As many of us might know, inflation has been on the rise. According to the Bureau of Labor Statistics, the annual inflation as of September 2021 is 5.4 percent. In our previous blog post published on April 19, 2021, we identified 10 Nasdaq-100 stocks that we expected to do well with rising inflation and 10 Nasdaq-100 stocks that would not do well in such an environment. Using the MacroRisk Analytics® platform, we look at the performance of these stocks and compare them to how the Nasdaq-100 index as a whole has fared so far. In addition, we identify another two sets of 10 Nasdaq-100 stocks that we expect to do well and not do well if inflation rises. Financial advisors and investors need to be aware of how inflation might impact their portfolios and assets.

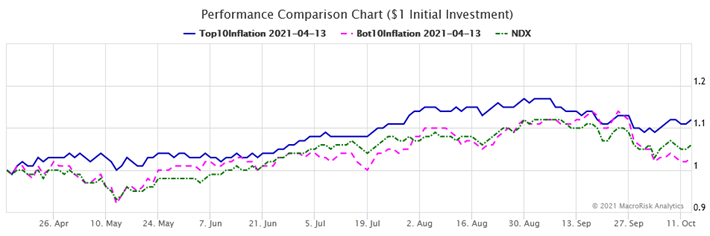

To perform the comparison, I created an equally weighted portfolio of 10 stocks that were expected to respond positively to rising inflation (blue line in the chart below) and an equally weighted portfolio of 10 stocks that were expected to respond negatively (pink line). Then I compared these two portfolios to the performance of the Nasdaq-100 Index (green line). The chart below shows this performance from April 13 through October 13, 2021, a six-month period. (The starting date is April 13, 2021, because data as of this date were initially used in the previous blog post to identify the two sets of 10 stocks.)

As can be seen, the portfolio of 10 stocks that we expected to do well in a rising inflation environment (blue line) did indeed do better than the Nasdaq-100 Index (green line) and the portfolio of 10 stocks that we expected to do worse in such an environment (pink line). The performance of the latter portfolio (pink line) and the Nasdaq-100 Index was somewhat similar over the six-month time period.

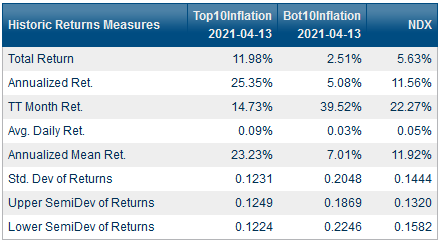

The table below shows the return and risk characteristics of the two portfolios and the index. The “top 10 inflation” portfolio also had lower risk than the index as represented by the standard deviation and the lower semideviation statistics, a good feat considering this portfolio consists of only 10 stocks while the index has 102 stocks.

So far, we have identified how the stocks we selected six months ago have performed through the present day. Next, I use the MacroRisk Analytics screening tool to identify new sets of stocks that have the potential to react positively or negatively if inflation rises.

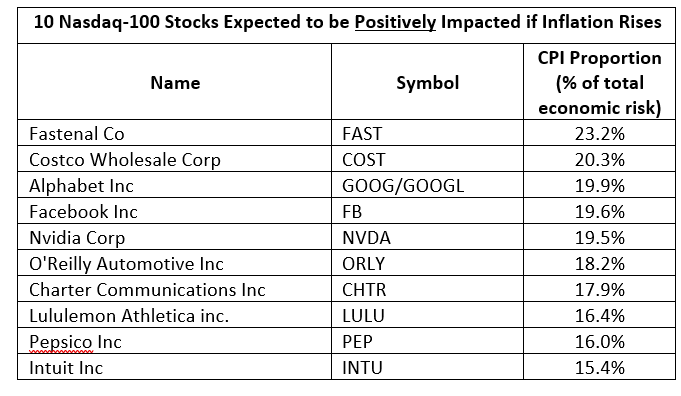

The table below shows 10 stocks out of the Nasdaq-100 Index that show strong potential to react positively to inflation as a proportion of total economic risk as of October 13, 2021.

The third column represents the proportion of total economic risk that inflation represents for an asset. The higher the number, the more significant the expected effect of inflation changes are on an asset’s stock price versus the other 17 economic factors in the MacroRisk Analytics model.

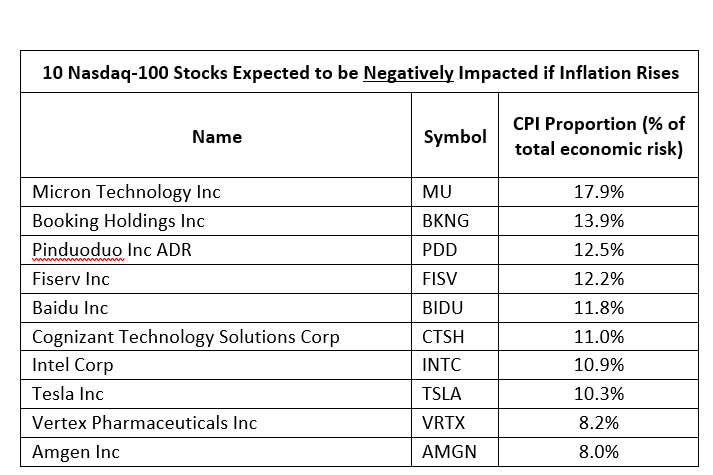

The table below shows 10 stocks out of the Nasdaq-100 Index that show strong potential to react negatively to inflation as a proportion of total economic risk as of October 13, 2021.

| Amgen Inc | AMGN | 8.0% |

In summary, this post analyzed the performances of two sets of stocks, identified in our previous blog post, that we expected to do well and not so well in a rising inflation environment. We then identified new sets of stocks using the most recent available data. Inflation is only part of the total economic risk, and other economic risks can have a big impact on the performances of individual stocks and portfolios.

—

Originally Posted on October 18, 2021 – We Identified Stocks We Thought Would Do Well and Bad with Rising Inflation, Here Is How They Are Doing So Far.

Disclosure: MacroRisk Analytics

THIS MATERIAL IS PROVIDED FOR EDUCATIONAL PURPOSES ONLY AND IS NOT INTENDED TO BE RELIED UPON AS A FORECAST, RESEARCH OR INVESTMENT ADVICE, AND IS NOT A RECOMMENDATION, OFFER OR SOLICITATION TO BUY OR SELL ANY SECURITIES OR TO ADOPT ANY INVESTMENT STRATEGY. THE OPINIONS EXPRESSED IN THIS REPORT MAY CHANGE AS SUBSEQUENT CONDITIONS VARY. THERE IS NO GUARANTEE THAT ANY FORECASTS MADE WILL COME TO PASS. RELIANCE UPON INFORMATION IN THIS MATERIAL IS AT THE SOLE DISCRETION OF THE READER. THE MATERIAL WAS PREPARED WITHOUT REGARD TO SPECIFIC OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY INVESTOR.

Copyright © 2010 – 2022 MacroRisk Analytics

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from MacroRisk Analytics and is being posted with its permission. The views expressed in this material are solely those of the author and/or MacroRisk Analytics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.