Sunday’s Super Bowl had a few notable “firsts,” including the first featuring two brothers on opposing teams, but it will undoubtedly be remembered as a major turning point in sports betting in the U.S.

Over 100 million Super Bowl LVII legal betting transactions were recorded this weekend, according to geolocation tracking firm GeoComply. This represents a new all-time record and a robust 25% increase from last year’s Super Bowl.

The data point comes after the American Gaming Association (AGA) forecast last week that more than 50 million American adults would bet legally on the Eagles-Chiefs game, the most ever and a 61% increase from last year. Betters were believed to have collectively wagered as much as $16 billion.

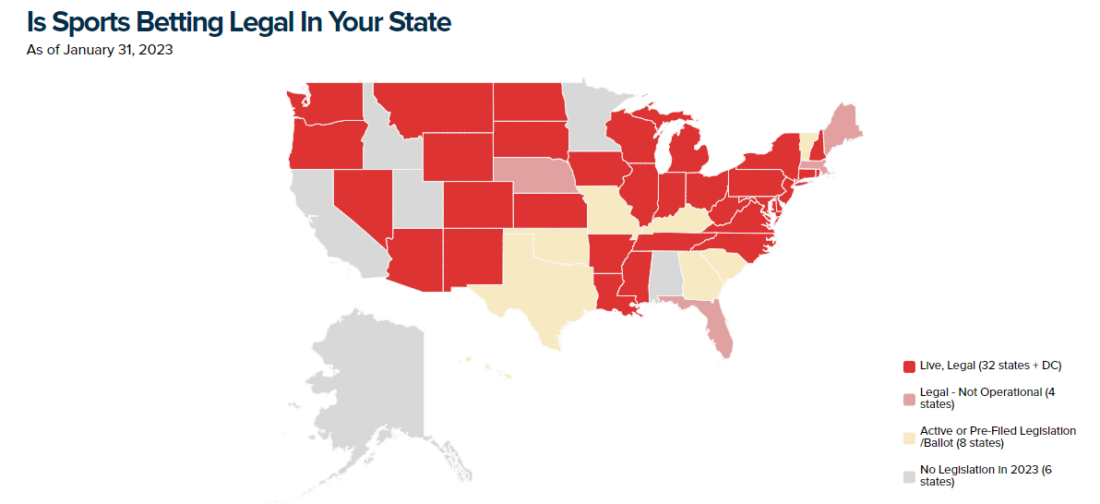

So why is this happening? An obvious contributor is the growing availability of online sportsbooks like DraftKings, FanDuel and others. Five years ago, the Supreme Court overturned a 1992 federal law that banned gambling on sports, and today, sports betting is legal in more than 30 states plus Washington, D.C., with several more debating it in state congresses.

Is Sports Betting Legal In Your State

Availability to gambling aside, I think there’s more going on when it comes to explaining the large volume of people participating this year.

