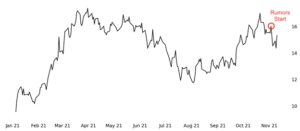

Rumors started to swirl concerning the nomination for the next Federal Reserve Chairperson a little over a week ago.* Would President Biden nominate the current Fed Chair Jerome Powell for another term, or would he go to the more dovish Democrat Lael Brainard?

10YSME \ 10YR Treasury Yield Index

Source: dxFeed Index Services (https://indexit.dxfeed.com)

Interest rate markets, which the Fed has significant influence over, were likely expecting another term for Powell given that Treasury yields fell several basis points following even the mention of Brainard in the interview process. Though further developments in this story will be important for the future of the US economy at large, most traders were seeking the answer to just one question as the news broke:

Are Yields a Buy or Sell?

A Logical Approach to Trading the News

It might seem simple, but asking how much a news item actually matters can be a solid way to start your research. Allegedly, yields fell because President Biden interviewed a dovish Fed Governor, a supporter of monetary expansion and thus low interest rates, for the next Fed Chair appointment.

Though the Fed Chair may hold considerable sway, most actions from the Federal Reserve or Federal Open Market Committee require a vote from a mix of the Board of Governors, of which there are seven, and the regional Federal Reserve Bank Presidents, of which there are twelve.

Given this information, which is readily available at federalreserve.gov and wikipedia.org, did it make sense for Treasury yields to fall near pandemic lows on the rumor of a new Fed Chair?

A Statistical Approach to Trading the News

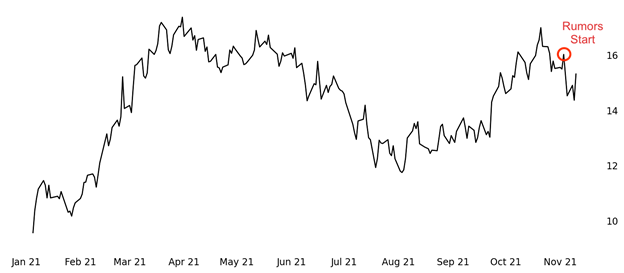

Vast amounts of market data now at your fingertips via trading platforms can give you the ability to commit statistical research as well. It can be as easy as asking how markets were affected in the past by similar events.

Since 2000, three new Fed Chairpersons have been appointed (Bernanke, Yellen, Powell). Cross referencing the dates of their terms’ start** with price action in yields leading up to and following said dates conclude no major trends higher or lower no matter if they were doves or hawks, supporters of monetary tightening and thus high interest rates.

TNX \ 10YR Treasury Yield Index

Source: Yahoo! Finance (https://finance.yahoo.com/)

After checking your platform, did markets shift enough during past Fed appointments to warrant the activity seen amid news of the potential for a new Chairperson?

Sure, this opportunity to trade the news has come and gone, but there are hundreds of news items posted daily covering the multitude of asset classes at your disposal. Open your search engine and trade platform, and go get ‘em!

—

*”Biden meets with Fed leaders Powell and Brainard as nomination decision nears” from cnbc.com 11/5/21

**Info available at federalreserve.gov

© 2021 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. The information presented here is for illustrative purposes only, and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Trading in derivatives and other financial instruments involves risk.

Disclosure: The Small Exchange

© 2022 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading in options, futures, and ETFs is not suitable for all investors. The risk of loss in the trading of options, futures, and ETFs can be substantial. Trading in derivatives and other financial instruments involves risk. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Interactive Brokers Group, Inc., the parent company of Interactive Brokers, LLC, is a minority owner of Small Exchange Inc.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Small Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Small Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.