In the first half of 2023, the iEdge S-REIT Index gained 2.1 per cent in total return terms, after a challenging 2022 which saw it decline 12 per cent.

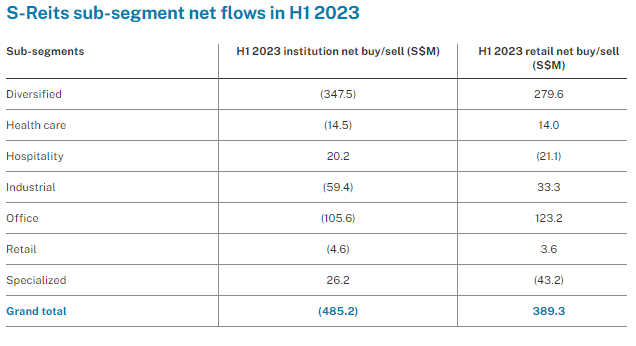

Retail investors continued to be a key driver in S-REITs fund flow activities in H1 2023, accumulating net retail inflows of S$389 million, while institutional investors saw net outflows of S$485 million. A similar trend was seen a year ago during H1 2022 when the sector booked S$443 million of net retail inflows and S$360 million net institutional outflows.

By sub-segments, data centre S-REITs received the most institutional net inflows and retail net outflows in H1 2023, at S$26 million and S$43 million respectively. On the other hand, diversified S-REITs saw the most institutional net outflows during the period at S$348 million, while seeing S$280 million of net retail outflow.

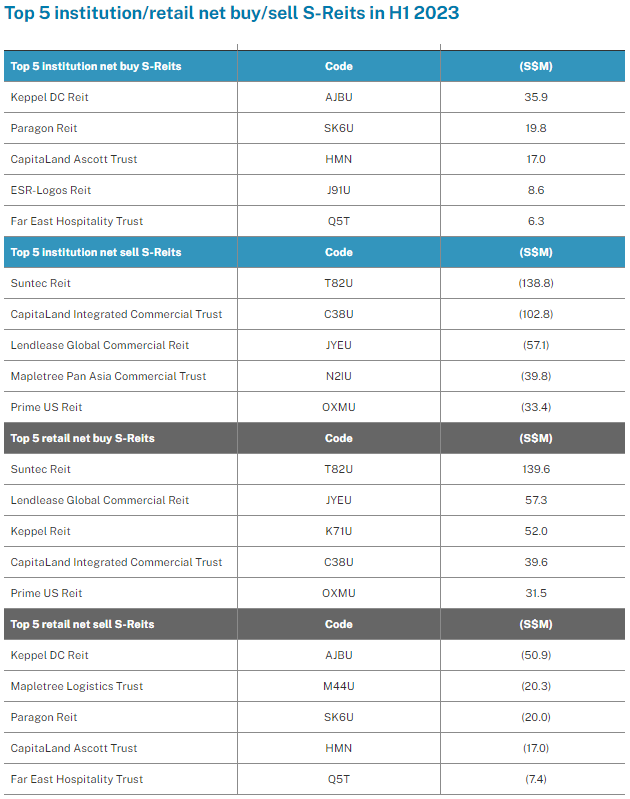

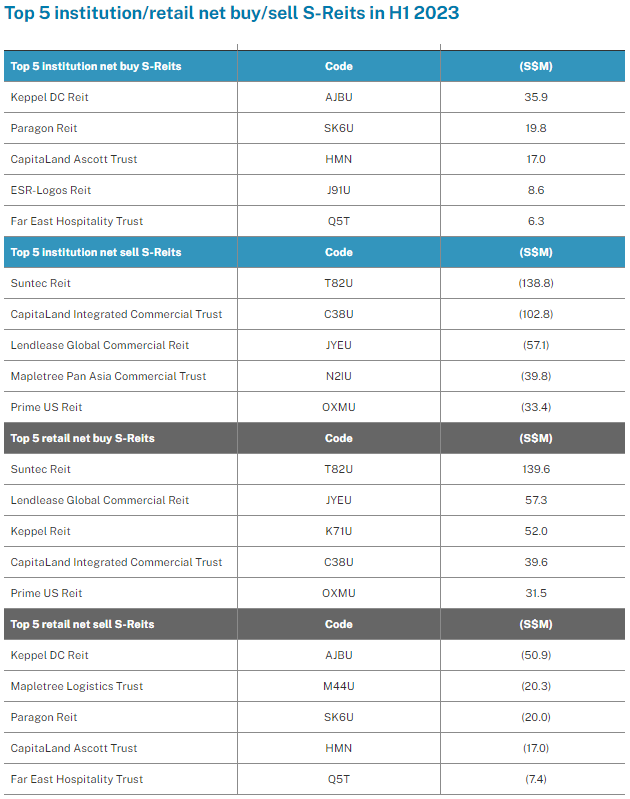

Keppel DC REIT was the best performing S-REIT in the first half of 2023 with 25 per cent total returns. It also received the most net institutional inflows in H1 2023 of S$36 million. This was a reversal from a year ago, during H1 2022, where institutional investors were net sellers of the stock with net outflows of S$120 million.

Keppel DC REIT’s Q1 2023 net property income grew 6.3 per cent, translating to a 3 per cent growth in distribution per unit for the period. It believes that data centre demand will continue to be driven by long-term trends such as adoption of cloud computing and digital transformation initiatives. It is expected to report H1 2023 results on Jul 24, 2023.

Paragon REIT booked the second largest net institutional inflows of S$20 million in H1 2023. Institutional investors continued to be net buyers of the REIT following net inflows of S$1 million in H1 2022.

Aside from Paragon REIT, CapitaLand Ascott Trust and Sabana Industrial REIT also saw significant net inflow from institutional investors in both the H1 2023 and H1 2022 periods.

CapitaLand Ascott Trust received net institutional inflows of S$17 million and S$41 million in H1 2023 and H1 2022 respectively while Sabana Industrial REIT received net institutional inflows of S$5 million and S$9 million in H1 2023 and H1 2022 respectively.

S-REITs which received the most net inflows from retail investors in H1 2023 were Suntec REIT at S$140 million, Lendlease Global Commercial REIT at S$57 million and Keppel REIT at S$52 million. Lendlease Global Commercial REIT booked net inflows from retail investors during the year-ago period as well, receiving S$11 million in H1 2022.

REIT Watch is a weekly column on The Business Times, read the original version.

—

Originally Posted July 10, 2023 – REIT Watch – Retail investors net bought S$390m of S-REITs in 1H2023

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.