Monday, 29th November, 2021

1/ Investors buy the dip with little fear of latest variant

2/ Has Moderna peaked?

3/ Traders favor Pfizer

4/ The bottom line

1/ Investors Buy the Dip with Little Fear of Latest Variant

Markets roared back to life after selling off on Friday over fears of the newest variant strain of COVID-19. Invesco’s Nasdaq 100 ETF (QQQ) led the way higher, adding 2.2%. State Street’s S&P 500 Index ETF (SPY) and Dow Jones Industrial Average ETF (DIA) gained 1.4% and 0.7%, respectively. The iShares Russell 2000 ETF (IWM) fell by 0.2%.

At first glance, Friday’s market selloff could be seen as an “exhaustion gap”. The exhaustion gap is a technical signal marked by a break lower in prices that occurs after a rapid rise in a stock or index’s price over several weeks prior. This can reflect a significant shift from buying to selling activity, which implies that an upward trend may be about to end soon.

The chart below illustrates the recent upward trend of SPY since mid-October. After a period of consolidation in November, Friday’s candle represents a significant break from the upward trend. Friday’s selloff came amid fears of the rise of the Omicron variant.

Investors will be watching to see how the market responds to this new strain of the virus. Monday’s gains could be seen as a reaction to a potentially oversold market and volume returning following Friday’s abbreviated holiday session. Investors will monitor how markets react after seemingly resetting from Friday’s selloff, which could either be the exhaustion gap signifying the end of an upward trend, or a speed bump on the road to new highs.

2/ Has Moderna Peaked?

On the heels of the weekend news of the Omicron variant, investors have bid up the share prices of Moderna (MRNA). Shares of the pharmaceutical giant are trading at the top of the volatility range and well above its 20-day moving average, as illustrated on the chart below.

On Sunday, MRNA’s chief medical officer said the company could roll out a reformulated vaccine against the new variant of COVID-19 early next year.

At first glance, it appears option traders are positioning themselves for the MRNA share price to continue to rise. Monday’s trading volumes featured over 183,000 call options compared to less than 82,000 puts. However, the open interest for MRNA has a nearly even number of bullish and bearish options.

Though call options traded with heavy volume during Monday’s more than 10% gain for MRNA stock, put options remain priced higher than calls after accounting for intrinsic value. This could mean that option traders are taking the opportunity to sell call options for elevated price levels while MRNA stock is on the rise but are positioning themselves for the stock to pull back in the near term.

3/ Traders Favor Pfizer

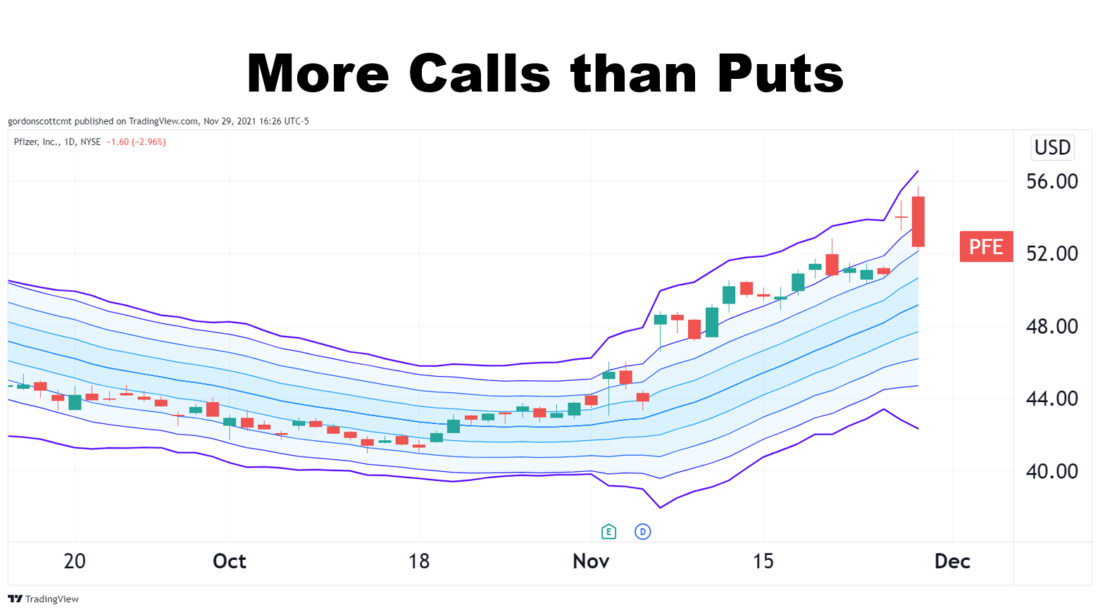

While Moderna (MRNA) shares are moving higher on the Omicron news, shares of fellow Covid treatment provider Pfizer (PFE) are slightly down today. Even with the small pullback, PFE shares are trading near the top of the volatility range, after having gapped up significantly on Friday.

PFE CEO Albert Bourla said Monday that he expects the company’s COVID-19 treatment pill to be effective against the new Omicron variant. The pill has yet to be approved by the Food and Drug Administration but could have its application fast tracked for emergency use.

Option activity skews toward call options. The open interest for PFE features over 1.76 million calls compared to 1 million puts. Monday’s trading volumes also favor calls over puts at nearly 3-to-1, indicating that option traders are positioning themselves for the stock to rise in the future.

Calls and puts are nearly evenly priced after accounting for intrinsic value, which could mean that option traders consider call options undervalued, even with PFE shares recently reaching all-time highs.

4/ The Bottom Line

Market participants decided to rush back in after sellers panicked on various big-tech company shares last Friday.

—

Originally posted on 29th November, 2021

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