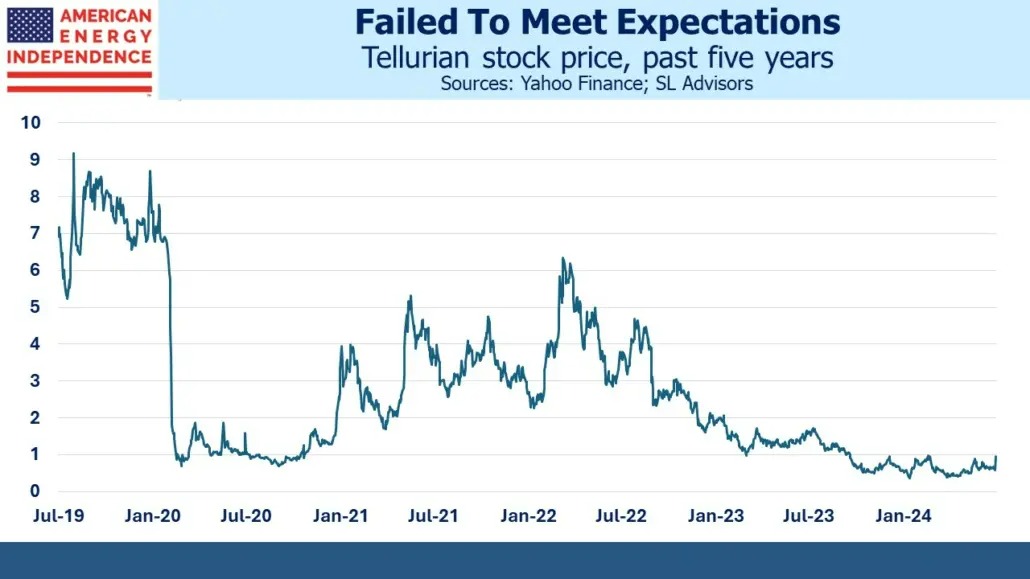

Tellurian finally put its investors out of their misery, selling to Woodside for $1 per share. The 75% premium to the prior day’s close is only impressive because the stock has sunk so low to this point. Founder Charif Souki was never able to obtain financing for this LNG wannabe. In 2022 in one of his regular videos on Youtube he memorably issued a mea culpa (see What’s Next For Tellurian?) for insisting on retaining natural gas price exposure in the Sale Purchase Agreements (SPAs).

This made the business model riskier because the future cashflows from liquefaction were less certain. Potential investors balked; SPAs expired because Tellurian hadn’t started work on their Driftwood LNG terminal.

Souki is a visionary with an excessive risk appetite. At Cheniere he wanted to start a natural gas trading business, which would have introduced more earnings volatility to a company with visible, long term cashflows from liquefaction. He was eventually pushed out.

At Tellurian the collapse in energy stocks during the pandemic resulted in a margin call on his personal, leveraged holdings in the company. Souki persuaded TELL’s board to compensate him for successfully getting the Driftwood LNG terminal started even though he hadn’t (watch Tellurian Pays For Performance in Advance).

Souki was pushed out in a repeat of his exit from Cheniere. Like Joe Biden, he stayed at it for too long.

TELL’s price drifted lower as the odds of Driftwood being completed receded. The LNG permit pause added further uncertainty.

A couple of years ago TELL was trading at $4.50. Its acquisition by Woodside more than 75% below that price reflects the low odds of Driftwood ever being financed. Woodside is betting that the LNG permit pause will be lifted, most likely by an incoming President Trump. Kamala Harris, younger and to the left of Biden, might even keep it in place if she’s elected.

The most likely outcome is that the Driftwood LNG export terminal, now in the hands of a company with the resources to finance it, will be completed. This will be a win for the climate by allowing LNG buyers to use less coal, and for our domestic energy sector.

With all the chatter of the Trump Trade and the inflationary impact of a Republican-controlled White House and Congress, the bond market is remarkably non-plussed. For the past year, ten-year inflation expectations as derived from the TIPs market have stayed in a tight range between 2.15% and 2.5%.