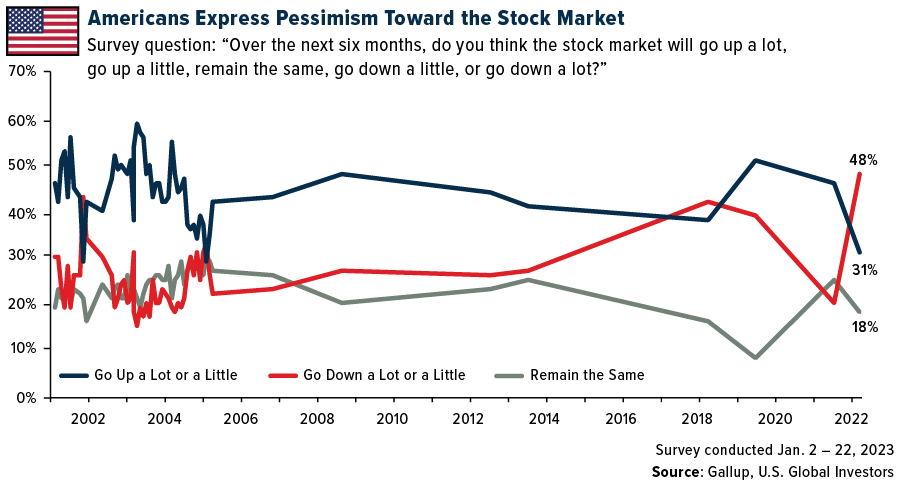

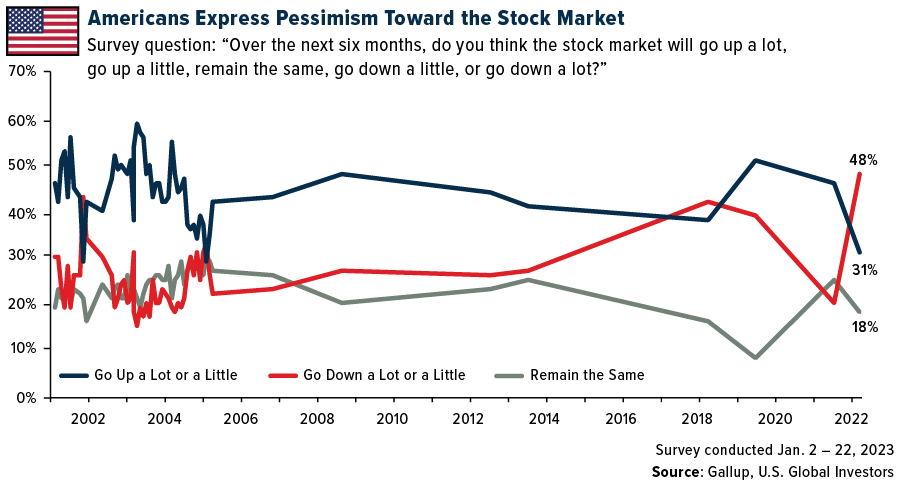

Record-High Percent Of Americans Predict Stock Declines In First Six Months Of 2023

Simply put, people are disappointed with how the stock market has performed over the last 12 months, and they feel jaded by stubbornly high inflation and rising interest rates. Take a look at the returns for companies that advertised during last year’s Super Bowl:

Even betting on the sportsbooks themselves has been mostly unprofitable.

According to a recent Gallup poll, a vast majority of Americans now believe that consumer prices will continue to tick up this year, and nearly 50% predict that stocks will fall in the first half of 2023. That’s a record-high percentage of people expressing pessimism toward the stock market since the firm began asking the question more than 20 years ago.

Taken together, some people may believe that the only way to grow their money right now is to score big on a sports wager. An estimated 58% of Americans own stocks, which is still a much larger share than those who bet on the Super Bowl, but market volatility and economic uncertainty have understandably dented people’s perception of traditional investing.

No Crypto Ads Played During Super Bowl

The same goes for the crypto industry, which saw a number of scandals and upheavals in 2022 and ended the year down 70%, as measured by the Bloomberg Galaxy Crypto Index. Last year’s Super Bowl was nicknamed the “Crypto Bowl” due to the innumerable ads for Coinbase, Crypto.com, eToro, FTX and other crypto-related companies.

In a remarkable about-face, no crypto firm ran ads during this weekend’s Super Bowl. What a difference 12 months can make.

Instead, viewers saw commercials for food and beverage companies, automakers, movie studios and streaming services.

The cost of a 30-second commercial during this year’s Super Bowl, by the way, was anywhere between $6.5 million and $7 million, a new all-time high. Since the first Super Bowl in 1967, ad prices have increased more than 16,000%.

