By: Global Unconstrained Fixed Income

It seems that ‘patience is a virtue’ when it comes to disinflation and a more accommodative rates environment.

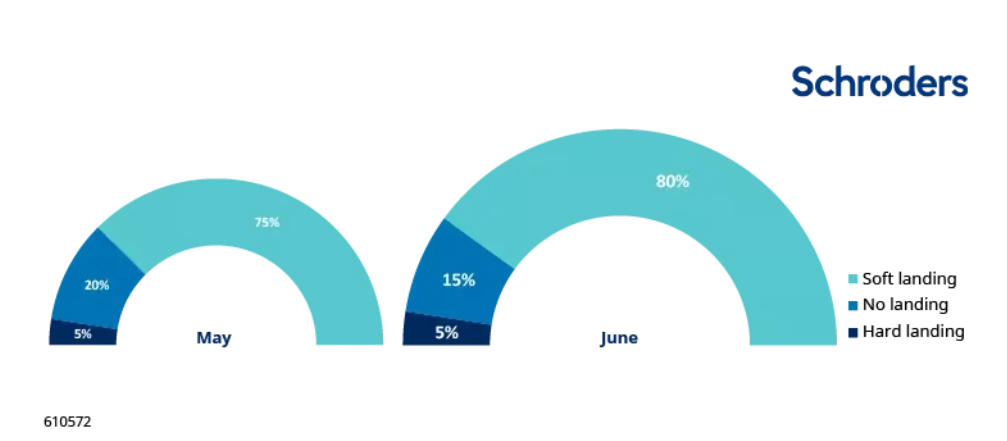

In the past month, we have increased the probability of a ‘soft landing’ to its highest level within the year, due to significantly improved US inflation news. This has reduced the ‘no-landing’ risk. Because of generally positive economic news, we continue to perceive only a very small risk of a ‘hard landing’.

Greater confidence of a soft landing….no landing risks abate (again)

Source: Schroders Global Unconstrained Fixed Income team, 17 June 2024. For illustrative purposes only. “Soft landing” refers to a scenario where economic growth slows and inflation pressures eases; “hard landing” refers to a sharp fall in economic activity and additional rate cuts are deemed necessary; “no landing” refers to a scenario in which inflation remains sticky and interest rates may be required to be kept higher for longer.

“The journey of a thousand miles begins with a single step”

Major central bank meetings have passed without fireworks. The European Central Bank (ECB) kicked off its easing cycle– a move which was well-flagged in advance. However, given the recent stubbornness in eurozone services inflation and the current growth rebound, we anticipate the ECB’s next move to be cautious.

Meanwhile, the US Federal Reserve (Fed) has revised its rate forecasts, now indicating one rate cut for this year, down from two. Despite this, the committee’s ‘modal view’ still suggests two cuts, as projected by eight of its members.

“Slow and steady wins the race”…?

So, what led us to increase our ‘soft landing’ probability even further? To put it simply; signs of easing inflation pressures. While we consider a whole host of economic indicators, few are as important as developments on the US inflation front. After all, low inflation is the ultimate path to a ‘soft landing’ as it provides room for the Fed to loosen policy. May’s US CPI report (CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services) showed promising signs, despite the stubborn shelter inflation. The cost of services, not including housing (the so called super-core measure) improved significantly over the month. In fact, compared to last month, the price of services has actually gone down.

“The experience of democracy is like the experience of life itself—always changing…”

With 2024 being a record year for the number of citizens heading to the polls (over two billion), there was always scope for a degree of political instability. Nevertheless, little would have prepared investors for the number of surprises in such short succession across both developed and emerging markets.

France’s fiscal challenges have pushed the country’s government bond valuations into decline, and the unexpected election announcement has exacerbated market stress. We don’t think the sell-off in European assets creates a buying opportunity just yet – the outlook is just too opaque, and we cannot discount the probability of a noticeable change in the French political landscape ahead. Nevertheless, the indiscriminate nature of the sell-off should present opportunities at some point.

“In the middle of difficulty lies opportunity”

Given the assignment of a high probability to a ‘soft landing’, we foresee challenges for global bond markets to rally structurally from their current position. In terms of asset allocation, we still favour covered bonds over other credit sectors like supranationals and agencies. However, unlike US agency mortgage backed securities, we have been reticent to increase our score on improved valuations alone due to ongoing political risk. For corporate credit, we continue to favour European over US investment grade, but remain cautious due to ongoing political risk.

—

Originally Posted June 24, 2024 – Unconstrained fixed income views: June 2024

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

I don’t see how one can consider future inflation without considering future government spending. As long as the US govt is on a spending spree driving up the debt you can expect: -Inflation: both from devaluation and also from govt purchases competing with private purchases -High rates Stock PE multiples are becoming unreasonably high. The yield curve is still inverted. Banks are still failing. And the PB ratios of the biggest banks in Europe are downright scary. I don’t see anybody with half a brain lining up to buy a 30 year bonds at 2% in that universe.