While gold and silver have not consistently benefited from inflationary signals over the past 12 months, it appears that they have become more sensitive to that prospect. We think inflation is becoming prevalent and broad-based and is giving off signs of being entrenched. However, bearish sentiment toward gold and silver has been in place for so long that speculative interest has been slow in returning.

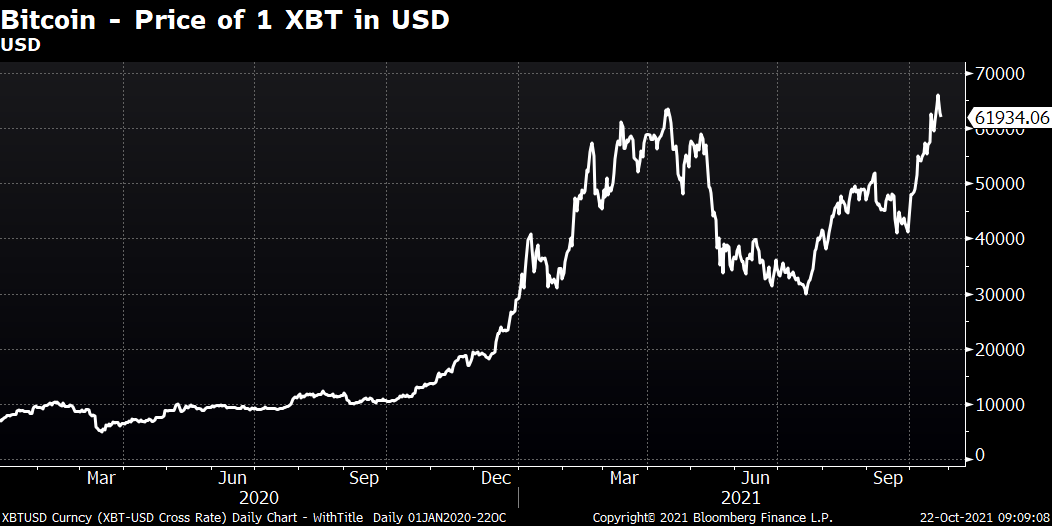

On the other hand, it is possible that surging bitcoin prices have siphoned flight to quality and inflationary buying fuel. According to legendary fund manager Paul Tudor Jones, cryptocurrencies have been the best inflation hedge over the last two years. While both gold and silver have recently seen consistent outflows from ETF instruments, we view that as a lagging indicator for prices. Small investors are a key component of daily flows in and out of ETFs, and they tend to participate near the bottoms and tops of the market.

It is significant that the US infection rate appears to have plateaued at a lower level, that the jobs market continues to improve in the US, and the that US is apparently closer to another stimulus/spending package. We are of a mind that inflation is beginning to garner a foothold. Indications that the Delta wave is coming under control could ramp up energy demand and send prices to even higher levels. This could also pressure the dollar and improve the chances that the world’s two largest gold consumers (China and India) see their demand for gold and silver recover in a more definitive fashion.

The fact that silver has outperformed gold over the past three weeks and that it has managed to rally in the face of stronger dollar action and has largely discounted the ebb and flow of flight to quality sentiment suggest it may be a more direct inflation hedge than gold. It should also be noted that silver ETFs maintain a net positive year-to-date inflow of 1.8%, while gold ETFs have seen an 8.2% contraction. A consistent risk-on mood in the marketplace, even higher energy prices, and signs of economic progress could see nearby gold prices back above $1925 and nearby silver back to $28.00.

Total Known Silver ETF Holdings

—

Originally Published on October 22, 2021

Charts Source: Bloomberg

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.