In January, S-Reits posted 7.1 per cent in total returns (based on the iEdge S-Reit Index) and booked net institutional fund inflows of S$3.2 million, outpacing STI’s 3.5 per cent total returns.

The US Federal Reserve at the Feb 1 FOMC meeting anchored to a 25 basis point (bps) hike instead of a 50bps hike, which saw 10-year US Treasury yields decline to around 3.5 per cent.

Expectations of a slower pace of interest rate increases this year could affect market sentiment towards sectors which are more sensitive to interest rates, such as Reits.

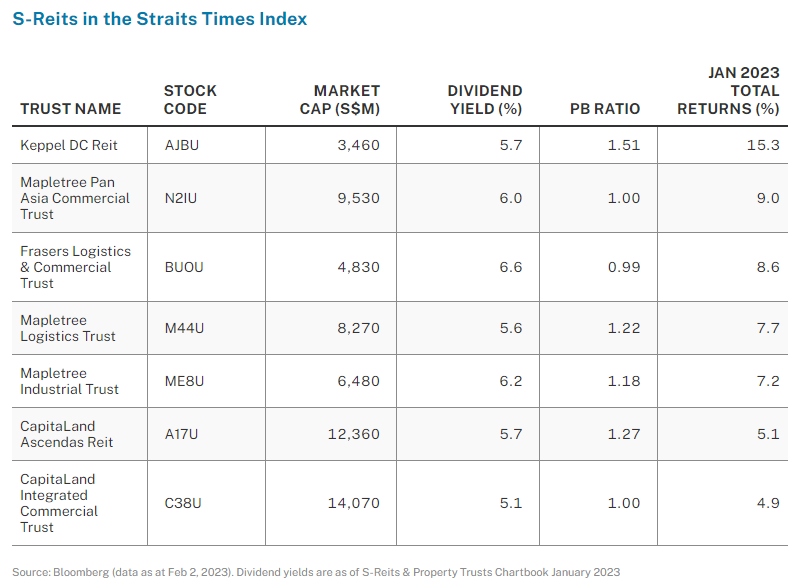

Within the STI, all seven S-Reits in the index outperformed the STI’s 3.5 per cent total returns for January.

The top five performing S-Reits were Keppel DC Reit (+15.3 per cent), Mapletree Pan Asia Commercial Trust (+9.0 per cent), Frasers Logistics & Commercial Trust (+8.6 per cent), Mapletree Logistics Trust (+7.7 per cent), and Mapletree Industrial Trust (+7.2 per cent).

Keppel DC Reit reported on Jan 31 that its FY22 distributable income grew 7.7 per cent year on year, while maintaining its continued pursuit of data centre growth opportunities with its disciplined capital management approach.

In 2022, Keppel DC Reit was among the 18 S-Reits that announced acquisitions, expanding its presence in London, one of the top global data centre hubs and in Guangdong, one of China’s most established data centre markets.

Mapletree Pan Asia Commercial Trust reported on Jan 31 that its Q3 FY22/23 net property income grew 76.8 per cent year on year, driven by full quarter contribution from properties acquired through the merger and increased contribution from the Singapore portfolio.

Positive rental reversion was recorded in all markets except Greater China.

Frasers Logistics & Commercial Trust in its Q1FY23 business update released on Feb 1 highlighted healthy leasing momentum with 2.8 per cent positive rental reversions.

The Reit also updated that it maintained full occupancy for its logistics and industrial portfolio, while commercial portfolio stood at 89.8 per cent.

Mapletree Logistics Trust reported on Jan 19 that its Q3 FY22/23 amount distributable to unitholders grew 10.8 per cent year on year, and its resilient operational performance was underpinned by a stable occupancy rate of 96.9 per cent and 2.9 per cent positive rental reversions.

Mapletree Industrial Trust reported on Jan 26 that its Q3 FY22/23 net property income rose 4.9 per cent year on year, despite lower distribution to unitholders.

Average overall portfolio occupancy increased to 95.7 per cent, with its Singapore portfolio improving to 96.9 per cent while its North American portfolio remained at 93.1 per cent.

Positive rental reversions were achieved across most of its segments in Singapore.

—

Originally Posted February 6, 2023 – REIT Watch – S-Reits report 7 per cent gains in January

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.