Singapore’s retail sales continued to rise in October 2022, though at a slower pace compared to the previous month. October’s retail sales increased 10.4 per cent year on year (yoy), extending September’s 11.3 per cent growth and marking its seventh consecutive month of double-digit yoy growth.

The estimated total retail sales value in October was S$4.0 billion, of which online retail sales made up an estimated 13.0 per cent, compared to the 13.9 per cent recorded in September. Analysts expect the growth momentum to continue into the last two months of 2022 as consumers enter the festive season and households front-load big-ticket item purchases ahead of the goods and services tax hike starting in 2023.

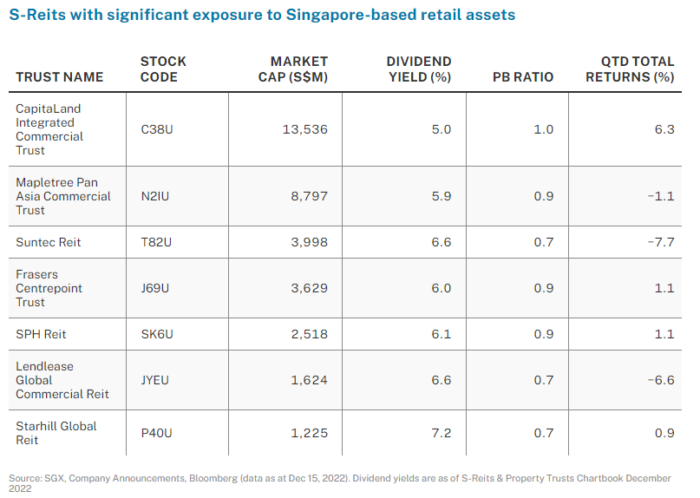

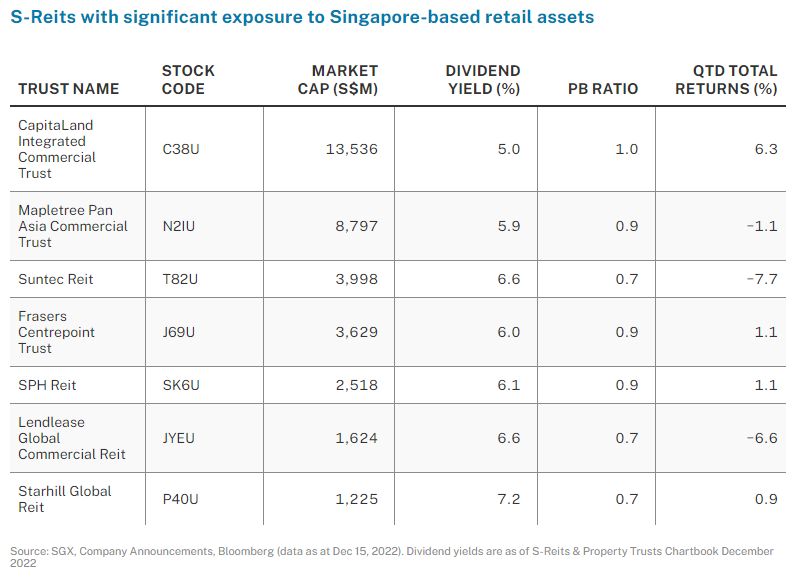

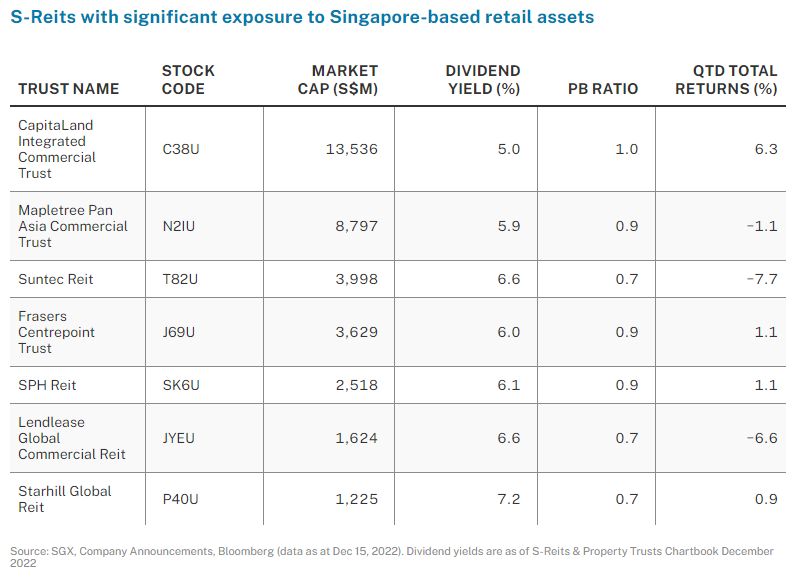

Listed on the Singapore Exchange are seven S-Reits which have significant exposure to Singapore-based retail assets: CapitaLand Integrated Commercial Trust, Frasers Centrepoint Trust, Lendlease Global Commercial Reit, Mapletree Pan Asia Commercial Trust, SPH Reit, Starhill Global Reit and Suntec Reit.

The S-Reits, in their most recent business updates and financial results, continued to post strong operational recoveries in terms of shopper traffic and tenant sales. In terms of price performance, the top three performers for the quarter-to-date till Dec 15 were CapitaLand Integrated Commercial Trust (+6.3 per cent), SPH Reit (+1.1 per cent) and Frasers Centrepoint Trust (+1.1 per cent).

CapitaLand Integrated Commercial Trust reported 21.3 per cent y-o-y growth in tenant sales and 21.9 per cent y-o-y growth in shopper traffic for 9M 2022. The leisure & entertainment trade category, which saw 124.4 per cent y-o-y growth, saw the strongest recovery in terms of tenant sales followed by shoes & bags at 70.3 per cent y-o-y growth.

The Reit noted that leasing activity started to pick up in Q3 2022 with demand primarily driven by food & beverage operators. For the full year FY 2022, SPH Reit’s portfolio gross revenue grew by 1.7 per cent yoy to S$281.9 million, while net property income (NPI) recovered by 3.5 per cent yoy to S$209.7 million. Its Singapore portfolio’s retail tenant sales grew 8.8 per cent yoy while footfall increased 15.9 per cent yoy. SPH Reit also announced that it will change its financial year end from Aug 31 to Dec 31.

Frasers Centrepoint Trust, which also reported full year FY2022 financial results in October, noted a 4.6 per cent y-o-y increase in gross revenue for the year and a 4.9 per cent y-o-y increase in NPI. This was lifted by stronger H2 2022 results due to an absence of rental rebates to tenants and an increase in atrium income with the resumption of atrium events from March 2022.

Its portfolio shopper traffic recovered 12.4 per cent yoy while tenant sales was up 11.3 per cent yoy and averaged 10 per cent above pre-Covid levels.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted December 19, 2022 – REIT Watch – Recovery continues for S-Reits with Singapore retail assets

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.