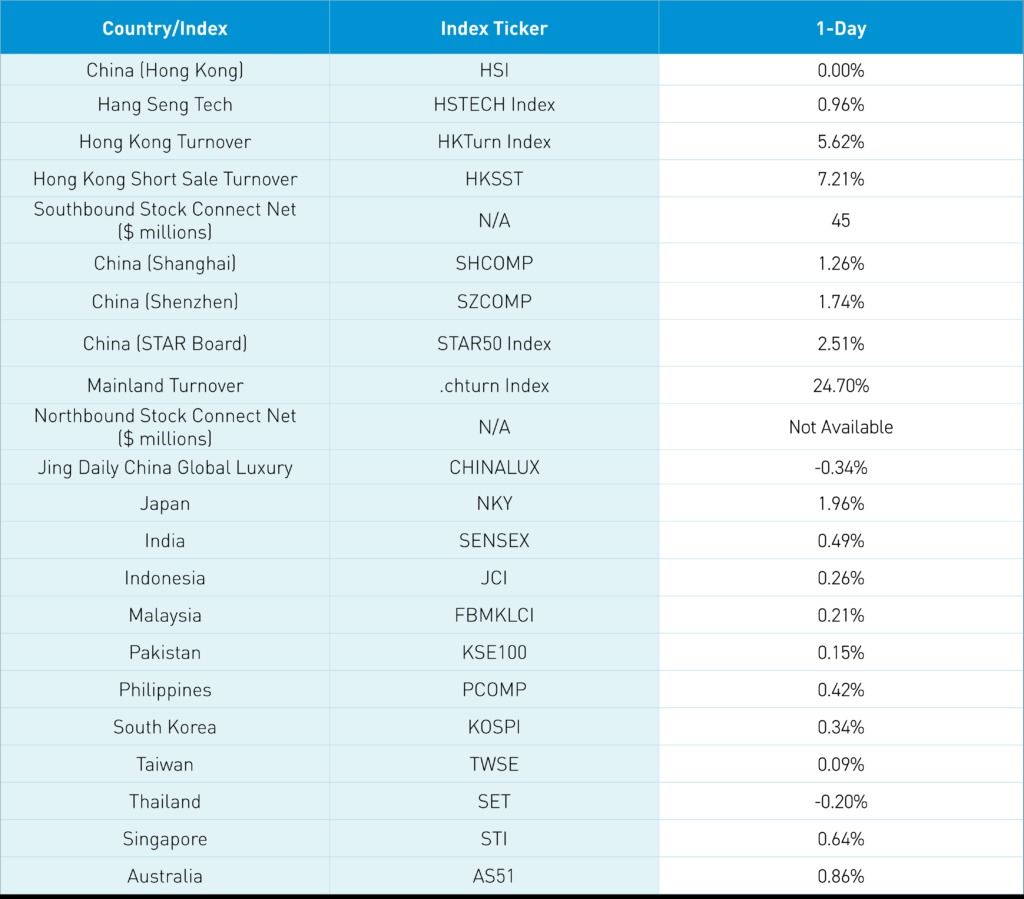

Asian equities were mostly higher overnight except for Thailand as Hong Kong was flat overnight.

All sectors were higher on the Mainland overnight, based on the constituents of the MSCI China All Shares Index. The Mainland market has lagged Hong Kong significantly in recent sessions. Why the divergence? I think local investors are waiting for some more indications of stimulus from the Third Plenum, which starts on Monday.

The “official” consumer price index (CPI) and producer price index (PPI) for China will be released tomorrow. The expectation is for CPI to rise due to sharp increases in pork prices, while the PPI is expected to fall, perhaps on slowing external demand.

Internet stocks mostly reversed declines from yesterday as Tencent and NetEase were higher. Meituan fell though, despite buying back more than 4 million shares yesterday. Bilibili outperformed internet names, gaining +3.51%, on continuing momentum from the short-video platform’s positive first quarter results. Alibaba was slightly higher by nearly +1% while JD.com fell -0.78%.

Ping An fell as the mega bank and fintech investor considers another convertible bond offering of above $2 billion.

Top government strategist Wang Huning said that China must bolster “internal circulation” including consumer spending in a vague but promising statement ahead of the Third Plenum meetings.

Goldman strategists noted that they are increasingly bullish on China small cap stocks due to low valuations, liquidity, and compelling industry composition. Meanwhile, the National Team is rumored to be getting involved in small cap index ETFs, as the China Southern 1000 ETF saw elevated turnover.

The Hang Seng and Hang Seng Tech indexes closed flat and +0.96% higher, respectively, on volume that increased +6% from yesterday. Mainland investors bought a net $45 million worth of Hong Kong-listed stocks and ETFs overnight via Southbound Stock Connect. The top-performing sectors were Information Technology, which gained +2.14%, Materials, which gained +1.18%, and Industrials, which gained +0.85%. Meanwhile, the worst-performing sectors were Energy, which fell -1.45%, Utilities, which fell -1.32%, and Real Estate, which fell -0.55%.