The Personal Consumption Expenditures (PCE) deflator, the Fed’s preferred measure, runs around 0.25% to 0.5% lower than CPI. This is because it’s constructed using dynamic weights that reflect actual spending patterns rather than the fixed weights in the CPI.

So as a practical matter bond investors are endorsing the Fed’s desired inflation objective of 2%. Given that monetary policy allows for some asymmetry – an inflation overshoot is less problematic than an undershoot – you could even argue that bond investors think there’s little asymmetry in the outlook.

Stocks have rallied during the summer, due to indications from Fed chair Jay Powell that rate cuts are coming but also because the odds of a Trump election victory have increased. Trump’s odds of winning didn’t dip with Biden’s withdrawal over the weekend.

VP Kamala Harris is a great opportunity for Trump to run against a liberal Democrat from California. She may yet turn out to be a better campaigner than she was during the primary four years ago, when she withdrew at an early stage. Otherwise, Republicans look set to sweep both houses of Congress too.

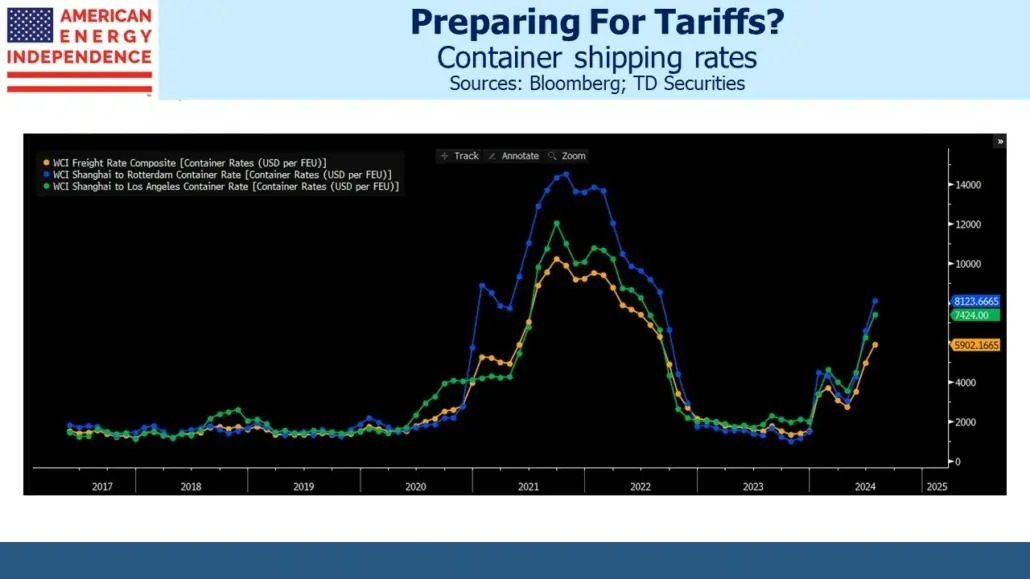

Container rates have been moving steadily higher this year, reaching levels last seen during the pandemic. There are signs that companies are building inventories of goods in the US, anticipating sharply higher tariffs after the election. Shipping rates from Shanghai to Los Angeles have more than quadrupled this year.

Ten year yields at 4.38%, approximately unchanged over the past month, don’t reflect the Trump Rally that is apparently driven in part by higher inflation expectations. Betting markets favor Trump over Harris by roughly a 2:1 margin. Democrats appear to be rejecting a competitive convention, thus foregoing the opportunity for a more centrist candidate to emerge.

Long term bond yields offer scant compensation for America’s fiscal outlook and there’s a good possibility of one party controlling both the White House and Congress. Therefore, shorting long term treasury notes expecting deficits and inflation to move higher looks like a good trade to this blogger.

—

Originally Posted July 24, 2024 – Tellurian Drifts Into Stronger Hands

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.