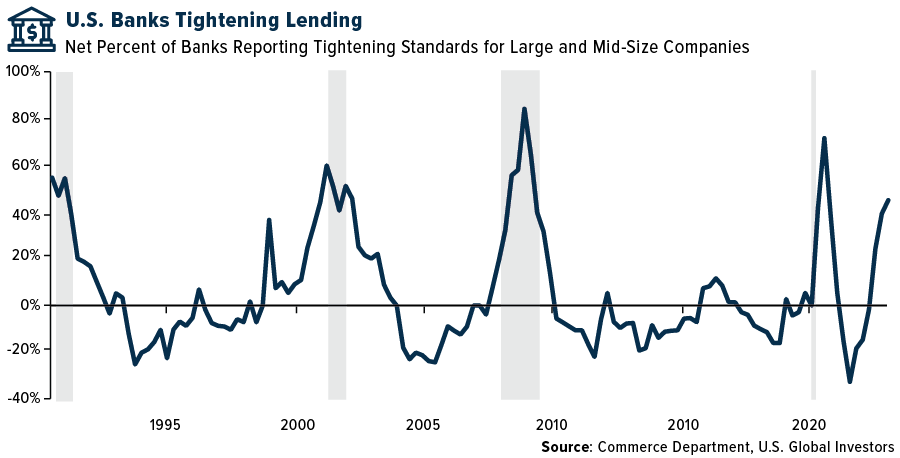

Another Sign Of A Potential Recession: Tighter Lending Standards

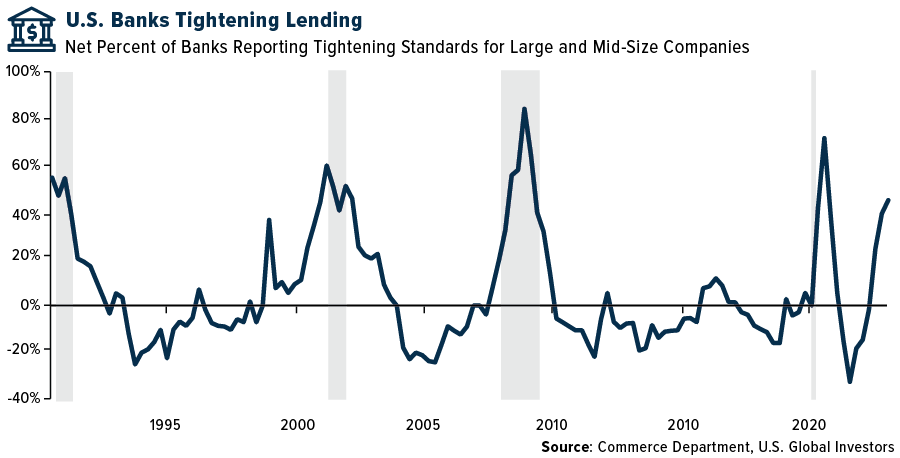

Recession risks are indeed rising, despite the strong jobs market in the U.S. As investment banking company Piper Sandler pointed out in a recent research note, every recession has been preceded by three things: 1) rising interest rates, 2) an inflation spike, and 3) tighter lending standards.

All of the attention has been on rates and inflation, but tighter bank lending can be just as meaningful. Take a look below. The percentage of banks in the U.S. reporting tighter lending standards has continued to increase since the third quarter of 2021, and as of the latest reading, some 45% of banks are saying that they’re slowing the rate of business loans.

A spike in tighter lending standards has historically coincided with economic downturns, as you can see; Piper Sandler says it stands by its forecast for a recession to hit in the second half of 2023.

I think it’s important, then, to proceed with caution. To state the obvious, gambling and sports betting are not the same as investing, and they shouldn’t be seen as replacements. You can lose your principal in a matter of seconds betting on a game, with no chance of ever seeing it again.

On the other hand, the value of your stocks can decline, but at least there’s hope of breaking even if you simply refrain from selling at a loss.

—

Originally Posted February 13, 2023 – As Sports Betting’s Popularity Rises In The U.S., Keep In Mind That It’s Not A Replacement For Investing

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Bloomberg Galaxy Crypto Index is designed to measure the performance of the largest cryptocurrencies traded in USD.

None of U.S. Global Investors Funds held any of the securities mentioned in this article as of 12/30/2022.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.