While we continue to see the long-term trend pointing up in gold, the approaching week could bring about extensive volatility as the market wrestles with concerns about physical demand destruction versus the possibility of a surge in safe haven buying. We base the projection of volatility on continued spikes in US infection counts and the strong probability that many areas will be forced to roll back re-opening activities to stem the spread.

Certainly the gold bulls were disappointed by the US Congress’ failure to move swiftly on another stimulus package, but they also have to be disappointed that the market has generally embraced the idea that gold will fall victim to demand destruction due to reduced recovery prospects instead of benefiting from flight to quality buying. However, some economists are beginning to raise their expectations for inflation. Inflows into TIPS (Treasury Inflation Protected Securities) recently reached record levels. Another factor that could cushion gold against a significant correction is the Fed’s purchase of $1.68 billion worth of corporate bonds, as noted in its most recent weekly report.

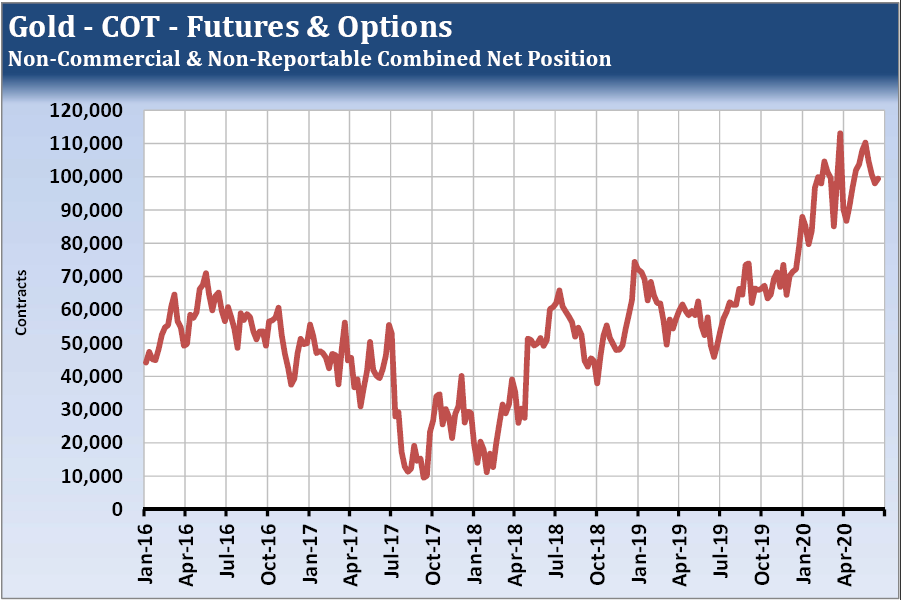

Gold prices on Friday were $87 above their early June low and $30 above the middle of the April-June consolidation. Those traders interested in buying gold might have to accept significant risk by placing stops well below close on June 19. On the other hand, large and small specs have already reduced their net long position from their 2020 peak of 427,000 contracts on February 25 to 262,000 on June 9, which is their smallest net long in 12 months. Those not wanting to miss out on the next wave up in gold prices could be well served by implementing a strategic long position using options.

—

Originally Published on June 26, 2020

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.