By John Del Vecchio and Brad Lamensdorf

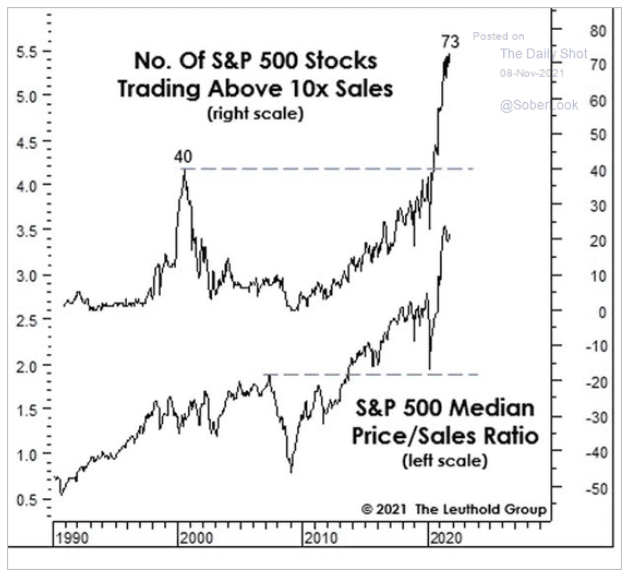

The number of stocks in the S&P 500 trading over 10x sales has skyrocketed to 73. Meanwhile, the median price to sales ratio for the index has hit a nosebleed 3.5x. When this bull market started in 2009, the ratio was less than one and you would have had to look hard for a stock trading above 10x sales.

Historically, price / sales has been a powerful valuation measure. Sales can be manipulated. John wrote an entire chapter in his book What’s Behind the Numbers? on a number of ways management teams can artificially boost the top-line.

However, the games played are more desperate at the top of the income statement. Meanwhile, between revenue and earnings there are many levers management can pull to generate earnings and “hit the number” to please investors. As a result, price to sales is often a preferable measure of valuation than earnings.

Ken Fisher introduced the measure in Super Stocks. Back in the 1980’s, it was crazy to see technology companies trading above 3x sales. We’ve come a long way! Fisher pointed out that when companies trade at those premium levels, all it takes is a glitch to send the stock plummeting.

It could be a revenue shortfall. Or increased competition. Possibly pricing pressure. It does not matter what. Expectations were so high that only perfect execution would do.

Now the entire index is trading over that level. 15% of the index is trading over 10X sales.

Should a glitch occur, and it could be anything, the downside is tremendous from here.

It’s likely to be epic.

—

Originally Posted on November 21, 2021 – The Glitch

Disclosure: Lamensdorf Market Timing Report

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s.

Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader. Past performance is not indicative of future results.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Lamensdorf Market Timing Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or Lamensdorf Market Timing Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.