Durable goods and Personal Consumption Expenditures (PCE) data released this morning reflect contracting demand alongside a moderation in price increases. Investors are reacting with mixed emotions: the S&P 500 is unchanged, crude oil has advanced 3.5%, yields have climbed across the duration curve and the dollar is down modestly. Yields for the 2-Year and 10-Year maturities are near their highs of the week.

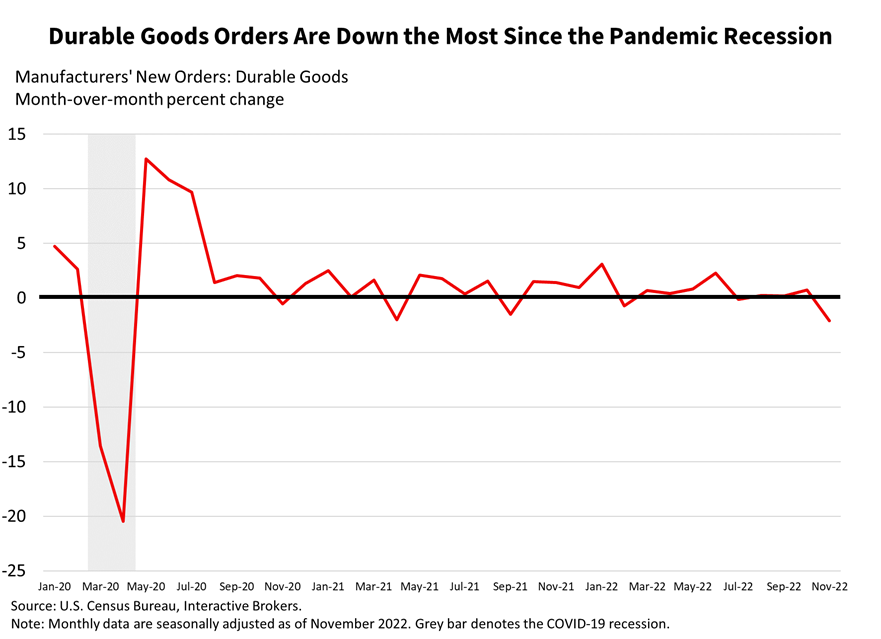

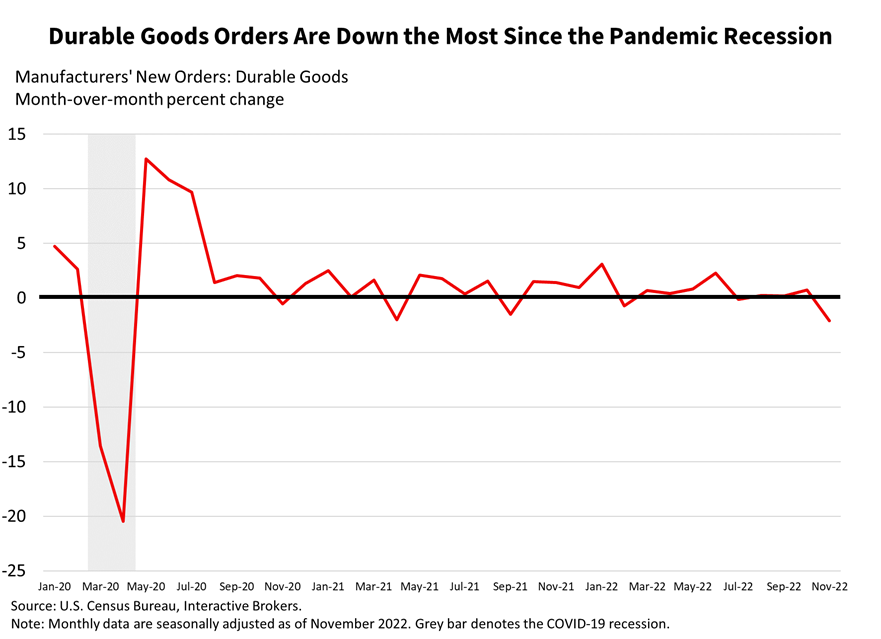

The durable goods data shows that higher costs of capital and persistent inflation continue to pressure the manufacturing sector, with November orders contracting the most since the depth of the COVID-19 pandemic in April 2020. The 2.1% November month-over-month (m/m) decline was much worse than expectations of a 0.6% contraction and the previous month’s 0.7% gain. November’s loss follows three consecutive months of gains. Slowing demand and improved supply chains, furthermore, are helping manufacturers trim their backlogs, with unfilled orders declining for the first time in over two years, breaking a streak of twenty-six consecutive months of increases. Without increases in new orders and a potential completion of unfilled orders, the manufacturing sector could eventually scale back employment and capital expenditures. This trend is already occurring in limited instances.

Yesterday’s weak earnings report from Micron Technology is an example. The report sparked a brutal market selloff in early trading yesterday. The chip manufacturer said it has excessive inventory and it is cutting back its manufacturing to bring supply and demand dynamics into balance. The company plans to slash capital expenditures a whopping 40% year over year (y/y) in 2023 with more cuts expected in 2024. In addition, Micron is cutting its workforce by 10% to lower expenses. As we enter the January earnings season, I’m expecting to hear a similar tune from other major companies: weaker earnings and lowered guidance alongside plans to reduce capital expenditure investments and headcount. On December 9, declining corporate fundamentals prompted me to warn of the cancellation of this year’s “Santa Claus” rally amidst higher yields, sticky inflation, geopolitical uncertainty, liquidity surprises and the equity market trading at roughly 18 times peak earnings.

