Equity bulls are struggling to achieve a third consecutive day of gains while looking ahead to an economic calendar featuring potential market moving catalysts in the coming days. This morning’s durable goods report served as a prelude to tomorrow’s preliminary data on economic growth for the first quarter and Friday’s release of the Fed’s preferred inflation gauge, which together may pass the baton to bulls or bears ahead of the central bank’s meeting only seven days from today. Meanwhile, a Treasury auction this afternoon involving $70 billion of 5-year notes may offer some clues on the duration appetite of market participants, particularly as the long-end of the curve is curbing stock momentum.

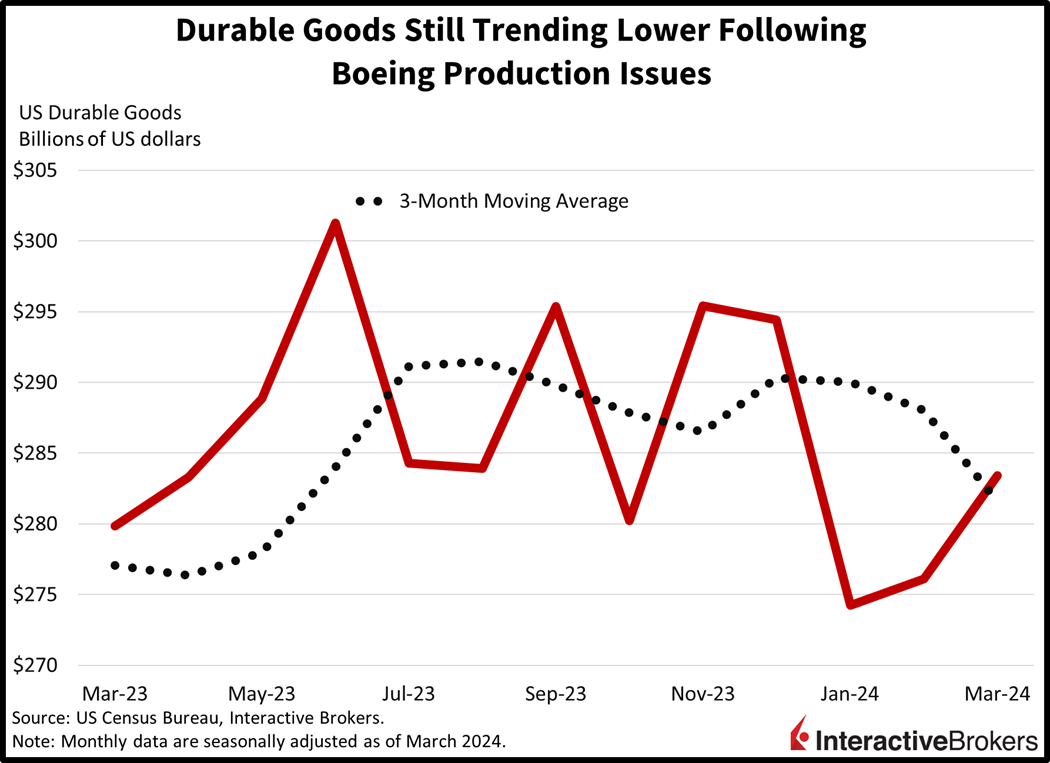

Durable Goods Orders Recovery Continues

Durable goods orders continued their recovery last month following struggles at Boeing that have weighed on aircraft purchases. March durable goods orders grew 2.6% month over month (m/m), narrowly beating expectations of 2.5% and February’s 0.7% rate. Orders excluding transportation rose 0.2% m/m, lighter than forecasts of 0.3% but higher than the previous month’s 0.1%. Capital goods orders excluding defense and aircraft, an indicator of business investment, lost a little momentum, gaining 0.2% m/m, exactly as projected but down from February’s 0.4%.

Manufacturing orders experienced strength across categories. Leading the charge last month were purchases of passenger aircraft, defense aircraft, automobiles and their parts, and other durable goods; the segments achieved m/m increases of 30.6%, 2.8%, 2.1% and 0.6%. Orders for the fabricated metal products, communications equipment, machinery and electrical equipment and appliances segments gained at more tempered levels between 0.1% and 0.2%. The computer and primary metals components did offset some of the progress though, with figures declining 3.9% and 0.5% m/m.

