In great news for consumers, market participants and the Federal Reserve (the Fed), consumer price pressures cooled in November. The overall Consumer Price Index (CPI) released this morning climbed 7.1% from the same month a year ago compared to the anticipated 7.3% increase. While 7.1% is still quite high, this month’s report offers many bright spots, including the rising odds that the Fed may soften its hawkish position, offering relief to investors, consumers and corporations. Markets are riding high on the news, with the S&P 500 up over 2%, the dollar down over 1%, and yields drifting lower into a bull-steepening motion.

From an optimistic perspective, price cooling was broad-based across commodities, goods and services.

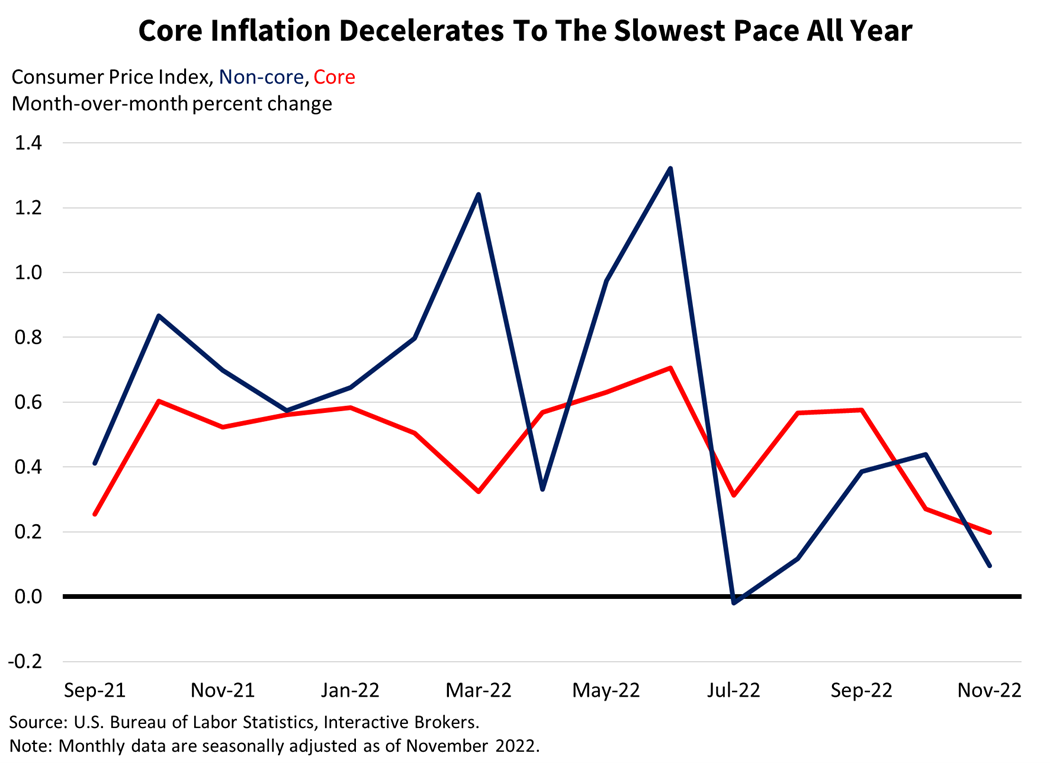

- Core CPI, which excludes the highly volatile food and energy categories, climbed 6% year over year (y/y) in November, better than the anticipated 6.1% increase. It registered a 0.2% month-over-month (m/m) increase, the slowest pace all year and slower than last month’s 0.3%.

- Used cars led the progress. Prices dropped 2.9% m/m, the fifth consecutive month of declines. Energy (gasoline, fuel oil) and energy services (electricity and utilities) followed with price reductions of 1.6% and 1.1% respectively.

- Services were helped by another big reduction in medical care services of 0.7% m/m and a decline in prices for transportation services of 0.1%.

- Food at home accelerated from 0.4% m/m in October to 0.5% in November while food away from home decelerated from 0.9% to 0.5% during the period.

- The pivotal, highly weighted shelter component cooled from 0.8% m/m to 0.6%.

- Inflation on an annualized rate based on November’s m/m CPI change is also encouraging. The monthly gain points to a 1.2% annualized rate for the overall index and 2.4% for the Core CPI, a lot closer to the Fed’s 2% target for core PCE inflation.

Later on Thursday, the retail sales report is expected to reflect declining purchases in November, signaling that this CPI report’s softness may be emblematic of declining demand against the backdrop of dwindling savings and higher interest rates. The CPI and Retail Sales reports taken together may reflect rising prices and declining consumption in November, signaling margin compression alongside earnings and economic weakness. Fed tightening expectations moved down notably this morning, with the terminal rate expected to be 4.83% in June 2023 before the Fed cuts to 4.38% by year-end.

The CPI news is helping investors feel optimistic that Fed Chairman Jerome Powell will announce tomorrow that the Fed is raising the fed funds’ rate 50 basis points, while the next two hikes are priced to be 25 bps, signaling a less hawkish inflation stance. Sometimes good news creates new challenges and this morning’s CPI data is no exception. The news regarding moderating inflation and the subsequent decline in bond yields and the equity market rally illustrates how improving optimism about the economy and the potential for the Fed to ease off its aggressive monetary policy tightening has helped loosen financial conditions. Market stability is important for the Fed, but this development is running contrary to the central bank’s goal of tightening financial conditions. Top of mind tomorrow will be how high the Fed’s dot plot indicates it will need to go and how long it needs to stay there to bring inflation down to its 2% target. With those concerns in mind, Fed Chairman Powell may use tomorrow’s press conference to re-anchor market expectations rather than allow sentiment to strengthen, similar to the Jackson Hole speech last August. In doing so, he will face the difficult task of striking a balance between tamping down investors’ expectations without sounding overly pessimistic. On the other hand, shades of dovishness will likely propel the market higher and yields lower which would be similar to market reactions following some of his past presentations, including his November speech at the Brookings Institution.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.