Shanghai, Shenzhen, and the STAR Board all closed higher by +1.26%, +1.74%, and +2.51%, respectively, on volume that increased +25% from yesterday. The top-performing sectors were Information Technology, which gained +3.77%, Consumer Discretionary, which gained +1.90%, and Financials, which gained +1.37%. Meanwhile, the worst-performing sectors were Health Care, which gained +0.12%, Energy, which gained +0.23%, and Consumer Staples, which gained +0.48%.

Last Night’s Performance

| MSCI China All Shares Index | # of Stocks | Average 1-Day Change (%) |

|---|---|---|

| Hong Kong Listed | 154 | -1 |

| Communication Services | 9 | -0.3 |

| Consumer Discretionary | 29 | -1.2 |

| Consumer Staples | 13 | -2.1 |

| Energy | 7 | -0.6 |

| Financials | 24 | -0.8 |

| Health Care | 14 | -3.3 |

| Industrials | 18 | -2.8 |

| Information Technology | 11 | -1.4 |

| Materials | 11 | -0.3 |

| Real Estate | 6 | -2.7 |

| Utilities | 12 | -0.1 |

| China Listed | 487 | -0.9 |

| Communication Services | 13 | -1.8 |

| Consumer Discretionary | 41 | -0.6 |

| Consumer Staples | 32 | -1.8 |

| Energy | 17 | 0.1 |

| Financials | 68 | -0.4 |

| Health Care | 45 | -2.3 |

| Industrials | 74 | -1.1 |

| Information Technology | 93 | -0.7 |

| Materials | 80 | -1.1 |

| Real Estate | 7 | -2.5 |

| Utilities | 17 | 2 |

| US & Hong Kong Dually Listed | Ticker | 1-Day Change (%) |

|---|---|---|

| Tencent HK | 700 HK Equity | -0.3 |

| Alibaba HK | 9988 HK Equity | -1.5 |

| JD.com HK | 9618 HK Equity | 0.3 |

| NetEase HK | 9999 HK Equity | -1.4 |

| Yum China HK | 9987 HK Equity | -0.9 |

| Baozun HK | 9991 HK Equity | 7.2 |

| Baidu HK | 9888 HK Equity | 0 |

| Autohome HK | 2518 HK Equity | -3.1 |

| Bilibili HK | 9626 HK Equity | -0.4 |

| Trip.com HK | 9961 HK Equity | 0.5 |

| EDU HK | 9901 HK Equity | -3.6 |

| Xpeng HK | 9868 HK Equity | -2.5 |

| Weibo HK | 9898 HK Equity | 0.5 |

| Li Auto HK | 2015 HK Equity | -1.3 |

| Nio Auto HK | 9866 HK Equity | -3.9 |

| Zhihu HK | 2390 HK Equity | 3.6 |

| KE HK | 2423 HK Equity | -2.4 |

| Noah HK | 6686 HK Equity | 0 |

| Tencent Music Entertainment HK | 1698 HK Equity | -3.4 |

| Meituan HK | 3690 HK Equity | -1.8 |

| Hong Kong’s Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| Tencent Holdings Ltd | -0.3 |

| Alibaba Group Holding Ltd | -1.5 |

| Meituan | -1.8 |

| AIA Group Ltd | -1.6 |

| Hong Kong Exchanges and Clearings | -2 |

| Ping Insurance Group | -2.4 |

| HSBC Hodings PLC | -1 |

| China Construction Bank Corporation | 0.2 |

| Industrial and Commercial Bank | -0.9 |

| CNOOC Ltd | -0.4 |

| Shanghai and Shenzhen’s Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| Kweichow Moutai Ltd | -2.3 |

| BAIC BluePark New Energy Technology | 5.3 |

| COSCO Shipping Holdings | -6.1 |

| Lingyi iTech Guangdong | 9.4 |

| Luxshare Precision Industry | 1.7 |

| China Yangtze Power Ltd | 2.1 |

| Zhongji Innolight Ltd | 2 |

| Zijin Mining Group Ltd | -1 |

| Seres Group Ltd | -0.4 |

| Wuliangye Yibin Ltd | -2.4 |

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.27 versus 7.27 yesterday

- CNY per EUR 7.87 versus 7.87 yesterday

- Yield on 1-Day Government Bond 1.24% versus 1.24% yesterday

- Yield on 10-Year Government Bond 2.27% versus 2.29% yesterday

- Yield on 10-Year China Development Bank Bond 2.36% versus 2.38% yesterday

- Copper Price -0.17%

- Steel Price +0.09%

—

Originally Posted July 9, 2024 – Internet Stocks

Author Positions as of 7/9/24 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Mostly Rebound, National Team Rumored To Be Buying Small Cap ETFs

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.