As we survey the economic landscape, we are reminded of Otis Redding’s classic hit, which is all about patience. “Looks like nothing’s gonna change, everything still remains the same.”

(Sittin’ On) The Dock of the Bay

In the summer of 1967, Otis Redding wrote his number-one single in Sausalito, just across the Golden Gate Bridge from our office. While the smash hit evokes a sense of loneliness, the main theme of the song is patience: sometimes it is best to stop and sit, observe, and wait. In last quarter’s outlook, we detailed how the prevailing expectations of recession, Fed cuts, and a selloff in risk assets have yet to come to fruition. At the end of the second quarter, we find ourselves in very much the same environment, and Otis Redding’s advice is as valuable today as it was when the song was released almost 60 years ago.

The Federal Reserve left the benchmark rate unchanged at 5.25-5.50% at its last meeting on June 11th. The meeting coincided with the release of the May CPI data, which had the market on edge for a potential 1-2 punch. Fortunately, the month-over-month change in CPI came in at 0.0%, which was its lowest reading since July 2022. Still, the Fed reduced the number of expected rate cuts in 2024 in its most recent dot plot. Granted, it is likely that the Fed made its decision on the dot plot before the May CPI figures were released, but it highlights again that the Fed will need to see at least several consecutive months of favorable inflation data before it lowers its benchmark rate. Despite the progress on the month-over-month change, the year-over-year change remained stubbornly above the Fed’s 2% target at 3.3%.

Jim Bianco at Arbor Research highlights the base effects on Core PCE (personal consumption expenditures) data that we feel are worth tracking and could factor into the Fed’s policy going forward. In short, we had four favorable inflation prints between May 2023 and August 2023. Those prints will now start rolling out of the year-over-year calculation and put upward pressure on annual inflation, unless they are replaced with similarly favorable data. This is akin to a golfer who has her four lowest scores about to roll out of her last twenty. Unless she matches those low scores, her handicap is likely to rise.

The interest rate market responded well to the benign CPI data, reversing the selloff that started at the beginning of the quarter. In the end, rates were largely unchanged across the curve, but the investment grade market posted a small positive quarterly return largely on spread tightening and carry. However, the total return for the Bloomberg U.S. Aggregate Bond Index was still negative for the first six months of the year. Risk assets, on the other hand, performed significantly better during the second quarter. The S&P 500 (+4.28%) and the Nasdaq (+8.47%) benefitted greatly from strong earnings and AI mania, particularly the mega cap technology companies at the top of the S&P 500. This type of concentrated outperformance among a few very large businesses typically raises concerns that equity markets may be heading towards the end of a cycle.

Our last few outlooks have felt somewhat repetitive, a bit like the song: “Looks like nothing’s gonna change, everything still remains the same.” Said another way, why are the markets so resilient in the face of higher fed funds rates, quantitative tightening, and an inverted yield curve? We feel that under the surface, there are forces at play that have almost completely offset the efforts of the Fed.

During the pandemic, in addition to slashing short rates, the Fed used quantitative easing (buying debt from the open market) as a tool to influence long-term rates and further ease monetary policy. Subsequently, in its effort to slow the economy and rein in inflation, it raised interest rates and engaged in quantitative tightening, where it let bonds on its balance sheet mature. In theory, this drains money from the system and creates headwinds for risk assets, but in reality it has been much less effective than expected.

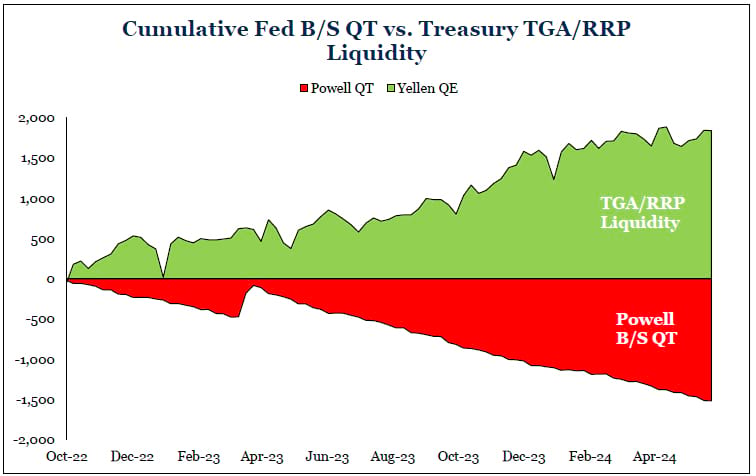

In our last quarter’s outlook, we highlighted that the federal debt in the fourth quarter of 2023 grew at almost three times the rate of GDP due to huge fiscal stimulus packages passed by Congress. In other words, the federal government was borrowing heavily to spur growth at precisely the same time the Fed was engaging in quantitative tightening to cool the economy and tame inflation. As the chart below shows, the liquidity that was removed by quantitative tightening has been replaced almost 1:1 by the impact of higher federal borrowing.

B/S = Balance Sheet, TGA = Treasury General Account, RRP = reverse repurchase agreement, QT = quantitative tightening

Before the days when the Fed held press conferences with granular transparency on its policy (and even when it changed the rate), the market would instead focus on the M2 money supply as an indicator of monetary conditions. The M2 money supply is higher on the year and only ~3.6% off its peak of 2022. This shows that the Fed’s efforts have not reduced the money supply and that the system remains awash in liquidity. As we all know, money abhors a vacuum and needs to find a home, which explains why risk assets have continued to do well.

We hope we are not succumbing to recency bias, but looking forward, we expect more of the same. Sticky inflation (i.e., Bianco’s base effects) should likely keep the Fed in its current wait-and-see mode, and when it finally decides to cut, history suggests it will likely act too late, not too early. Moreover, there is scant evidence that the Federal government will slow spending either before or after the election, as one of the few policies both parties agree on is large deficits – though one approaches it from the revenue side (lower taxes) and the other from the expense side (higher spending). In the meantime, we will continue to do what we have done historically: take what the market gives us, avoid making binary bets (including on Fed policy and elections), and invest in well-managed companies whose bonds offer attractive yields.

Like Otis Redding, we also suffer bouts of loneliness when we do not follow the herd. FOMO and oceans of liquidity often cause investors to stretch for yield and future returns. In markets like we have today, we find the value proposition for extending duration and/or going down the credit spectrum is not worth the additional risk. We feel there is more value at the short end of the curve given the extended period of inversion, and we also feel that longer maturities generally do not offer enough yield for the risk of a possible recession and spread widening.

For now, we will just sit on the dock and wait for the tide to roll in. As the song says, “I can’t do what ten people tell me to do, so I guess I’ll remain the same, yes.”

We thank you for your continued confidence in our management.

—

Originally Posted July 11, 2024 – Third Quarter Strategic Income Outlook

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Osterweis Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Osterweis Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.