Market participants are piling into the Trump trade on the back of Fed friendly data reflecting a strong economy amidst cooperating price pressures. The Harris Trade is getting some love as well, however, as investors look past lackluster earnings reports from some of the Mag 7 members this week while hoping that next week offers better commentary on the AI front. Next week will also be eventful from a central banking perspective, with Tokyo and Washington on deck. The stronger yen has certainly weighed on global risk assets in the past few weeks, as the Bank of Japan considers hiking rates further while curtailing bond purchases. From the Fed, meanwhile, market bulls are looking for the delegation to commit to beginning the easing cycle in short order, while the bears are wishing that Powell and company deliver a message supporting further patience.

Consumers Dip into Savings

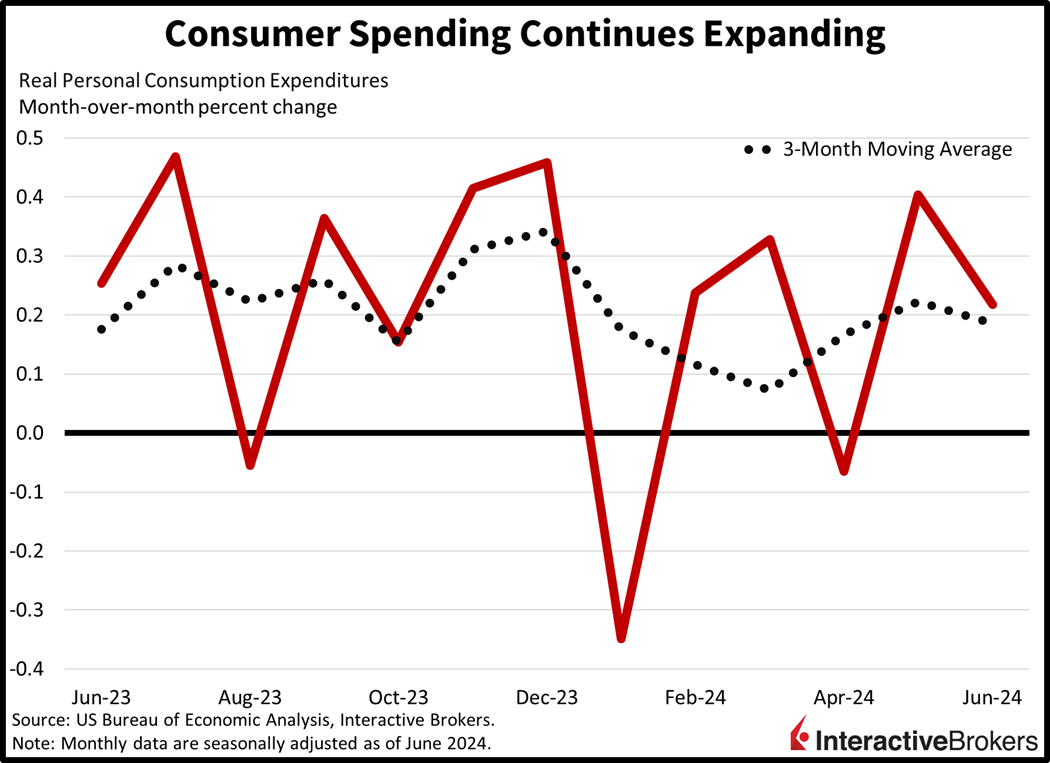

This morning’s Personal Income and Outlays print reflected a similar dynamic as yesterday’s gross domestic product report: persistent consumption amidst aligning price pressures. The developments are already well known as this monthly report covering June is quite stale, however, and hardly a reason to celebrate. Consumer spending rose 0.3% month over month (m/m) while incomes rose 0.2% m/m, slower than the 0.4% notched in May on both fronts. The former indicator arrived in-line with expectations while incomes were projected to increase by 0.4%, or double the pace recorded. Household outlays were dominated by nondurables and services, which grew 0.5% and 0.2% m/m, respectively, on a volume basis, while durable goods experienced a 0.2% decline. Folks sacrificed cash reserves to complete orders, however, with the personal savings rate dropping from 3.6% to 3.5% during the period.

