E-mini S&P (March) / NQ (March)

S&P, yesterday’s close: Settled at 3913.75, down 1.75

NQ, yesterday’s close: Settled at 11,185.50, up 72.00

Fundamentals: Fed speak took hold of yesterday’s session and will remain in the spotlight with Chair Powell at 8:00 am CT. U.S. equity benchmarks were in full melt-up mode on the heels of Friday’s data, but comments from San Francisco Fed President Daly halted the rise. She highlighted the concern of pausing prematurely and emphasized that core services inflation remains elevated with “no sense of coming down”. Shortly after, Atlanta Fed President Bostic said, “it is fair to assume the Fed is willing to overshoot.” Price action across indices surrendered the entire morning’s worth of gains before broadly flatlining into the close. Daly and Bostic were 2022 voters, and we are aware of the Fed’s well-coordinated communication tactics, but neither will vote on policy in 2023. So what groundwork were they forming for Fed Chair Powell today?

Risk-assets are now on their back foot and entering a pivotal stretch between Powell this morning and Thursday’s CPI report. Inflation is expected to have continued coming down in December. Analysts expect y/y Core CPI to hit 5.7%, the lowest since December 2021, whereas the Cleveland Fed model projects 5.87%. One concern might be a reinvigoration in the m/m read. Analysts expect Core to rise only 0.3%, whereas the Cleveland Fed sees +0.48%, a three-month high. Still, headline inflation via both analysts and the Cleveland Fed is seen below 6% for the first time since September 2021.

Do not miss our daily Midday Market Minute, from yesterday.

Although it is undoubtedly too early to claim victory, as Daly pointed out yesterday, the Fed cannot indicate they plan to pause rate hikes until the exact moment they want to, as we have pointed out in recent weeks. In the Minutes from the Fed’s December meeting, released last week, they noted, “because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee’s reaction function would complicate the Committee’s effort to restore price stability.” They are clearly aware that markets will front-run and over-extrapolate a policy shift. Therefore, such a shift must be communicated by them at the right moment. Are they ready now? Maybe, we believe a pause is firmly on the table for this February 2nd meeting. However, if CPI is set to fall for the third month in a row, not to mention Core PCE at 4.5%, the Fed’s preferred inflation indicator, they must stand steadfast in their hawkish message in the days surrounding the release.

Technicals: As we await Fed Chair Powell, price action across U.S. equity benchmarks is now in the red on the week. We have strong resistance overhead in the S&P aligning Friday’s settlement and that from yesterday, a close back above there can begin repairing the damage from yesterday’s reversal. However, we have notable resistances above there, including a major three-star, cited below. Similarly, the NQ has major three-star resistance overhead aligning with yesterday’s settlement. Although yesterday’s reversal created damage across indices, the NQ was the only one that failed to close above the 21-day moving average, after closing above it Friday for the first time since December 14th, signaling a failure to shift momentum to the bulls. If we see continued weakness, a close below major three-star support in the S&P and NQ at … Click here to get our (FULL) daily reports emailed to you!

Crude Oil (February)

Yesterday’s close: Settled at 74.63, up 0.86

Fundamentals: Crude Oil slipped from its high yesterday, a failure to hold the 21-day moving average. Although price action across risk-assets came in broadly yesterday afternoon due to Fed speak, Crude was two to three hours ahead of that. We see this reversal as the rally getting ahead of itself amid ongoing growth uncertainties after achieving technical resistance (detailed below). Furthermore, given the two-day rebound, a consolidation is due ahead of the EIA’s Short-Term Energy Outlook and weekly data. From a macro perspective, we are watching the U.S. Dollar and risk-assets closely through Fed Chair Powell’s comments this morning.

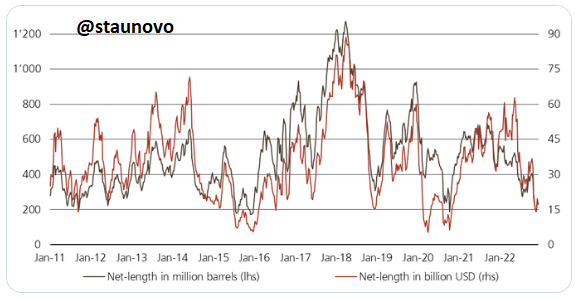

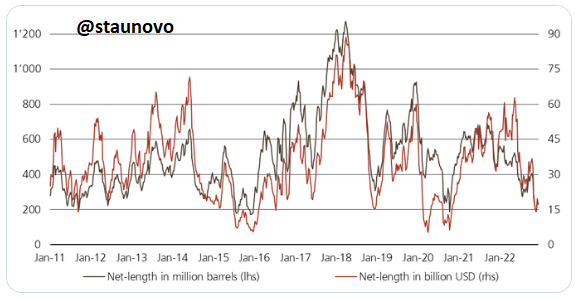

Technicals: We do remain upbeat the energy space over the intermediate and longer-term, however, we are uncertain about the timeline price action needs to loll the bulls to sleep. And they are certainly getting lolled to sleep per the chart below, provided by Giovanni Staunovo, @staunovo, on Twitter. Given the sharp two-day drop to start the year, the consolidation over the last three sessions and failure to hold yesterday’s rebound has played out a bear-flag pattern. We now have major three-star support at … Click here to get our (FULL) daily reports emailed to you!

Gold (February) / Silver (March)

Gold, yesterday’s close: Settled at 1877.8, up 8.1

Silver, yesterday’s close: Settled at 23.871, down 0.111

Fundamentals: Gold celebrated a new local high yesterday, whereas Silver floundered and through the overnight surrendered much of Friday’s post-data gains. Although Gold has retreated from yesterday’s high it is holding ground well ahead of Fed Chair Powell, despite a firming U.S. Dollar and Bonds sharply lower. Yesterday’s comments from San Francisco Fed President Daly and Atlanta Fed President Bostic do set the stage for Powell today, discussed in more detail in the S&P/NQ section. Still, we remain optimistic into Thursday’s CPI report and the Fed’s February policy meeting.

Technicals: Price action in Gold is battling to hold a critical level of support. However, Silver settled below a pivotal pocket at 23.98-24.09, which now marks resistance. While Gold is battling at our momentum indicator, denoted as our Pivot and point of balance below, Silver is trading decisively below the market. This can begin to signal some exhaustion, and continued action below here in Gold opens the door for a pullback into major three-star support at … Click here to get our (FULL) daily reports emailed to you!

—

Originally Posted January 10, 2023 – Managing the Fed’s Reaction Function

Disclosure: Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results. The information contained within is not to be construed as a recommendation of any investment product or service.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Blue Line Futures and is being posted with its permission. The views expressed in this material are solely those of the author and/or Blue Line Futures and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.