Traders can be a predictable lot. Last week was a rough one for the megacap technology stocks that have been driving this year’s recent rally. It was not at all surprising that traders sought to buy the dip this morning, though the magnitude seemed a bit excessive. And I do not believe that yesterday’s political upheaval was a meaningful catalyst.

Putting last week into perspective, the S&P 500 (SPX) closed down about -2.5% last week, which was better than the Nasdaq 100’s (NDX) -4.3% and the Magnificent Seven ETF’s (MAGS) -5.8%. That’s unpleasant for many investors, though far from catastrophic. Traders often operate on the basis of “whatever doesn’t kill you makes you stronger”, so it makes sense to see them bargain hunting today.

Yet even the vaunted rotation (“routation”?) took a bit of a breather. The Russell 2000 (RTY) closed up just over +1%, which is certainly respectable, though it was briefly up +5% shortly after Wednesday’s open. Meanwhile, the Russell 1000 Growth ETF (VONG) was down about 4.5%, a bit worse than NDX, its Russell 1000 Value counterpart (VONV) was only up about +0.4%. Value stocks and small caps were a reasonable place to hide out, but not a major source of profit.

Also, we saw traders seeking volatility protection on Friday amidst the widespread tech outage caused by the Crowdstrike (CRWD) software glitch. The Cboe Volatility Index (VIX) crossed 17 on Friday afternoon, before closing a 16.52, up from 12.46 the prior week. Perhaps more importantly, we saw a near-term inversion in the VIX futures term structure. It started on Thursday, and by Friday’s close we saw August VIX futures at 15.92, -0.6 below the spot of 16.52. I consistently remind readers that backwardation in a commodity futures’ curve implies a short-term imbalance of demand over supply, and it seemed to be the case for volatility protection via VIX last week. Even now, with spot VIX having dropped to 15.56, we still see August futures trading a hair below at 15.50. That tells me that despite this morning’s rally, which had faded considerably by midday, is still not a sign of “all clear”.

If is indeed understandable why traders would assert a greater chance of near-term volatility than a month away. Remember, VIX measures the market’s best estimate of volatility over the coming 30 days. In the coming 30 days we have the bulk of earnings season (including Tesla (TSLA) and Alphabet (GOOG, GOOGL) tomorrow) and a potentially consequential FOMC meeting, whereas there are perceived to be fewer catalysts du18 nring the dog days of summer. That of course conveniently ignores Nvidia (NVDA) earnings and the Fed’s Jackson Hole conference, but volatility traders often tend to utilize short-term thinking.

During the past 24 hours, I’ve been asked numerous questions about whether President Biden’s recusal from the upcoming election and endorsement of Vice President Harris would meaningfully shift investor perceptions. My answer tended to be a frank “no”. It’s not clear how much, if any, this will shift the polling; even if it does, it’s not as though the broad market has been engaging in the political process. Shortly after the Presidential debate, or debacle, depending on your political viewpoint, I posited two key factors to measure investor perceptions about the state of the race:

- Is there any significant change in the VIX futures curve, particularly in the October-December period?

- Did the Treasury yield curve steepen meaningfully?

Remember, because VIX is a 30-day volatility lookahead, the futures that expire in mid-October are the most relevant for covering the period around the November 5th Election Day. Even though spot VIX has skyrocketed from 12.24 just before the June 27th debate to 15.56 now, the October VIX future is almost identical: 18.07 then vs. 18.00 now. The same can be said for the further out portions of the VIX futures curve from then until now. Thus, there is little change in perceptions about volatility around and in the months following Election Day.

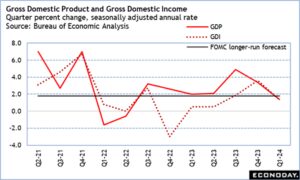

In the meantime, the US Treasury yield curve remains quite stable since Friday. There is a concern among bond investors that a second Trump administration would attempt to substitute tariffs for income taxes, thus increasing the deficit. The curve has indeed steepened a bit since the debate, with 2-year yields dropping by 20basis points and 5-years dropping by 10bp, while 10-years are essential unchanged, that dip in the short-term yields has been migrating slowly during that period, not precipitously after either the debate or the well-received CPI report on July 11th.

Bottom line: equity traders are voting with their wallets today, attempting to go bargain hunting, rather than at the polls.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.