Risk sentiment strengthened this morning following the release of mixed data for eurozone inflation but even more significant, easing U.S. wage pressure, which has been a big driver of price hikes. Choppy trading surfaced during the past couple of weeks as investors weighed the risks of continued monetary policy tightening and potentially weakening corporate earnings. Markets this morning demonstrated an easing of those concerns with the S&P 500 Index leaping roughly 2% and bond yields declining across durations. The dollar index was unchanged while crude oil sought to recover some lost ground driven by expectations of weakening demand amidst a global economic slowdown despite China ending its zero Covid policy, for now. We’ve been here before, of course, with China previously appearing to embrace the reopening of its economy only to reimpose draconian measures to contain Covid days later.

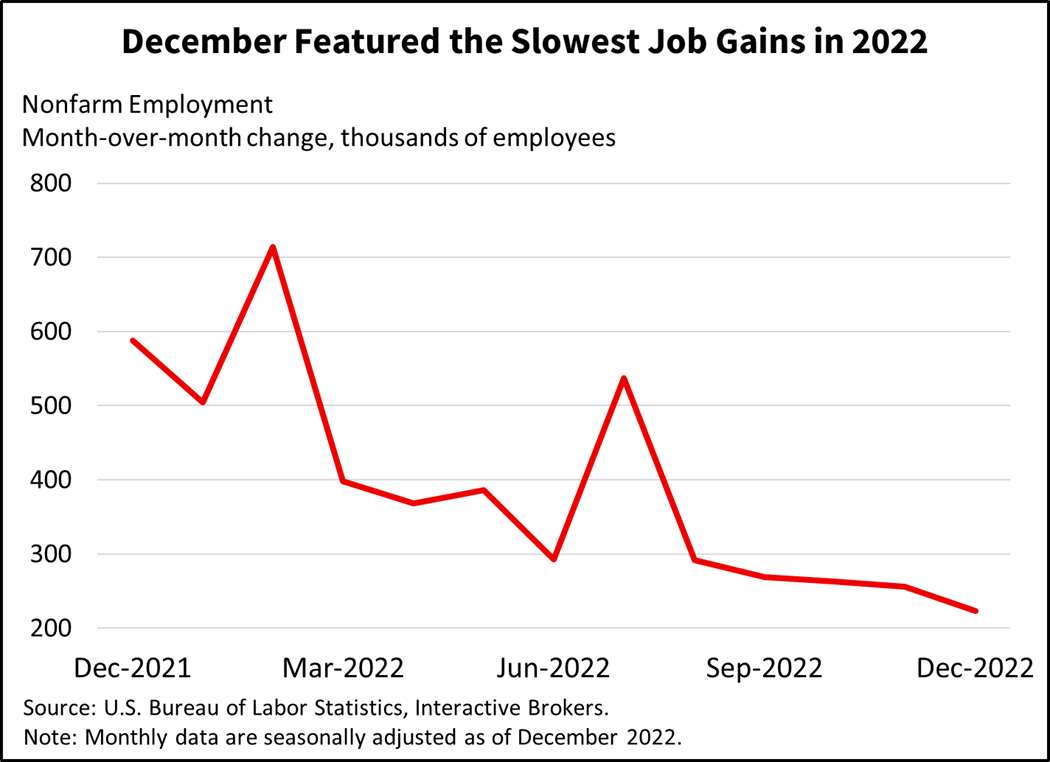

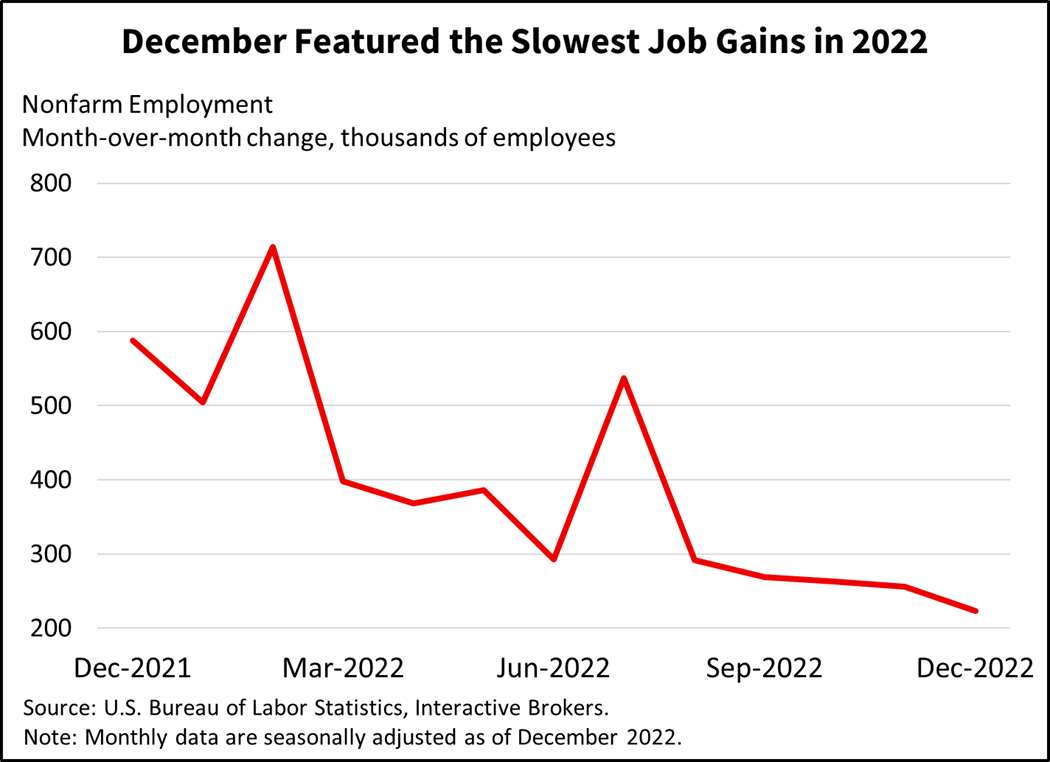

The U.S. labor market added 223,000 jobs in December, a strong number and higher than the 200,000 expected. Still, December’s monthly job gain was the slowest in all of 2022, a positive development in curtailing inflation. The unemployment rate fell back to this cycle’s trough of 3.5%, a significantly tight level and its second-consecutive monthly decline. Wage growth decelerated to its lowest rate since last February, providing additional favorable news on the inflationary front. The Federal Reserve (the Fed) is concerned that the imbalance between job openings and job seekers is leading to unsustainably high wage pressures that contribute to rising consumer prices in excess of the central bank’s 2% target.

December’s payroll job gains were led by education and health services, leisure and hospitality, construction, and other services, with each adding 78,000, 67,000, 28,000 and 14,000, respectively. Trade, transportation and utilities, manufacturing, mining and logging, financial activities and government contributed at lower degrees. High profile tech layoffs may finally be making their way to the official labor data, albeit modestly. Professional business services and information each shed 6,000 and 5,000 jobs.

Investor sentiment appears to have also strengthened in response to the overall rate of inflation, or the headline number, declining in the eurozone. However, the underlying data portrays that inflation is persistent across non-energy sectors and likely to moderate at a slow pace among most countries that use the euro currency.

