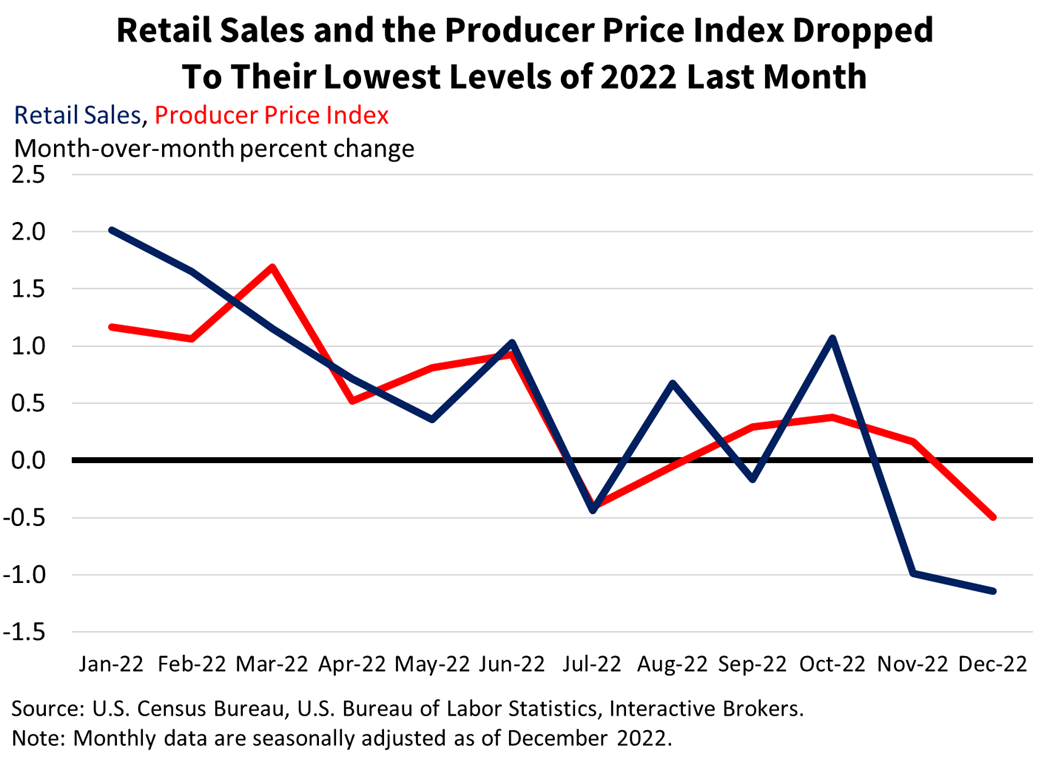

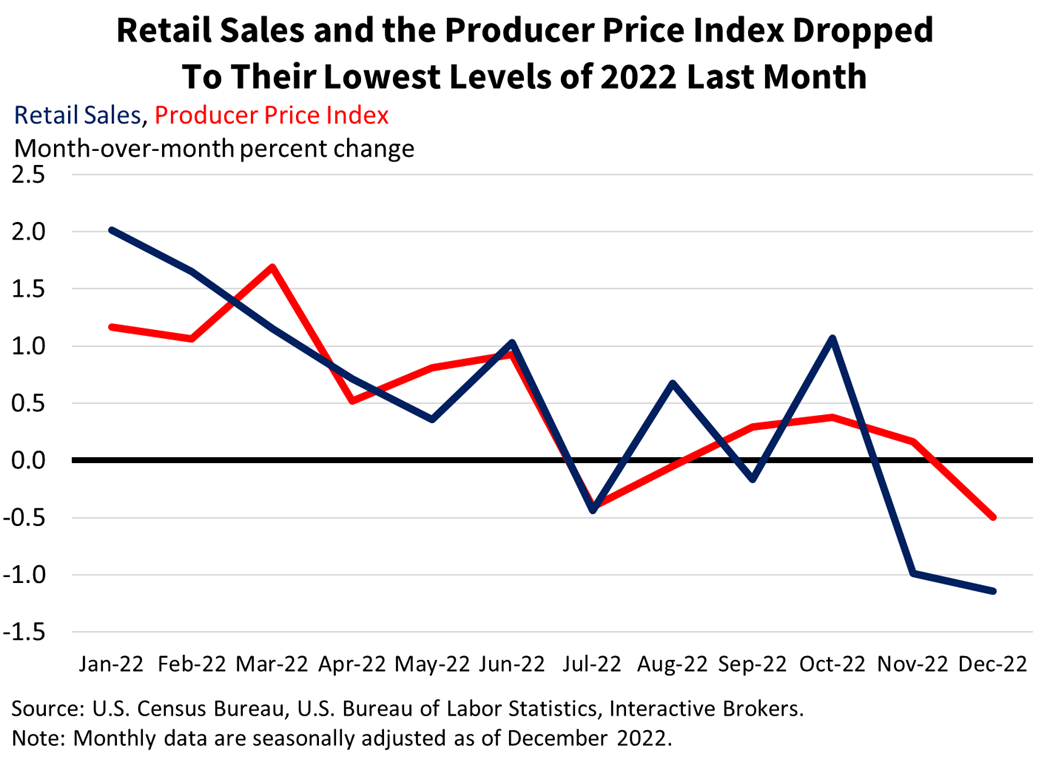

In positive news for the Federal Reserve’s efforts to curtail inflation but negative news for corporate earnings prospects, consumers finished 2022 by tightening their purse strings in December after curtailing spending in November. December’s retail sales dropped 1.1% month over month m/m compared to the 0.8% decline expected by a consensus of analysts. On a year-over-year (y/y) basis, sales rose 6.0%. In comparison, November sales performed similarly, declining 1.0% m/m and rising 6.0% y/y. With consumer spending representing approximately 70% of GDP, weakening retail sales can play a significant role in fighting inflation, but also challenge corporations that are likely to see declining sales and earnings. In another matter, this morning’s December Producer Price Index (PPI) also came in sharply below expectations, falling 0.5% m/m but rising 6.2% y/y versus the -0.1% and 6.8% consensus.

Markets are reacting following this morning’s reports, with the S&P 500 adding to yesterday’s modest losses with a drop of 0.7%. Yields are down across the duration curve in a bull flattening motion driven by the long end as inflation expectations drift lower. The 10-year yield is down 12 basis points while the 2-year is down 8 basis points. WTI crude oil is continuing its recent uptrend, rising 2.2% to $82 while the dollar index is continuing its recent downtrend, losing 0.3% in morning trading.

Almost every category in this morning’s retail sales report experienced lower spending. Leading the declines were department stores, gasoline stations and furniture stores with m/m declines of 6.6%, 4.6% and 2.5%. Weaker spending at motor vehicle and parts dealers, ecommerce retailers, and dining establishments also contributed to losses with contractions of 1.2%, 1.1% and 0.9% respectively. Offsetting some weakness was spending in building materials and grocery stores with modest gains of 0.3% and 0.1% during the period.

A deeper dive into the data, however, illustrates that a portion of the December retail sales decline resulted from lower gasoline prices, which have had a multi-pronged impact on consumers. Until recently, consumer sentiment had been dinged by rising gas prices. After hitting a pandemic low of approximately $1.77 in May of 2020, the average weekly price of gasoline climbed to approximately $5 by the middle of last June. Since then, gasoline prices have been in somewhat of a freefall and started December at approximately $3.50. From there, prices continued declining and ended December at $3.10.

