After much anticipation, the U.S. House approved a bipartisan $1.2 trillion infrastructure spending package last week, sending it to President Joe Biden’s desk to sign. Although no single lawmaker got everything they wanted, I believe this bill is generally constructive news for the metals and mining industry, which will be tasked with supplying the critical minerals necessary to build and improve the nation’s roads, bridges, ports, power grid and so much more.

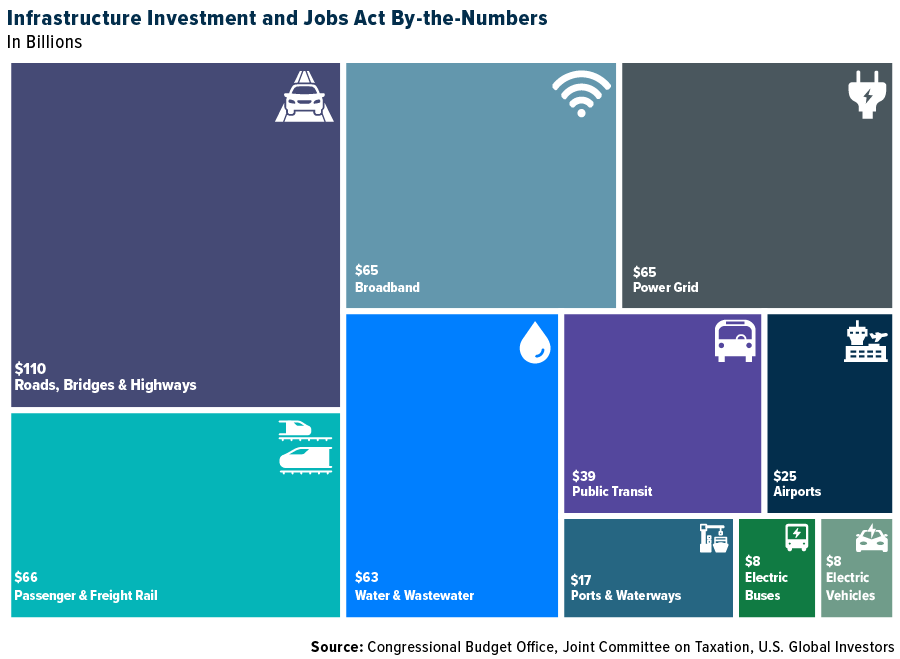

First let’s look at what’s in the bill. Some $517 billion will be deployed over 10 years, with roads, bridges and highways receiving the largest portion at $110 billion. According to the White House, the $40 billion set aside for bridges is the single largest bridge investment in the U.S. since the Eisenhower Administration. Passenger and freight rail projects come next at $66 billion, followed by power infrastructure and broadband infrastructure at $65 billion each. Water projects, public transit, airports and ports and waterways will also receive new funding, as will new electric vehicle (EV) charging infrastructure.

Applications for funding may not be approved for several more months, but already the spending package is being compared to past major infrastructure programs such as the transcontinental railroad and Interstate Highway System.

That said, I believe this could be a catalyst for significantly higher prices for metals and other raw materials, meaning now may be the time to get exposure to the mining industry as well as refiners and manufacturers.

More Mining Needed to Meet Decarbonization Goals

In a recent note to clients, Morgan Stanley analysts said the biggest recipient materials of a core infrastructure package would be cement, aggregates (sand and gravel) and finished steel products such as rebar. According to the bank’s estimates, a $1.5 trillion infrastructure plan would translate to incremental steel demand of 75 metric tons over 10 years.

That could be good news for iron producers like BHP and Anglo American.

Although the infrastructure bill seeks to put the U.S. on track for net-zero carbon emissions by 2050, there’s really no substitute at the moment for cement and steel, the production of which emits great amounts of carbon into the atmosphere.

