The Global Unconstrained Fixed Income team assesses the current macroeconomic environment, and where it might be heading by looking at the likelihood of various possible states of the world. We then consider what this means for fixed income investors.

Alone, together?

At the moment, major central banks are gearing up for imminent rate cuts – the European Central Bank (ECB) will almost certainly cut in June and the Bank of England is likely to follow suit. However, despite their protestations, it’s hard to see how the rate paths of non-US central banks won’t be influenced by the action, or lack thereof, of the Federal Reserve (Fed) in upcoming months given its impact on financial conditions (that’s how cheap / easy it is for consumers and businesses to access finance) commodity prices and currency movements amongst others.

What we really need to see is the softening growth momentum in the US to continue. This would pave the way for the Fed to begin lowering policy rates later in the year.

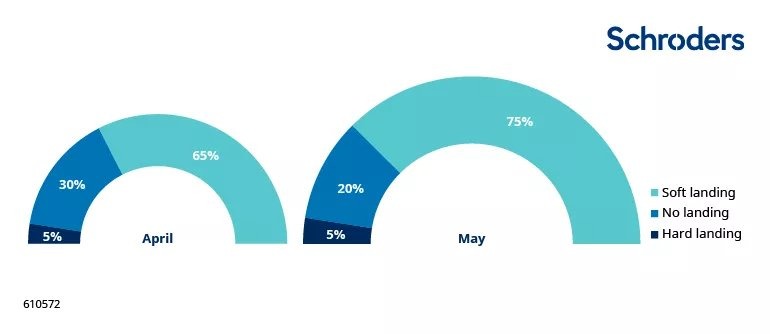

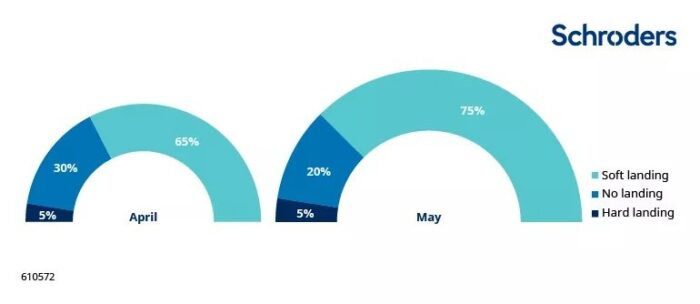

Greater confidence of a soft landing…. no landing risks abate

Source: Schroders Global Unconstrained Fixed Income team, 21 May 2024. For illustrative purposes only. “Soft landing” refers to a scenario where economic growth slows and inflation pressures eases; “hard landing” refers to a sharp fall in economic activity and additional rate cuts are deemed necessary; “no landing” refers to a scenario in which inflation remains sticky and interest rates may be required to be kept higher for longer.

Over the past month, we’ve dialled back the risk of a ‘no landing’, increasing the probability of ‘soft landing’ (our base case) in reflection of early signs of moderation in the US economy and better news on inflation.

This moderation has been pretty broad based across economic indicators, with consumer confidence, the quits rate and initial jobless claims suggesting some of the concerns over the labour market overheating may have been previously overstated. Above all, it is nonfarm payrolls that sets the tone, and the lower pace of hiring in ‘core’ areas (private sector excluding healthcare) was a welcome sign in the latest report. At nearly 100,000 ‘core’ jobs growth though, and 175,000 total payroll gains, the labour market still remains healthy.

On inflation, oil prices have retreated from their April highs as geopolitical tensions abated. Meanwhile, the US Consumer Price Index (CPI) data for April showed further improvement from March, especially in core areas, such as services excluding housing. With core inflation rising almost 0.3% month-on-month, the absolute level remains too high for both the Fed and the market, but the improvement from the first quarter is an important step in the right direction.

Should this softening of growth momentum continue, it will pave the way for the Fed to begin lowering policy rates later in the year.

Hard to explain

There has been one puzzling phenomenon. The last reading from the ISM Services survey was poor, falling below 50 (marking a contraction) for the first time in over a year, with weakness across new orders, employment and production. For reasons that are not immediately obvious though, this previously powerful leading indicator has become less reliable in the post-Covid era.

It is too early to raise the risk of a hard landing on the basis of one very weak survey indicator. However, our scrutiny of services sector data, both official and survey based, will be even greater than normal in upcoming months.

What does this mean for our asset class views?

Our outlook for global bond markets has improved with our reduced probability of no landing, the scenario in which bond returns are most adversely affected. Moreover, the latest Fed meeting quashed the growing discussion of whether further hikes were a possibility if data remained strong – a crucial development. This all justifies an incrementally more positive stance on global duration (or interest rate risk).

Our asset allocation is relatively little changed since last month, with a slight upgrade to emerging market local currency debt the only notable change. We remain positively disposed towards covered bonds (debt comprised of loans that are backed by separate collateral), agency mortgage-backed securities (MBS), shorter dated European investment grade credit and quasi-sovereign issuers, and underweight US investment grade and high yield globally due to unattractive valuations. (Investment grade bonds are the highest quality bonds as determined by a credit rating agency; high yield bonds are more speculative, with a credit rating below investment grade).

—

Originally Posted May 20, 2024 – Unconstrained fixed income views: May 2024

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.