Big-tech earnings last night from Alphabet and Microsoft are driving risk-on sentiments today, with investors largely ignoring two consecutive days of hotter-than-projected inflation. This morning’s PCE data included consumer spending levels that exceeded expectations while yesterday’s GDP fell below analysts’ forecasts, but traders are focusing their macro attention on Walmart CEO John Furner’s deflationary outlook, which is bolstering animal spirits. Furner mentioned that much of the company’s inventory has experienced unchanged prices compared to 12 months ago and that he expects charges to begin to decline in the near-term.

Living for the Moment

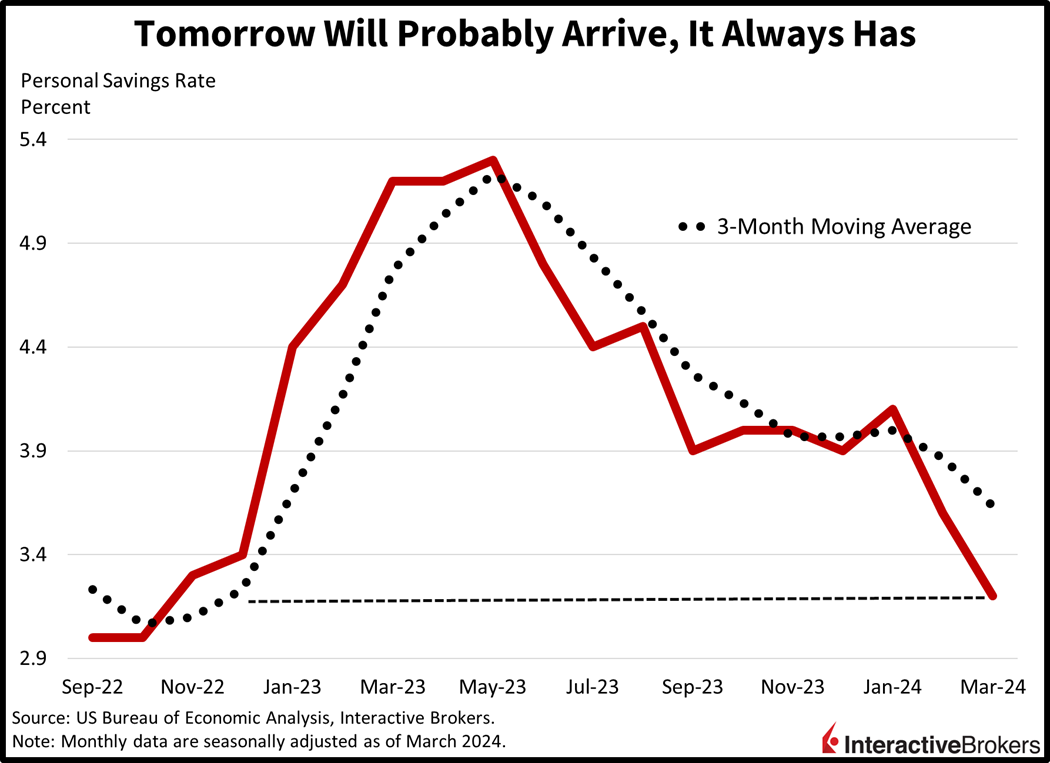

One of inflation’s strongest allies, consumer spending, showed no signs of weakening in March, according to this morning’s personal income and outlays report from the US Bureau of Economic Analysis. Folks maintained their robust activity amidst a persistent decline in the propensity to save. March consumption rose a whopping 0.8% month over month (m/m), exceeding the anticipated 0.6% by a wide margin and matching February’s pace. Goods receipts performed stronger than services, as expenditures on non-durables and durables rose 1.5% and 1% m/m, while services slowed to 0.6% during the period. Incomes, however, only rose 0.5%, in-line with the Street and loftier than the previous month’s 0.3%. The spread between spending and incomes drove the personal savings rate to its lowest level since October 2022, raising the odds of a downturn later this year.

