After presenting a trader friend with the potential edge in selling crude oil’s recent quinquennial highs, he responded, “Cool, but how high can it go?”

This question can plague many attempting to act on what the data tells them, and it’s especially justified for volatile commodity markets like oil and natural gas. Thankfully, crude oil has been around for a while, and there’s enough data to both display an opportunity and measure the risk around it.

Crude Oil: Trading the Reversal

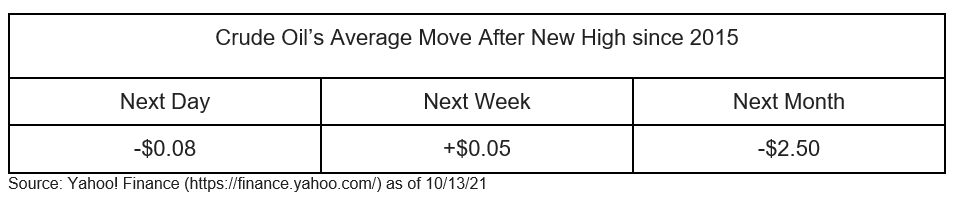

Knowing that a market has historically reversed course from its highs can be great news for contrarians looking to sell expensive crude oil, and an average move lower of -$2.50 in the month following said high can pose a big fat edge.

Extending Duration in Crude Oil

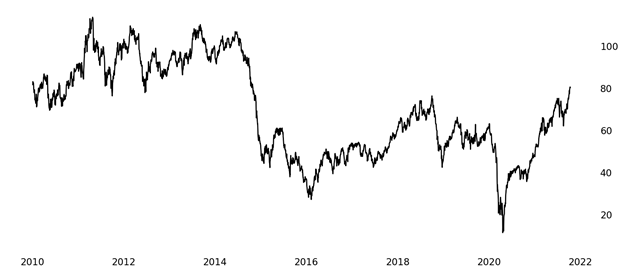

The challenge becomes withstanding the P/L volatility that can come along with a short crude oil position, not to mention the market’s ability to reach $100 a few times in the last decade.

CL \ Crude Oil

Source: Yahoo! Finance (https://finance.yahoo.com/) and dxFeed Index Services (https://indexit.dxfeed.com)

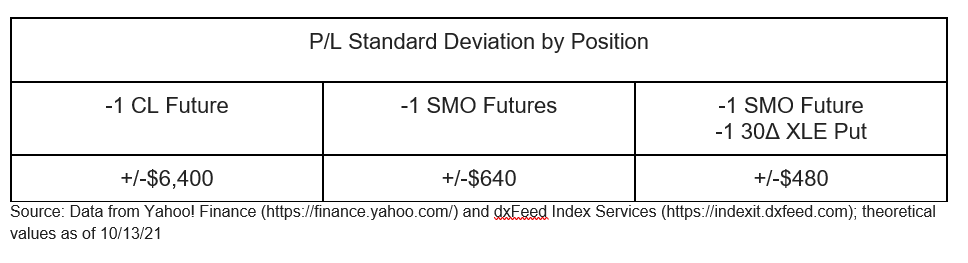

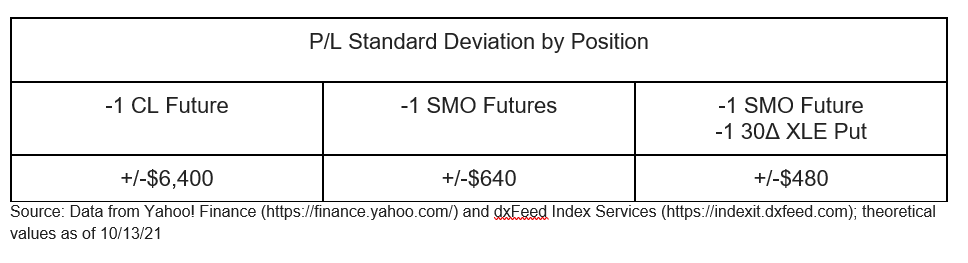

The first step to extending duration is often to simply reduce size. Small Crude Oil (SMO) futures cut the size of traditional crude futures (CL) contracts tenfold. Next, offsetting part of the short position with a long deltas via a short put can help even further. Options on the highly correlated, similarly sized Energy Sector ETF (XLE) offer a solid spot to do so.

Crude oil has a volatile reputation, and rightfully so! The commodity has both broken the $0 bound and bounced back above $80 since the start of 2020. But the modern trader has the tools to remain chill during periods of explosiveness in this market and potentially take advantage of the opportunity in front of them.

Looking for a new way to trade stocks, commodities, and foreign exchange? Sign up for in-depth analysis on products that are small, standard, and simple from the Small Exchange: https://go.smallexchange.com/IBKRTC

—

The information presented here is for illustrative purposes only, and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances.

Disclosure: The Small Exchange

© 2022 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading in options, futures, and ETFs is not suitable for all investors. The risk of loss in the trading of options, futures, and ETFs can be substantial. Trading in derivatives and other financial instruments involves risk. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Interactive Brokers Group, Inc., the parent company of Interactive Brokers, LLC, is a minority owner of Small Exchange Inc.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Small Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Small Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.