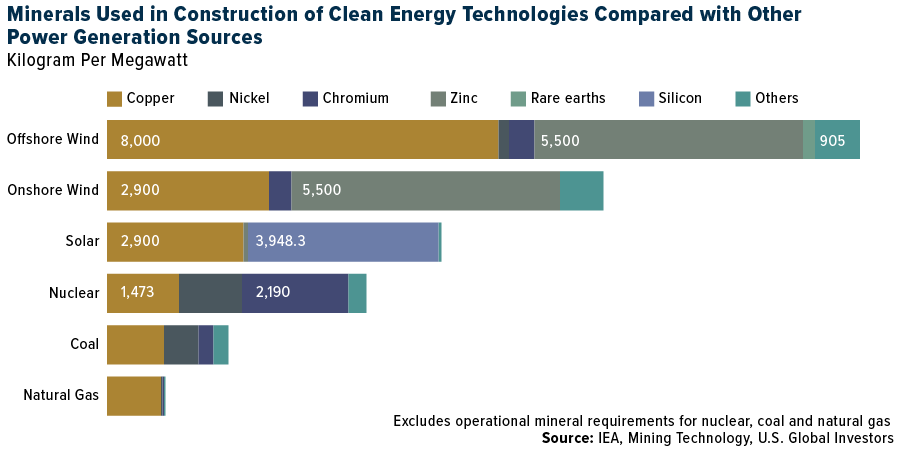

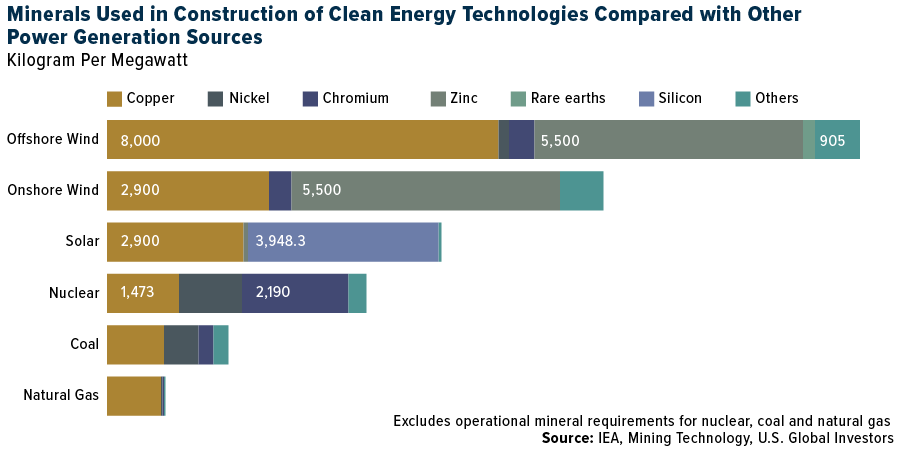

In fact, a move to decarbonize inevitably means, paradoxically, that more metals must be produced through scaled-up mining. As I’ve shared with you before, EVs require six times the amount of minerals on average, such as nickel, copper, cobalt and lithium, as traditional internal combustion engine (ICE) vehicles.

Take a look at the chart below. An offshore wind farm uses nine times as many resources as a natural gas plant, according to the International Energy Agency (IEA), with some 8,000 kilograms of copper needed to produce just one megawatt of power.

Well-Positioned for a Potential Commodities Boom

We seek to select companies that produce the minerals that we believe will benefit the most from higher construction spending.

That includes copper producers such as Ivanhoe Mines, the number one holding in PSPFX as of September 30. We also like CopperBank Resources as a more speculative play. To get access to renewable energy and battery metals such as cobalt and lithium, we prefer names like First Cobalt, Standard Lithium and Piedmont Lithium.

And then there are the manufacturers of renewable energy generators themselves. Canadian Solar is one of the fund’s top holdings, and we also like Spain-based Siemens Gamesa Renewable.

We invite you to learn more about the Global Resources Fund (PSPFX) by clicking here!

Please click here to see the PSPFX prospectus.

—

Originally Posted on November 11, 2021 – $1.2 Trillion Infrastructure Bill Means More Metals And Mining Will Be Needed

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Investing involves risk. Principal loss is possible. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Fund portfolios are actively managed, and holdings may change daily. Holdings are not recommendations to buy or sell a security and are reported as of the most recent quarter-end. Holdings in the Global Resources Fund as a percentage of net assets as of 9/30/2021: Ivanhoe Mines Ltd. 4.92%, CopperBank Resources Corp. 1.97%, Canadian Solar Inc. 1.86%, Siemens Gamesa Renewable Energy SA 1.37%, Standard Lithium Ltd. 1.26%, First Cobalt Corp. 1.11%, Anglo American PLC 1.08%, BHP Group Ltd. 0.41%.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.