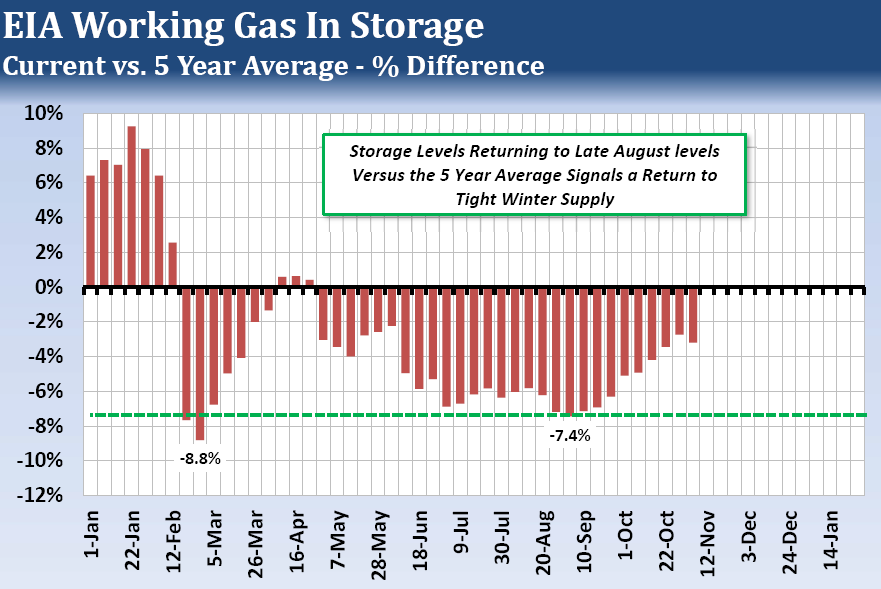

The bull market in natural gas may have paused, but we don’t think it is over. Supply remains tight. US storage is running 3.2% below the five-year average right as the injection season is coming to an end.

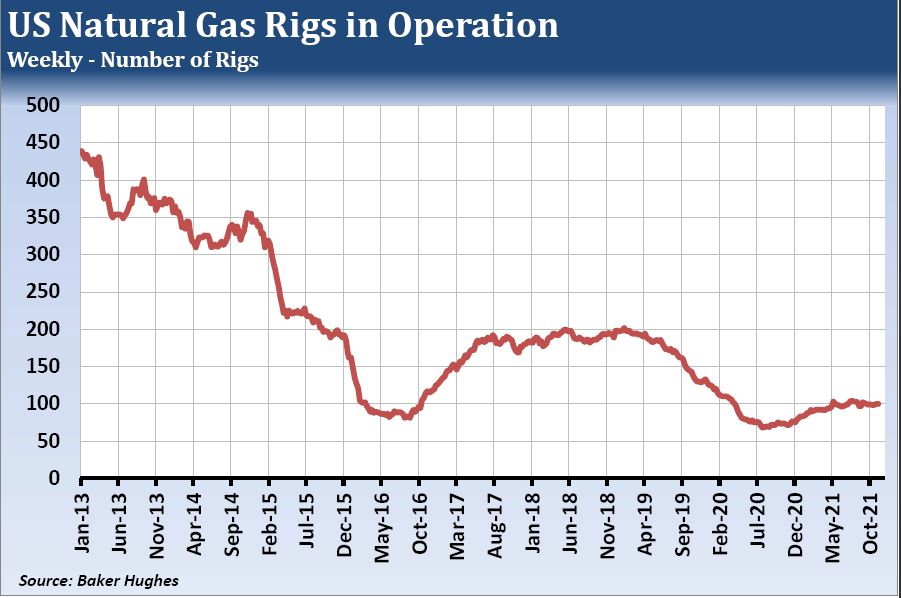

The Genesis of the August-October rally was the pandemic-related crash in the weekly US natural gas rig operating count. The count fell to 68 rigs in June 2020 from the roughly 200 rigs that were operating between June 2017 and June 2019. This was also a mere fraction of the record high count of 1,606 from 2008. Recent counts have been back near 100.

Another impetus behind the rally was the fear that global LNG supplies were insufficient for the winter months. Price gains were exaggerated by a combination of tight supply in Europe and a drop off in wind power generation. Capping off the run was the developing energy crisis in China, partially caused by a shortage of coal supplies.

As is usually the case with “blow off” type rallies, the action was brought about by the mad scramble by China and Europe to secure available supply. This led to wild speculation in Europe, boosting prices in some parts of the world to quadruple the levels that were being seen in the US.

The bull case is threatened by Russia’s capacity to supply gas via pipelines running through the Ukraine and Belarus. However, those nations have mixed records in their political and economic dealings. Belarus has threatened to withhold Russian supply flow to Eastern Europe because of the threat of EU sanctions associated with refugees. Even though the Kremlin has promised it would supply Europe with all the gas it will need, Russia has rarely passed up an opportunity to extract high prices or a chance to grab foreign territory or tweak Europe’s nose or use energy as a weapon. In recent years, they have solicited high long-term contract prices and have held back supply from the Ukraine in the middle of winter.

Source: EIA

It could be that the most important factors to monitor in the coming weeks are the weekly US EIA gas storage levels, particularly as they relate to the 5-year averages. This most recent weekly injection was only 7 BCF, and with the cooler weather this past week, we could see a withdrawal in the next report. Once the withdrawal season is fully underway, we suspect the supply deficit to the five-year average will get wider and that concerns about tight supply this coming winter will resurface.

After the recent selloff, the spec and fund net short has likely reached 110,000 contracts or more, and that alone could spark significant short covering, especially if we see the first winter weather forecast of the season for the US or Europe. A normal correction of the 2021 rally was violated last week at $5.1340, but the market aggressively rejected the 50% correction at $4.6835, and that level could be strong value in the weeks ahead.

—

Originally Published on November 12, 2021

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.