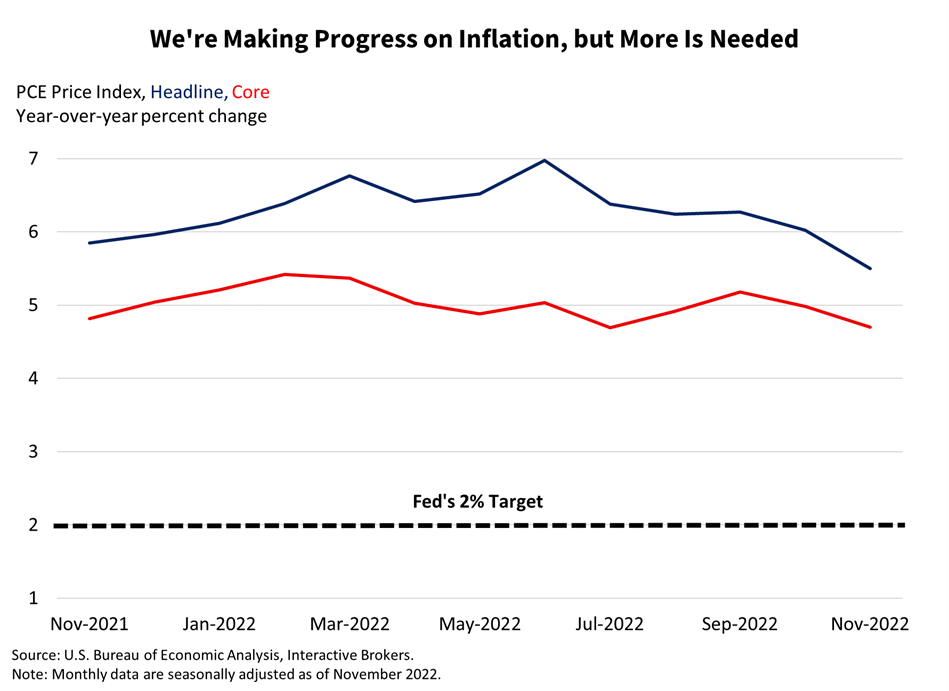

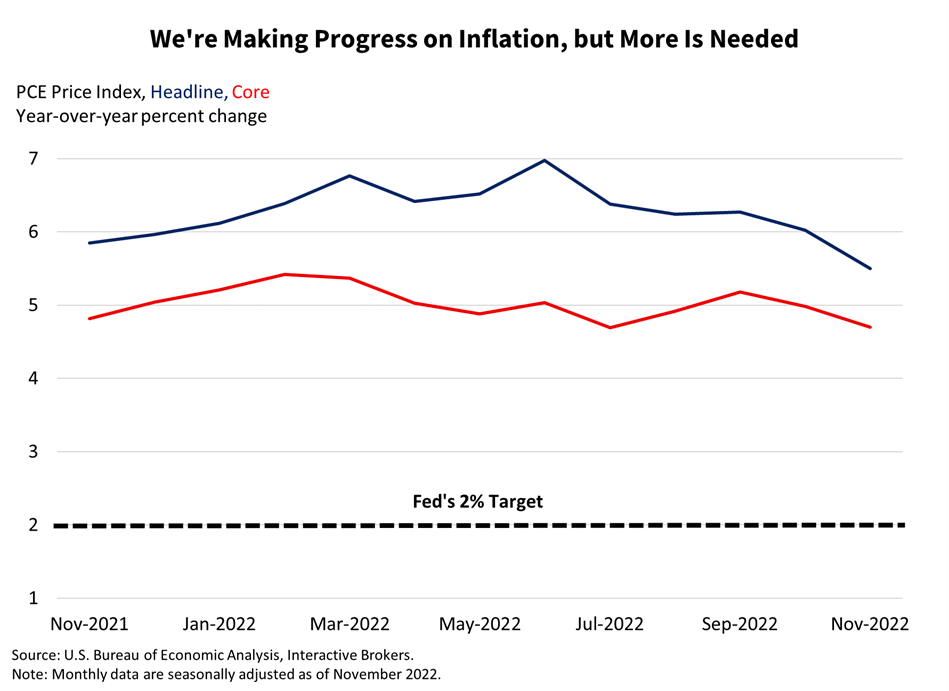

Turning to this morning’s inflation report, the Core PCE Price Index climbed 4.7% y/y and 0.2% m/m in November, in-line with market expectations and cooler than October’s readings of 5.0% and 0.2%. The general PCE Price Index, which includes food and energy, increased 5.5% y/y and 0.1% m/m. The PCE indicates that income gains outpaced spending by a wide margin during the month, with the former up 0.4% and the latter up only 0.1% versus consensus expectations of 0.3% and 0.2%. The rising spread between income and spending propelled the personal savings rate up from 2.2% to 2.4%, still at dangerous levels, but we’ll take whatever progress we can get.

The PCE data implies that higher interest rates, inflation and uncertainty about the economy have prompted caution at the cash register. This trend may help Americans improve their financial health and spending power, which over the long term is positive because consumption represents approximately 70% of U.S. GDP. The minimal increase in spending is also encouraging for the inflation outlook because it shows that higher interest rates are helping to curtail demand.

Despite expectations that manufacturing may scale back its workforce, the job market is likely to remain strong, largely due to weak labor force participation. This means main street will have to deal with sticky inflation, but Americans will at least have ample job opportunities to choose from. Wall Street, on the other hand, will potentially be forced to cut back its workforce as the pandemic era boosts in earnings and revenue have set too high a bar for y/y comparable metrics as we enter a period of higher interest rates, weakening demand and normalcy.

As we continue to navigate challenging economic times and approach the end of 2022, my wish is that all of you and your families find the holidays a time of renewal and comfort.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.