Overall inflation fell to 9.2% year-over-year (y/y) in December, substantially better than the 9.7% expected as well as the 10.1% in November and 10.6% in October. The headline number reflects decelerating energy price gains rather than a broad-based moderation of inflation. In December, energy prices climbed approximately 25% compared to more than 41% increases experienced in recent months. Warmer-than-normal weather in Europe has weakened demand for natural gas, helping to slow energy price gains resulting from the Russia and Ukraine conflict. Energy prices also reflect a handful of countries providing energy subsidies.

On a more concerning note, core inflation, which doesn’t include volatile energy and food prices, hit 5.2% y/y, up from 5% in November and higher than expectations for an unchanged reading. Inflation and higher interest rates, furthermore, didn’t slow retail sales volumes, which climbed 0.8% month-over-month in November compared to a 1.5% decrease in October. The combination of persistent core inflation and strengthening consumer spending underscores the European Central Bank commenting last month that interest rates will have to continue rising significantly to control inflation. At least one central banker, French ECB member Francois Villeroy de Galhau, believes the terminal rate will be reached this summer, according to statements he made yesterday. In a similar manner, ECB Governing Council member Mario Centeno this morning opined that the central bank is close to reaching its terminal rate, but he cautioned that the organization cannot hesitate in its tightening campaign as it strives to tame inflation.

Similar to the Fed, the ECB is looking to reach its terminal rate and maintain it for quite some time in order to reverse the excesses caused by the Covid-19 pandemic and the emergency measures designed to contain it. In addition to reaching the terminal rate and staying restrictive for a while, both central banks are winding down their balance sheets at meaningful clips. Both central banks are pushing rates higher, liquidity lower and economic growth lower, making it challenging for equity investors as they manage stretched valuations versus fixed-income comparisons alongside slower revenue and earnings growth as the economy slows down.

Meanwhile, in Canada, the employment gain was 104,000 in December, much greater than the 10,000 jobs gained in November and the consensus expectation of 8,000. The unemployment rate fell to 5%, better than expectations for a rise to 5.2%.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.