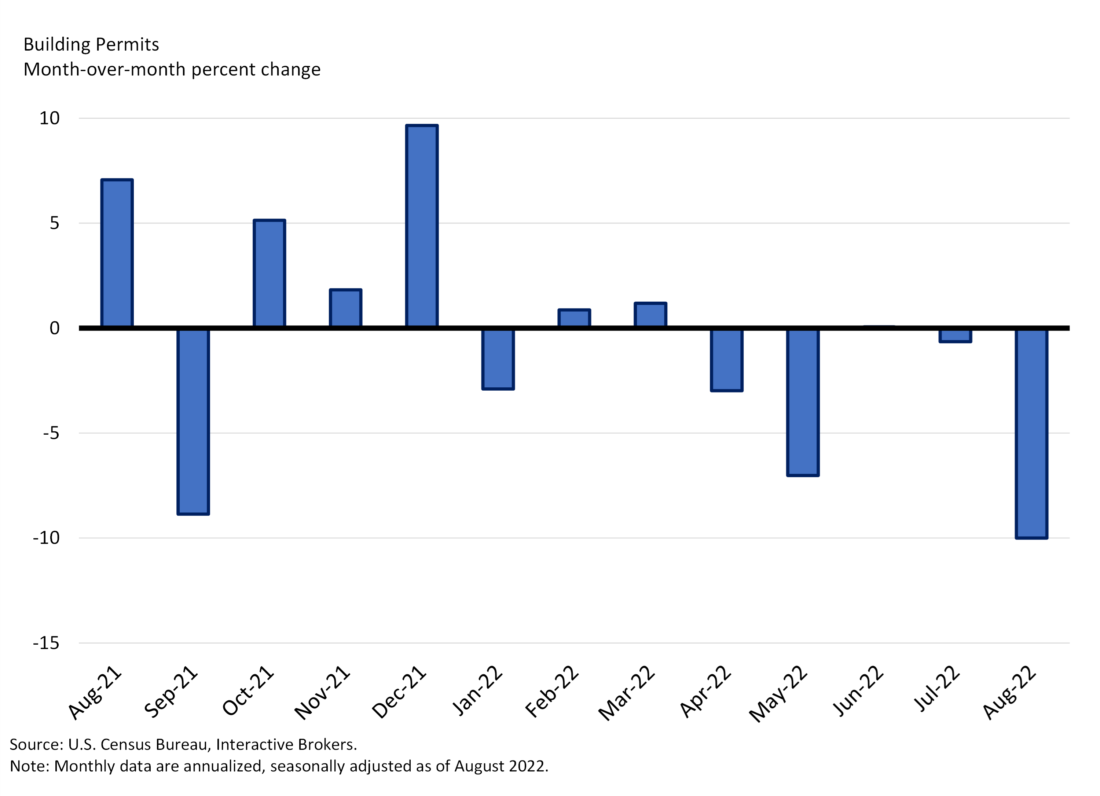

August building permits declined 10.0 percent from the July level, much weaker than expectations of a 4.4 percent drop. Permits for the single-family segment fell 3.5 percent, the two to four unit segment dropped 9.6 percent while the apartment building segment (5 units or more) fell 18.5 percent during the period. The Northeast led the decline at -15.2 percent, the South came in at -13.5 percent, the Midwest at -6.5 percent and the West at -1.1 percent. On a more positive note, housing starts grew and performed much better than expectations at 12.2 percent. Building permits reflect plans for the near future, while housing starts reflect when shovels actually hit the ground, when construction starts. The data is telling us that the construction activity occurring now is likely to be short lived because trends for permits are worsening.

So why did housing starts rise so much? Remember when the marketplace was excited over peak inflation and the idea of a “Powell pivot” during the summer? That caused rallies in equities and bonds, loosened financial conditions and brought down mortgage rates to near 5 percent in early August. There may have been a “last chance” mentality among homebuilders and homebuyers that August could be a good time to secure financing before rates rise again and/or economic conditions deteriorate. Rates matter a lot for housing because it’s capital intensive and requires many work hours to purchase a unit outright, most participants rely on financing. It was indeed a good time for seekers of lower rates because the rallies in equities, bonds and mortgages were head-fakes.

Mortgage rates are now back up above 6 percent and at their highest level since the Great Financial Crisis of 2008. Tighter underwriting and a structurally undersupplied housing market are likely to provide a floor for housing prices; however, lofty valuations born in a low rate, high-liquidity environment cannot sustain themselves in a high-rate, low liquidity one. Home prices are already falling and the extent to the decline will depend largely on how the Fed’s inflation battle affects mortgage rates. If you believe that inflation will be more persistent and that the Fed will have to stay higher and tighter for longer than the market anticipates, you’re probably bearish on home prices. On the contrary, if you believe inflation will be resolved and the Fed will begin to loosen soon, you’re probably more sanguine.

Residential investment is a large contributor to GDP and this report reduces GDP prospects moving forward. The capital-intensive nature of the real estate sector provides big dollar boosts to GDP. To build a structure you typically need authorization from your jurisdiction, financing from a bank to pay for the land, materials to build, labor to put the materials together, and durable appliances to go inside the unit once building is complete. Other additions to GDP after homes are built include advertising dollars for sales, broker fees, home maintenance, home improvement, etc. Finally, a reduction in housing activity reduces consumption, the primary driver of U.S. GDP, as homeowners, homebuilders, and other participants curtail their overall spending due to economic uncertainty while opportunities for laborers to work in the real estate sector dwindle.

The Fed wants to reduce economic activity as they raise rates to reduce inflation. If the real estate sector is strong and construction activity is booming, that’s inflationary and not good for the Fed’s goals of 2 percent inflation, it produces too much investment and consumption. This report is positive for the Fed’s goals of 2 percent inflation because the homebuilders got the message to slow down. Homebuyers are facing the worst affordability in decades and don’t have much of a choice then to slow down.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.