The Fed’s Nemesis Just Won’t Quit

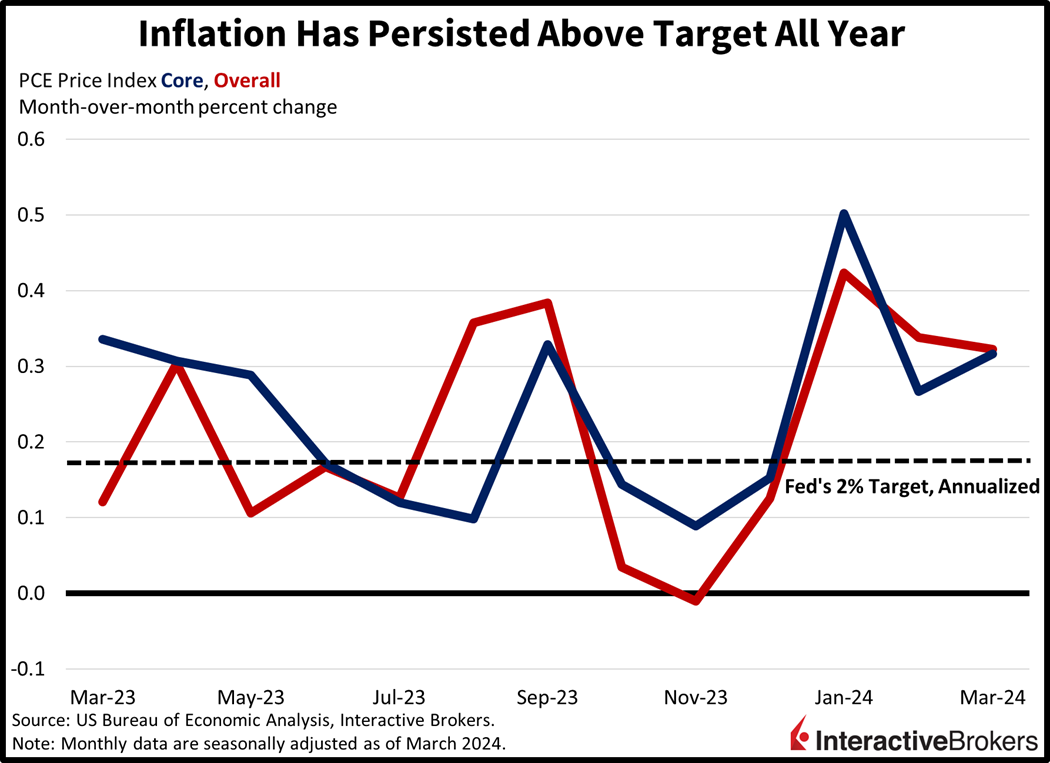

Price pressures are still sticky as illustrated by this morning’s release of the Personal Consumption Expenditures (PCE) Price Index, which increased 0.3% m/m and 2.7% year over year (y/y) in March, matching estimates on the monthly reading but arriving loftier than the 2.6% y/y median expectation. In comparison, February’s figures came in at 0.3% m/m and 2.5%. The core PCE figures, which exclude food and energy due to their volatile characteristics, rose 0.3% m/m and 2.8%, the same paces as February, but the yearly figure came in much hotter than the 2.6% projected.

Advertising Revenues Climb and Personal Computer Demand Grows

Businesses appear to be increasing their digital advertising budgets while PC manufacturers are anticipating growing demand after a period in which consumer goods sales have been weak. Those are observations from the following earnings calls:

- Alphabet reported blockbuster results with earnings that jumped 57% y/y. The results sparked heavy buying of the company’s shares and pushed Alphabet’s market cap above $2 trillion. It reported an acceleration of its core advertising business while cloud computing revenues also grew significantly. Meanwhile, the company said it is investing heavily in AI to ensure that individuals seeking information will continue to use its search services. Alphabet also approved an additional $70 billion share buyback program and its first dividend. Its share price jumped more than 14% last night.