Core Arrives Hotter but Who Cares

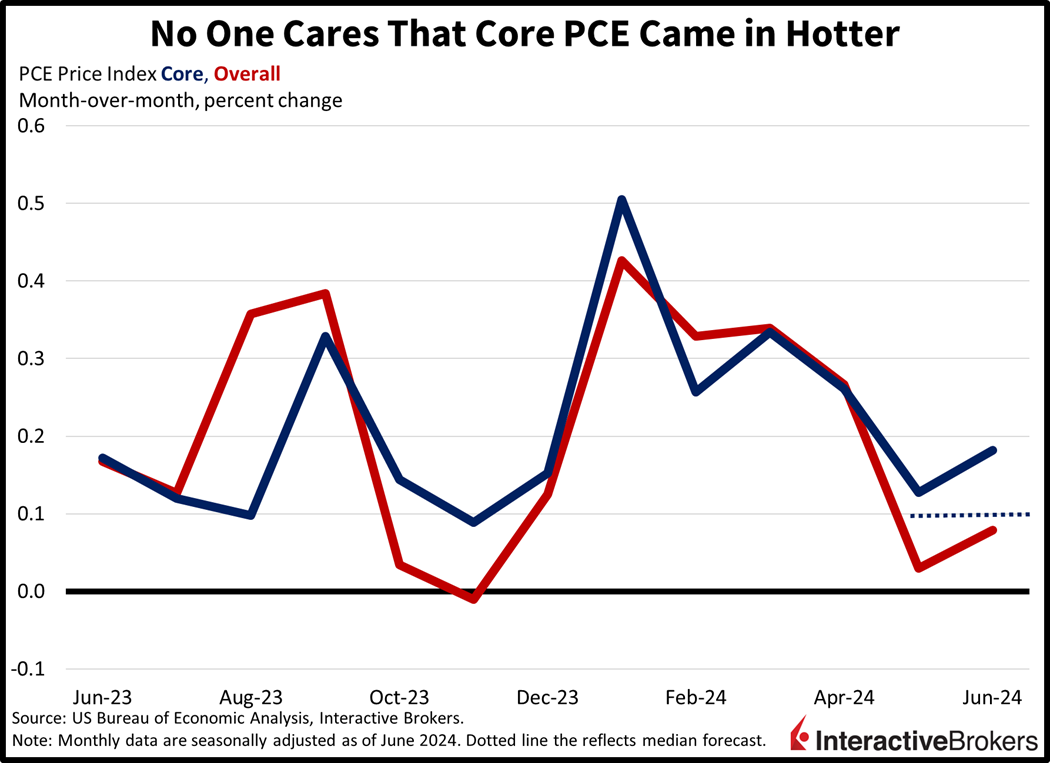

The inflation figures in the report accelerated in the short-term, or m/m but came in at levels consistent with the Fed’s 2% target on an annualized basis. The inflation figures, which include the Fed’s favored core Personal Consumption Expenditure (PCE) Index, rose 0.1% overall and 0.2% excluding food and energy, both above May’s numbers by roughly 5 basis points (bps) before rounding. The year-over-year (y/y) results arrived at 2.5% for headline and 2.6% for core, similar to the previous report’s 2.6% for both metrics. While results arrived in-line with the median estimate on the headline side, core came in 10 bps higher after rounding for both m/m and y/y versions.

US Consumer Spending is Mixed During Second Quarter

Second-quarter earnings results paint a mixed view of US consumers, while at least one industrial company posted metrics that benefited from growing demand for semiconductor-related products. Consider the following earnings highlights:

- Colgate-Palmolive (CL) generated a 9% increase in organic sales and a 48% gain in non-adjusted earnings per share (EPS). Both metrics surpassed analysts’ expectations. The company’s Latin America division led the growth, with organic revenue climbing 18.8%, followed by Africa/Eurasian. Additionally, sales of Hills pet food grew significantly. North America had the lowest growth, followed by the Asia Pacific region. During the quarter, the company increased its advertising by 18%. The company’s share price jumped approximately 4% in premarket trading.