Outlook Brightens for Semiconductors and Consumer Spending

A glut of industrial semiconductors appears to have moderated while in other economic areas, travel and consumer spending are still strong. Consumers are also flocking to streaming entertainment while Tesla struggles with declining sales. Those are a few themes discussed in the following earnings call highlights:

- Tesla said first-quarter earnings and revenue declined 55% and 9%, respectively, year over year (y/y), which was considerably worse than analyst consensus expectations. Tesla also disclosed that it will lay off 2,688 workers at its Austin, Texas factory and 3,332 workers from its California operations. Many EV manufacturers are lowering prices to better compete and China is aggressively subsidizing car manufacturing, but Tesla Chief Elon Musk said the current quarter will be stronger with Tesla sales increasing y/y. Musk attributed the first-quarter sales decline to the Red Sea conflict pressuring supply chains, an arson attack at a Berlin factory and the ramp up of manufacturing of the Model 3 car in Fremont. Additionally, global sales are being challenged by other manufacturers focusing on hybrids rather than EVs. Despite the weak first quarter, Tesla shares soared approximately 12% this morning in response to Musk committing to launch a lower cost model early next year. The company had previously targeted the middle of next year for the launch.

- Texas Instruments climbed into the limelight yesterday when it guided for earnings and revenue for the current quarter to exceed analysts’ expectations. The company said its largest customer segment—industrial equipment makers—has worked through existing inventory, setting the stage for a strong current quarter. Among chip manufacturers, Texas Instruments has a broad range of customers. As such, it is considered a strong indicator of the strength of the overall economy. If its second-quarter growth materializes, it would be a turnaround from recent quarters in which sales declined. For the first quarter, revenue dropped 16% y/y and earnings declined 35%. Despite the y/y declines, earnings and revenue exceeded analysts’ forecasts. Texas Instrument shares climbed 8% following the company’s earnings release last night.

- Visa Inc. posted results for its fiscal second quarter ended March 31 that point to strong travel trends and persistent consumer spending. In contrast, results in China illustrated the country’s economic weakness. The company’s earnings and revenue both exceeded analyst consensus expectations and the company noted that consumer spending has remained steady. Against a backdrop of airlines expressing high ticket sales and cruise operators reporting high booking rates, Visa said its cross-border transactions excluding intra-Europe climbed 16% on a constant dollar basis. The data point is a key metric for assessing travel demand. More broadly, overall payment volume climbed 8% y/y. Visa expects to generate net revenue growth in the low-double-digits range this year. Its share price climbed approximately 3% this morning.

- Netflix also beat earnings and revenue expectations and reported a 16% increase in subscribers. While some of the company’s subscriber growth has resulted from cracking down on password sharing, other metrics, such as revenue, which climbed 15% y/y, were also strong. Higher pricing along with the increase in subscribers accounted for the revenue gains. Additionally, its advertisement supported subscription option has also contributed to strong growth with ad members climbing 65% quarter over quarter. Netflix shares declined approximately 2.5%, likely in response to the company announcing that it will no longer report subscription numbers as it is now focusing on earnings and revenues.

Divergence in Winners and Losers Widens

Markets are mixed with bifurcated action across equity sectors, the yield curve, currencies and commodities. For equities, a positive reaction from Tesla’s current-quarter guidance and plans for a lower priced model is driving up the tech-heavy Nasdaq Composite Index, with the benchmark up 0.3%. That’s about it though, as far as bullish equity action at the index level, as the Russell 2000, Dow Jones Industrial and S&P 500 indices are lower by 0.7%, 0.3% and 0.2%. Sectoral breadth is mixed with consumer discretionary, technology and real estate leading on the upside; they’re up 1%, 0.5% and 0.3%. Leading the laggards lower are the industrials, healthcare and energy segments, which are down 1.2%, 0.6% and 0.5%. Treasuries are seeing split movements as well, with the 2- and 10-year maturities trading at 4.94% and 4.65%. The former is unchanged while the latter is up 5 basis points (bps). The dollar is positive with its index gaining 19 bps and trading at 105.88. The greenback is gaining relative to all of its major developed market currencies, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is down despite a decline in US inventories and elevated geopolitical tensions between Washington and Beijing. WTI is lower by 0.7%, or $0.61, to $82.72 per barrel. Gold and copper are up though, with prices gaining 0.1% and 0.7%, respectively, during the session.

Tomorrow’s GDP Data Could be Pivotal

Tomorrow’s pivotal GDP report comes as market participants are hoping for a soft number that would lead to rate cuts sooner rather than later. For tomorrow’s report, however, we’re expecting a stronger-than-projected figure of 2.7% versus the consensus estimate of 2.5%. Ferocious consumer spending strength, as illustrated by Visa earnings, airline guidance and other indicators, is likely to deliver the upside beat, which will likely be followed by a move higher in bond yields. For equities, however, investors can digest strong GDP data in two distinct ways. It would be great for revenue growth prospects but bad for the timing and extent of rate cuts.

Visit Traders’ Academy to Learn More About Durable Goods and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.