- Snap also reported earnings and revenue that beat analyst consensus expectations and its average revenue per user of $2.83 exceeded the expectation of $2.67. The company attributes its strong revenue growth to enhancements made to its advertising platform. Additionally, revenue from Snapchat+ subscribers climbed 194% y/y. Snap’s current-quarter revenue guidance exceeded expectations, and the bottom range of its adjusted earnings outlook fell slightly below expectations. Its share price bounced 23% in after-market trading.

- Microsoft reported quarterly results that highlight the growth of artificial intelligence and point to a potential pickup in demand for personal computers. Earnings and revenue for the fiscal third quarter ended March 31 beat analyst consensus expectations. On a y/y basis, revenue and earnings climbed in the low double-digits range. In a sign that PC manufacturers are experiencing increasing demand, Microsoft’s revenues for original equipment manufacturers (OEM) climbed 11%. Meanwhile, artificial intelligence services continued to contribute to a larger portion of growth of the company’s cloud services such as Azure. The near-term demand for the Microsoft’s AI services is outpacing the company’s capacity, says CFO Amy Hood. Additionally, content sales resulted in a 62% increase in revenue from the company’s Xbox product line. In another encouraging development, Microsoft’s current-quarter revenue guidance exceeded analysts’ expectations.

- Intel’s results also underscored a resurgence in demand for personal computers. The company’s earnings and revenue beat analyst consensus expectations and its Client Computing Group revenue climbed 31% y/y due to strong demand among PC manufacturers. Revenues grew in the low double-digit range across segments. Intel’s share price dropped, however, because its current-quarter revenue guidance of between $12.5 billion and $13.5 billion fell short of analysts’ anticipation of $13.63 billion.

Fundamentals Drive Market Rally

Markets are rip-roaring higher with stocks up significantly across the board alongside lower yields on the back of robust earnings performances from the tech behemoths and CEO Furner’s deflationary outlook. Currency markets are pointing to some risks, however, with the yen getting crushed as the Bank of Japan decided to not raise rates at its meeting today. Furthermore, Governor Kazuo Ueda didn’t present a currency intervention strategy, disappointing investors who responded by raising their hands for more dollars. Which dollars? Any of them: they’re all gaining relative to the Japanese currency.

All major equity indices are higher on the session with the tech-heavy Nasdaq Composite leading the charge and the S&P 500 not far behind; they’re up 1.6% and 1%. Cyclically tilted names are underperforming though, as the Dow Jones Industrial and Russell 2000 benchmarks are up a more modest 0.2% and 0.5%. Sectoral breadth is split, with 6 out of 11 sectors higher. Driving the upside are the communication services, technology and consumer discretionary segments, which are higher by 2.4%, 1.5% and 1%. Energy, utilities and financials are offsetting bullish momentum in the other areas, with the components lower by 1.6%, 1% and 0.3%. Treasury yields are lighter as market players pray that disinflation is around the corner. The 2- and 10-year maturities are trading at 4.98% and 4.67%, 1 and 4 basis points (bps) south on the session. The dollar is gaining as currency watchers view the Fed as more hawkish than other central banks. The greenback’s index is trading at 106.15, 55 bps higher so far today as the US currency gains relative to all of its major developed market currencies, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Middle Eastern tensions are rising modestly today, with some attacks occurring near the Red Sea and in southern Israel. The conflicts are causing WTI crude oil to trade higher by 0.3%, or $0.29, to $84.03 per barrel, as traders monitor whether any supplies may be compromised. Copper and gold prices are near the flatline, meanwhile.

Consumer Outlook is Troublesome

Today’s PCE data points to potential trouble ahead for the consumer. While folks are spending like there’s no tomorrow against the backdrop of sticky inflationary pressures, the next day will probably arrive. The basement level of savings is occurring as the Fed is constrained from reducing rates just yet, which signals a long road across the monetary policy bridge. If the consumer taps out during our journey to the other side of the overpass, then we will enter recession. Today’s odds of that occurring aren’t high at 30%, but well worth monitoring.

Visit Traders’ Academy to Learn More About Personal Income and Outlays and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Muy interesante tu página José. Ahora estaré mejor informado. Gracias por compartirla.

Thanks for engaging!