- Sketchers (SKX), which makes and distributes comfort sneakers, generated a 7.2% y/y revenue increase but a 7.1% decline in earnings per share. Both metrics, however, exceeded the analyst consensus expectation. Sales generated strong gains in the company’s direct-to-consumer channel, but also expanded through wholesale distribution. Domestic sales outpaced international results. David Weinberg, Chief Operating Officer of Skechers, says supply chain issues, including disruptions in the Suez Canal, were challenging. The company also increased its full-year guidance and announced a $1 billion share repurchase program. Its stock price jumped 3% in early trading.

- 3M (MMM), which manufactures a variety of products including Scotch Tape and Post-it Tabs, generated adjusted revenue growth of 1.2% and a 39% adjusted earnings per share increase on a y/y basis. Both metrics exceeded analyst consensus estimates. Sales of products for automotive electrification climbed 17% while overall electronics revenue climbed in the low-double digit range with strong demand for semiconductor related items. Most of the company’s other products generated sales growth in the low-to-mid single digits. In a presentation, the company noted that industry clients are cautious and consumer demand for hardline items, or durable goods, was soft. It maintained its revenue guidance and increased its earnings outlook, citing second-quarter gains in operational efficiencies. 3M stock jumped approximately 6.8% in premarket trading.

Markets Rally as Stagflation Fears Ease

Markets are bullish across the board as investors gear up for an even busier week ahead that will feature Fed and Bank of Japan meetings as well as a long list of earnings reports, including four more of the Mag7 group. All major equity indices are higher with the Trump trade dominating. The Dow Jones Industrial and Russell 2000 are gaining 1.6% and 1.1%. The Harris Trade is advancing as well, with the S&P 500 and Nasdaq Composite benchmarks higher by 1.0% and 0.9%. Sectoral breadth is terrific with all segments pointing north except for energy; it’s down 0.3%. Leading the aircraft toward greater altitudes are industrials, communication services and financials, which are up 1.7%, 1.6% and 1.5%. Treasurys are catching a bid with yields on the 2- and 10-year maturities roaming at 4.4% and 4.21%, 4 bps lighter on the session. The dollar is near the flat-line though, appreciating relative to the franc, yuan and Canadian dollar but losing ground versus the pound sterling, euro, yen and Aussie dollar. Commodities are mixed with lumber, gold and copper gaining by 1%, 0.8% and 0.2%, but crude oil and silver are down 2.1% and 0.2%. WTI crude is changing hands at $77.47 per barrel on demand concerns out of Beijing, the world’s top energy importer.

Bulls Charge on Oversold Technicals

Today’s buying activity is motivated by an equity market that has recovered from turbulent selling pressure countless times in the past 19 months. Another important technical consideration is the fact that the S&P 500 experienced a 5% correction from its intraday high of 5670 while trading near its 50-day moving average. Market bulls immediately charged in yelling, “enough selling for now” and piled into bullish call options that expire later this afternoon. No one cared that the core PCE came in above expectations. Finally, as we approach two of the worst months for stocks from a seasonal perspective, this selloff has more to go. Next week will feature a plethora of catalysts. Bullish investors will be looking for earnings commentary supporting optimism regarding AI’s ability to boost the bottom line, a Fed that is looking to embark on an easing cycle with multiple rate reductions and an employment market that is slowly taking the stairs to a lower floor. On the contrary, the motivated and hungry bears will be seeking narratives of AI failing to deliver the dollars right here right now, a Fed that is not satisfied with a 33% year-to-date field goal percentage on inflation and an employment market that is either heating up or falling off a cliff.

Visit Traders’ Academy to Learn More About Personal Income & Outlays and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.