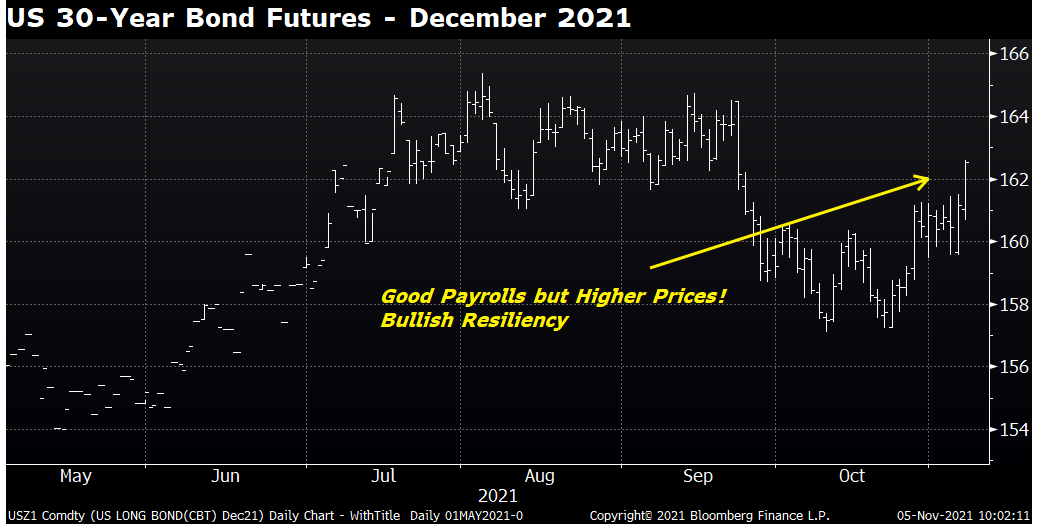

The rally action in the Treasury market seems contrary to the jobs data on Friday. It also seems contrary to the historic rally in equities and the long-anticipated shift in the Fed from all-out easing toward less accommodation. There appears to be a large contingent that firmly embraces the “transitory inflation” view, despite several signals that would indicate something more significant. Recent yield curve action suggests long rates will continue to be held down, and there are concerns in China about a slowing economy and stubborn delta infection counts.

There have been several US economic releases over the last month that have depicted weakness in the US economy and have kept the idea of a compliant Fed alive. The Treasury market has shown consistent resiliency, where minimally weak economic data sparked gains and strong data elicited very little pressure. Another example of bullish sensitivity has been the market’s recent interpretation of yield curve flattening and even inverting, with some traders viewing it as a sign of a return to recession while others as a sign of a shift into a rising rate environment.

With the Fed supporting Treasury Bonds, the October lows near 157-00 could be very solid, especially if there are no front-page inflation scares or the market does not suddenly embrace ideas that the delta wave is coming to an end.

In the interim, we see upside potential in December Bonds, perhaps to consolidation highs. There is also a potential for the rally to extend further to the July-September consolidation highs.

—

Originally Published on November 5, 2021

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.