The year 2022 was a challenging one for the global Reits sector, with a rising interest rate environment and declining global growth.

During the year, the iEdge S-Reit Index declined 16 per cent in price returns, with dividends boosting its total returns to -12 per cent. Comparatively, the FTSE Epra Nareit Global Reits Index declined close to 25 per cent in price returns.

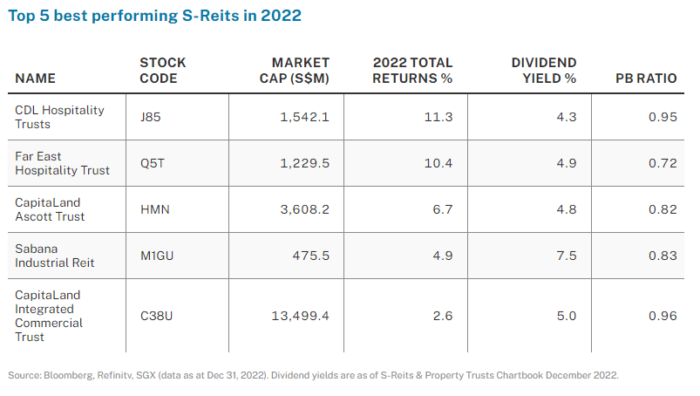

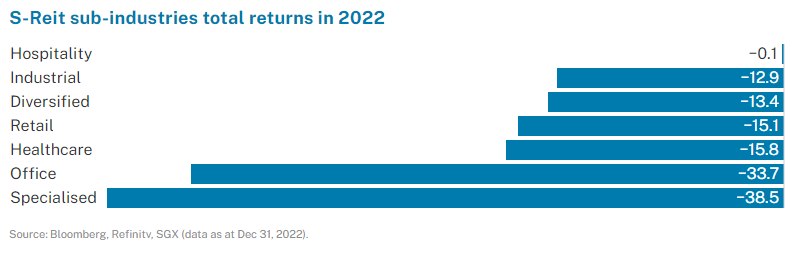

Despite headwinds over the past year, S-Reits reported solid and resilient fundamentals alongside the continued reopening of economies and the return of global travel. Hospitality Reits benefited significantly in 2022 with the rise in international tourist travels and was the sub-industry that saw the strongest performance for the year.

All hospitality trusts with Singapore assets recorded significant improvements in occupancy and RevPAR in H2 2022, benefiting from pent-up demand for overseas travels.

Retail Reits recorded marked recovery in shopper traffic footprint, stronger leasing activity and tenant sales with some even exceeding pre-Covid levels. In particular, consumer and leisure activities picked up in H2 2022 with the return of large-scale events and Mice activities. Office Reits also saw growth in occupancy rates and rental reversions while industrial Reits noted continued resiliency despite macro challenges.

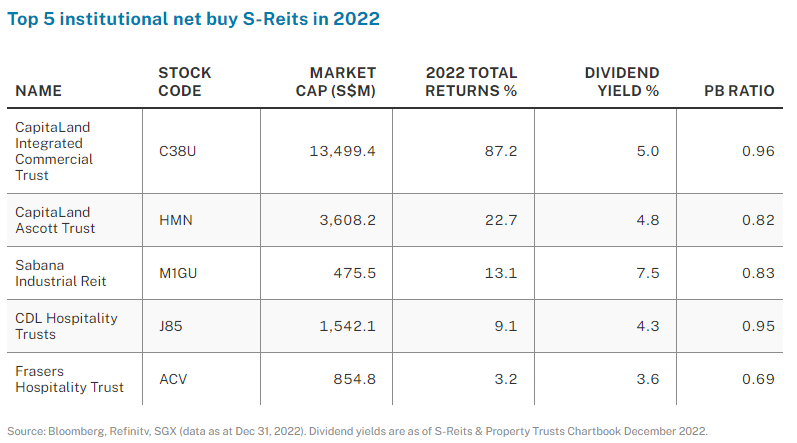

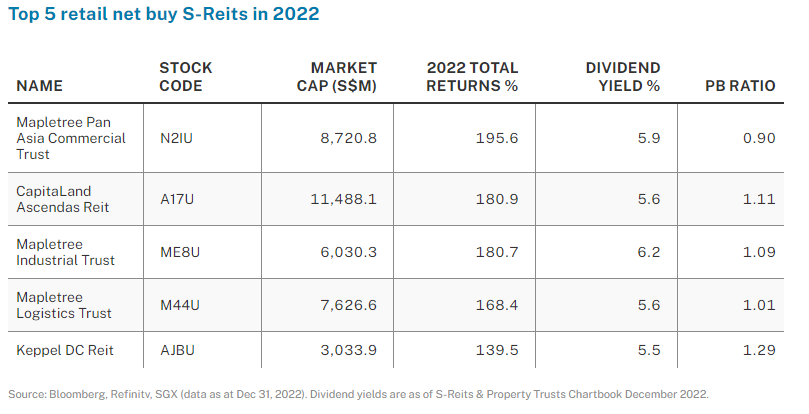

Retail investors continued to be a key driver in S-Reits’ fund flow activities in 2022, accumulating net retail inflows of S$1.53 billion, while institutional investors saw net outflows of S$1.28 billion. S-Reits continued to be active in asset acquisitions throughout 2022, with total purchase considerations exceeding S$6 billion. Some of these acquisitions include maiden acquisitions and forays into new markets.

Daiwa House Logistics Trust and Digital Core Reit, both listed in 2021, announced maiden acquisitions in Japan logistics facilities and European data centre facilities respectively, with both expected to be DPU accretive. ParkwayLife Reit and First Reit continued to expand their healthcare focus in Japan nursing homes through portfolio expansions and acquisitions.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted January 9, 2023 – REIT Watch – Solid fundamentals in S-Reits despite challenging 2022

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.