The lower prices resulted in total consumer expenditures on gasoline declining and contributing significantly to the overall drop in retail sales. Declining gasoline prices have had another significant economic impact: the University of Michigan’s Consumer Sentiment Index has been rebounding in recent months and last week hit its highest level since April. The improvement in sentiment has been attributed to job market gains, moderating inflation and gasoline price declines. Despite this improved sentiment, retail sales were still down sharply in December as shoppers continued to be hampered by higher interest rates and prices. While inflation is slowing, it remains too high of a burden for most consumers against the backdrop of dwindling savings and rising credit card bills.

The Fed’s aggressive rate hiking has sought to reduce demand and so far has throttled price gains for consumer goods, but the services sector has seen stubborn inflation. Similar to last week’s Consumer Price Index report, today’s PPI shows that prices for services are still increasing. However, both reports confirm that demand for goods is falling sharply. Not only are higher interest rates making it more expensive for consumers to purchase goods, banks are also making it more challenging for consumers to qualify for financing as they brace for rising credit losses and possible recession.

The Fed has remained steadfast in its belief that it must control inflation, even if doing so weakens overall economic growth and the labor market. In its December meeting, it disappointed investors when it said it expects the terminal fed funds rate, or the highest rate of the cycle, to be between 5% and 5.25%, implying 75 basis points of increases this year. It was a more hawkish outlook than in September, when the central bank said it expected the terminal rate to reach only 4.6%. Fed Chairman Jerome Powell and his colleagues on the committee also dashed any hopes of rate cuts this year.

Today’s retail sales and PPI reports illustrate that the Fed is making progress in fighting inflation and while it’s unclear if it will cause the Fed to become more dovish, it at least implies that the central bank may not need to become more aggressive in raising rates and tightening liquidity. Fed members understand that as soon as they lift their foot off the monetary policy brakes, the risk of another inflationary uptrend rises dramatically. This is especially true when there’s a challenging global situation underpinning energy and transportation prices, like in the 1970s and 1980s. The Fed is no longer navigating an economy with plenty of disinflationary factors aiding its mission: it’s navigating the opposite, and the lessons of the 1970s and 1980s are calling on Powell to stay firm.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.